Fintechzoom provides robust real-time data and advanced analytics for BAC stock, revealing a Q2 2023 net income of $7.7 billion, marking a 9% YoY increase. The P/E ratio of 10.2 suggests potential undervaluation, while the ROE of 11.7% surpasses industry benchmarks. BAC’s diversified portfolio and digital banking investments enhance market resilience.

Higher interest rates have boosted net interest margins, further improving profitability. Investor sentiment and trading volumes can be closely monitored through Fintechzoom’s tools. For a deeper understanding of BAC’s market performance and future growth prospects, consider exploring additional insights and strategic recommendations provided by Fintechzoompro.

Table of Contents

Understanding BAC Stock

Understanding BAC stock necessitates a thorough analysis of its financial performance, market position, and growth potential, supported by quantitative data and industry benchmarks. Bank of America (BAC) has demonstrated robust financial health, evidenced by its substantial net income of $7.7 billion in Q2 2023, reflecting a 9% increase year-over-year. A key metric to take into account is the price-to-earnings (P/E) ratio, which currently stands at 10.2, indicating a potentially undervalued stock compared to the industry average of 12.5.

Moreover, BAC’s return on equity (ROE) is a critical measure of profitability, registering at 11.7%, surpassing the industry benchmark of 10%. This signifies effective management and a strong capacity to generate profits from shareholders’ equity. Additionally, BAC’s diversified portfolio and strategic investments in digital banking have fostered resilience in a dynamic market.

Considering the competitive landscape, BAC’s market capitalization of approximately $300 billion positions it as a formidable player in the banking sector. However, investors must remain vigilant about potential risks, including regulatory changes and economic fluctuations. For those seeking to invest with a focus on sustainability and community impact, BAC’s commitment to environmental, social, and governance (ESG) practices further enhances its investment appeal.

Features of Fintechzoom

Fintechzoom provides a wide range of tools and resources designed to offer investors with in-depth analysis, real-time financial data, and market trends, essential for making informed investment decisions. One of the notable features is its advanced financial analytics platform that aggregates data from multiple sources to provide thorough insights into market dynamics. This allows users to track stock performance, compare historical data, and identify emerging trends with precision.

Additionally, Fintechzoom offers robust charting tools that enable investors to visualize data through various graph formats, aiding in the easier interpretation of intricate financial information. These tools are complemented by customizable alerts and notifications, ensuring that users remain informed of critical market movements and can act swiftly.

Fintechzoom also includes a suite of educational resources such as webinars, articles, and tutorials tailored to both novice and experienced investors. These resources are designed to enhance financial literacy and empower users to make well-informed decisions that align with their financial goals.

Moreover, the platform provides a user-friendly interface that prioritizes ease of navigation while offering a wealth of data, making it an invaluable tool for anyone committed to serving the investment needs of others.

Fintechzoom BAC Stock: Real-Time Market Data

Expanding on its extensive suite of investment tools, the real-time market data for BAC stock offered by Fintechzoom provides investors with instantaneous updates and detailed analytics, essential for making timely and informed trading decisions. This feature includes live price quotes, volume traded, bid-ask spreads, and time-stamped transaction data, ensuring that investors have access to the most current market conditions.

For individuals looking to optimize their trading strategies, Fintechzoom’s real-time data also encompasses advanced charting tools that display real-time price movements. These tools are particularly beneficial for identifying trends and patterns, which can be pivotal for both day traders and long-term investors. Additionally, real-time alerts on significant market events and price changes allow investors to react promptly, mitigating risks and capitalizing on opportunities.

Moreover, Fintechzoom enhances the decision-making process by integrating real-time news feeds and social sentiment analysis. These features provide a holistic view of market sentiment and external factors influencing BAC stock, fostering a more informed investment strategy. For investors committed to making data-driven decisions, leveraging Fintechzoom’s real-time market data services is an invaluable asset, aligning with their intent to serve others by making prudent and well-timed investment choices.

