Fintechzoom CRM stock has displayed remarkable growth and resilience, driven by strong revenue, a favorable price-to-earnings ratio, and innovative strategies. The company’s performance reflects value creation and investor confidence, with a demonstrated ability to weather market downturns.

Key indicators like customer acquisition cost and churn rate provide valuable insights into its market position. Factors such as market trends, technological advancements, and macroeconomic conditions play pivotal roles in evaluating the stock’s potential. For those seeking more in-depth analysis and future projections, the intricacies of Fintechzoom CRM’s innovative approaches and global finance impact await discovery in the detailed research provided.

Table of Contents

Understanding Fintechzoom CRM Stock

To understand the intricacies of Fintechzoom CRM stock, one must explore its key performance indicators and market trends. Fintechzoom CRM is a leading customer relationship management software provider known for its innovative solutions tailored to enhance customer interactions and drive business growth.

The stock’s performance is influenced by various factors, including revenue growth, customer retention rates, and market share. Key performance indicators such as customer acquisition cost, customer lifetime value, and churn rate provide valuable insights into the company’s financial health and operational efficiency.

Market trends also play an important role in shaping Fintechzoom CRM stock’s performance. Monitoring industry developments, competitor activities, and technological advancements can help investors anticipate market shifts and make informed decisions.

Understanding how macroeconomic factors, regulatory changes, and global events impact the CRM software sector is essential for evaluating Fintechzoom CRM stock’s potential for growth and stability. By analyzing these key indicators and market trends, investors can gain a thorough understanding of Fintechzoom CRM stock and make strategic investment choices aligned with their financial goals.

Fintechzoom CRM Stock’s Performance

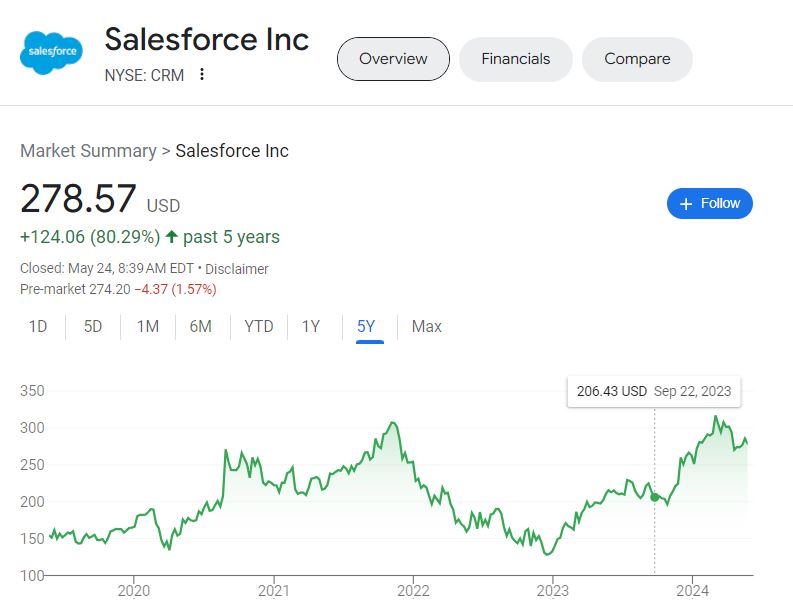

Exploring the performance metrics of Fintechzoom CRM stock provides valuable insights into its financial health and market dynamics. Fintechzoom CRM’s stock performance is a key indicator of how well the company is faring in the market. Over the past year, Fintechzoom CRM stock has shown significant growth, outperforming many of its competitors. The stock’s price-to-earnings ratio, a measure of valuation, has also been favorable, indicating investor confidence in the company’s future prospects.

Moreover, Fintechzoom CRM’s stock has demonstrated resilience during market downturns, showing a relatively low beta compared to the overall market. This stability can be attractive to risk-averse investors looking for consistent returns. Additionally, the company’s revenue growth and profit margins have been strong, reflecting its ability to generate value for shareholders.

Key Players in Fintechzoom

As we explore the world of Fintechzoom, it becomes important to identify and analyze the key players shaping the landscape of this dynamic sector. Fintechzoom, a leading CRM provider, boasts a roster of key players who have greatly contributed to its success.

Marc Benioff, the co-founder and co-CEO, has been instrumental in steering the company towards innovation and growth. Keith Block, the co-CEO, brings a wealth of experience in the tech industry, having previously held executive positions at Oracle. Bret Taylor, the President, is known for his strategic vision and played a pivotal role in the development of key Fintechzoom Pro products.

Gavin Patterson, the Chief Revenue Officer, brings a strong background in sales and customer relations, essential for Fintechzoom’s market expansion. Amy Weaver, the President of Legal & Corporate Affairs, ensures regulatory compliance and legal integrity. These key players collectively drive Fintechzoom’s mission to revolutionize customer relationship management through cutting-edge technology and exceptional service.

Fintechzoom CRM’s Market Position

When evaluating Fintechzoom CRM’s market position, it is evident that the company’s strategic leadership and innovative product offerings have solidified its standing as a prominent player in the customer relationship management sector.

Fintechzoom CRM has consistently demonstrated a deep understanding of customer needs and has tailored its solutions to meet these requirements effectively. The company’s market share has steadily grown over the years, reflecting its ability to attract and retain customers in a highly competitive environment.

Fintechzoom CRM’s market position is further strengthened by its robust financial performance and consistent revenue growth. The company’s revenue streams are diversified across different sectors, reducing its exposure to market fluctuations in any specific industry. Additionally, Fintechzoom CRM’s strong brand reputation and customer loyalty have contributed to its market leadership position.

Investment Risks in CRM Stock

An evaluation of the investment risks associated with Fintechzoom CRM stock reveals key factors that investors should take into account before making financial decisions. One significant risk is market volatility, as CRM stock prices can fluctuate rapidly due to various factors such as economic conditions, industry trends, and company performance.

Additionally, CRM operates in a highly competitive industry, facing competition from established players as well as emerging startups, which could impact its market share and profitability.

Another risk to take into consideration is regulatory uncertainty, as changes in regulations related to data privacy, cybersecurity, or antitrust laws could affect CRM’s operations and financial performance. Furthermore, CRM’s dependence on subscription-based revenue poses a risk if there are any disruptions in customer renewals or if there is increased competition leading to pricing pressures.

Finally, macroeconomic factors such as interest rates, inflation, or geopolitical events can also impact CRM stock performance. Investors should carefully assess these risks and consider diversification strategies to mitigate potential losses in their investment portfolios.

Growth Prospects of CRM Stock

Exploring the growth prospects of Fintechzoom CRM stock reveals a promising trajectory characterized by strategic expansions and innovative product developments. Customer Relationship