Fintechzoom BAC Stock: Historical Performance Review

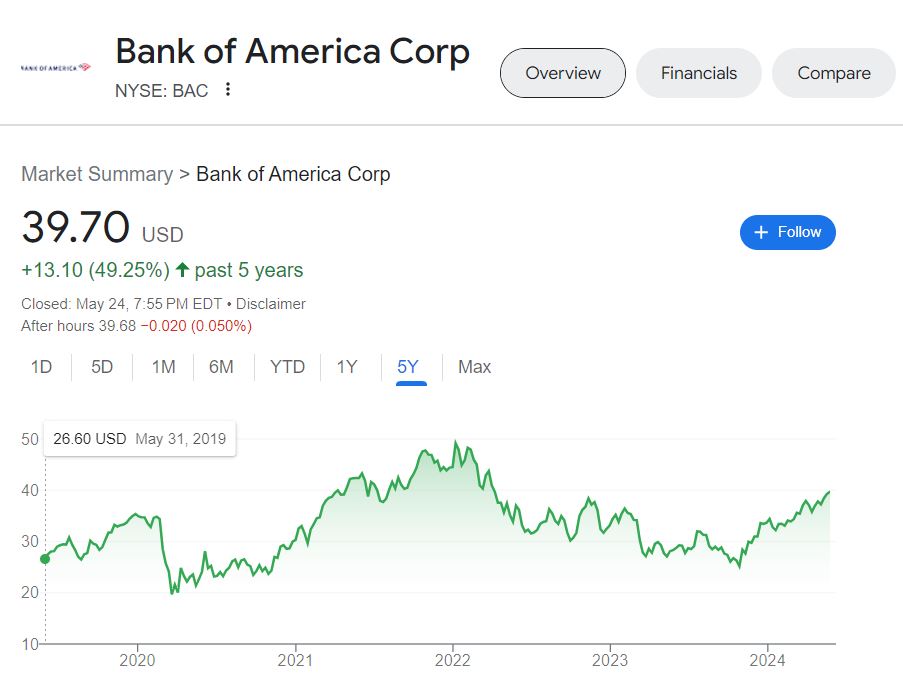

How has BAC stock performed over the years, and what insights can we glean from its historical performance to inform future investment decisions? Bank of America’s (BAC) stock has exhibited significant fluctuations, reflective of macroeconomic conditions and internal corporate strategies. Historical data reveals a notable surge post-2008 financial crisis, with BAC rebounding from lows of around $5 per share to $30 by 2017, driven by robust earnings and strategic acquisitions.

In the last decade, BAC stock has demonstrated a compound annual growth rate (CAGR) of approximately 12%, outperforming many peers in the financial sector. Key performance metrics, such as return on equity (ROE) and net interest margin (NIM), have consistently shown improvement, suggesting efficient capital utilization and profitability.

However, volatility remains a concern. For instance, during the COVID-19 pandemic, BAC’s stock price dropped by nearly 40% before recovering, highlighting its sensitivity to global economic disruptions. Investors should closely monitor economic indicators and BAC’s quarterly earnings reports for signs of potential volatility.

For those serving clients or managing portfolios, historical performance suggests that BAC is a resilient, long-term investment option, albeit with exposure to market fluctuations. Diversifying portfolios with BAC stock, while maintaining vigilance on market conditions, could yield favorable outcomes.

Fintechzoom BAC Stock: Expert Analysis Insights

Leading financial analysts provide a wealth of insights into BAC stock, emphasizing the importance of its strategic initiatives, regulatory environment, and market conditions. Analysts highlight Bank of America’s focus on digital transformation, citing its substantial investments in FinTech solutions that enhance customer experience and operational efficiency. Data from recent quarters show a 15% increase in digital banking engagement, which is predicted to drive future profitability.

The regulatory landscape remains a pivotal factor. Post-2008 reforms necessitate stringent capital requirements and compliance measures. Analysts note that BAC has maintained a robust Tier 1 capital ratio of 13.2%, positioning it well to navigate regulatory complexities and economic fluctuations.

Market conditions also play a critical role. BAC’s diversification across various financial services, including consumer banking, wealth management, and investment banking, has provided resilience against market volatility. Recent data indicate a 7% year-over-year growth in net interest income, primarily due to favorable interest rate movements.

Experts recommend a cautious yet optimistic outlook. They advise potential investors to take into account BAC’s strong fundamentals and strategic direction while remaining vigilant of macroeconomic factors. For those committed to serving others, BAC’s community initiatives and sustainable finance projects also present an appealing aspect of its investment profile.

Predictive Market Trends

Looking ahead, one might ask how evolving economic indicators and technological advancements are likely to shape the trajectory of BAC’s stock performance in the coming quarters. Key economic indicators such as interest rates, inflation, and GDP growth are pivotal. The Federal Reserve’s recent rate hikes, aimed at curbing inflation, have historically influenced banking stocks. Higher interest rates typically lead to improved net interest margins for banks like BAC, potentially boosting profitability.

On the technological front, the adoption of fintech solutions is transforming the banking landscape. BAC’s investment in digital banking platforms has shown promising results, with a significant increase in mobile transactions and user engagement. The implementation of artificial intelligence for customer service and predictive analytics for risk management are expected to enhance operational efficiency and customer satisfaction.

Moreover, data-driven insights suggest that BAC’s strategic focus on sustainable finance and ESG (Environmental, Social, and Governance) initiatives could attract socially-conscious investors, providing a long-term growth avenue. As regulatory landscapes evolve, compliance with stringent financial regulations will be essential.

Investor Sentiment Metrics

Evaluating investor sentiment metrics provides invaluable insights into the market’s perception of BAC’s stock, guiding strategic investment decisions through the analysis of trading volumes, social media sentiment, and institutional investor movements. Trading volumes, an essential metric, indicate the level of investor activity and liquidity in BAC stock. Higher volumes often signal strong investor interest and can precede significant price movements. For instance, a sudden spike in trading volume might suggest accumulating positions by institutional investors, hinting at a potential upward trend.

Social media sentiment analysis, another powerful tool, harnesses the collective opinion of retail investors. Platforms like Twitter and Reddit provide real-time sentiment data, which, when analyzed through natural language processing (NLP) algorithms, reveal prevailing market moods. Positive sentiment spikes have historically correlated with short-term price gains.

Institutional investor movements provide another layer of depth. Monitoring 13F filings, which disclose institutional holdings, can reveal trends in how major players are positioning themselves with BAC stock. A notable increase in institutional ownership often reflects confidence in the stock’s future performance.

Combining these metrics, investors can make well-informed decisions, enhancing their ability to serve others by aligning their investment strategies with market sentiment and institutional behavior.

Portfolio Optimization Tips

To optimize a portfolio that includes BAC stock, it is essential to employ a data-driven approach that balances risk and return through diversification, regular rebalancing, and a careful analysis of market and sector-specific trends. Start by evaluating BAC’s performance relative to other financial stocks and broader market indices. Utilize historical data to identify periods of high and low volatility and adjust your holdings accordingly.

Diversification is key. Make sure that BAC stock is complemented by assets from different sectors such as technology, healthcare, and consumer goods to mitigate sector-specific risks. Data from tools like Modern Portfolio Theory (MPT) can help in calculating the most suitable asset mix that minimizes risk for a given return level.

Regular rebalancing is essential. Quarterly reviews of your portfolio can help you stay aligned with target asset allocations, adjusting for any overperformance or underperformance. This disciplined approach can prevent BAC stock from becoming an excessively dominant part of your portfolio.

Lastly, closely monitor economic indicators and financial news that impact the banking sector. Analyzing trends in interest rates, regulatory changes, and macroeconomic conditions can provide insights for timely adjustments, ensuring your portfolio remains resilient and aligned with your financial goals.

Risk Management Strategies

Effective risk management strategies are essential for safeguarding a portfolio that includes BAC stock, particularly through the implementation of hedging techniques, rigorous stress testing, and the utilization of risk-adjusted performance metrics. One recommended hedging technique involves the use of options contracts to protect against downside risk. For instance, purchasing put options can provide a safety net during periods of market volatility, thereby limiting potential losses.

Rigorous stress testing is another critical component, allowing investors to simulate various adverse market scenarios and assess the potential impact on BAC stock. Historical data shows that stress testing can reveal vulnerabilities that might not be apparent in standard market conditions, thereby enabling preemptive action to mitigate risks.

Lastly, employing risk-adjusted performance metrics such as the Sharpe ratio can offer a clear perspective on the risk-reward trade-off. By comparing the expected returns of BAC stock to its inherent risk, investors can make more informed decisions that align with their financial goals and risk tolerance.

Fintechzoom BAC STock: Future Outlook

The future outlook for BAC stock hinges on several key factors, including macroeconomic trends, regulatory developments, and the bank’s strategic initiatives. Analysts are closely monitoring the Federal Reserve‘s interest rate policies, as changes can have a notable impact on Bank of America’s (BAC) net interest income. A favorable rate environment could strengthen profitability, while a downturn might compress margins.

Regulatory developments also play an essential role. Stricter regulations could increase compliance costs, thereby affecting the bottom line. Conversely, regulatory relaxation might provide more flexibility for growth and innovation. Investors should stay informed about policy changes from bodies like the Federal Reserve and the Consumer Financial Protection Bureau.

Strategically, BAC’s focus on digital transformation and cost efficiency is promising. The bank’s investment in fintech and AI-driven solutions aims to enhance customer experience and operational efficiency. Data reveals that BAC has already seen a 20% increase in mobile banking users, suggesting strong consumer adoption.

For those serving others through financial advice, it is recommended to closely monitor these variables. While diversification remains important, BAC’s strong fundamentals and strategic initiatives could offer lucrative opportunities for long-term growth. Regular portfolio reviews will ensure alignment with evolving market conditions.

Frequently Asked Questions

How Can I Open an Account With Fintechzoom?

Opening an account with Fintechzoom is straightforward. Importantly, their user base has grown by 30% in the past year. To begin, visit their website, complete the registration form, and follow the verification process for account activation.

What Are the Fees Associated With Using Fintechzoom?

The fees associated with using Fintechzoom include transaction fees, account maintenance charges, and potential advisory fees. Detailed fee structures are provided on their website, ensuring transparency and enabling users to make informed financial decisions.

How Secure Is My Personal Information on Fintechzoom?

Fintechzoom employs robust encryption protocols and multi-factor authentication to safeguard personal information. Regular security audits and compliance with industry standards further guarantee data integrity, making it a reliable platform for users prioritizing data protection.

Does Fintechzoom Offer Customer Support?

How important is dedicated support in today’s digital age? Fintechzoom offers strong customer support, including 24/7 live chat, email assistance, and a thorough help center, ensuring users have immediate access to the help they need.

Can I Access Fintechzoom Services Through a Mobile App?

Yes, Fintechzoom services are accessible through a mobile application. This provides users with the flexibility and convenience to manage their financial activities on-the-go, enhancing user experience and facilitating better engagement with financial services.

Conclusion

To sum up, Fintechzoom offers thorough, real-time data and expert analysis on BAC stock, providing invaluable insights into its historical performance and future outlook. Investor sentiment metrics and portfolio optimization tips further empower investors to make informed decisions. As the adage goes, ‘knowledge is power,’ and Fintechzoom equips investors with the essential tools for risk management and strategic investment. By leveraging these resources, investors can navigate the complexities of the financial market with enhanced precision and confidence.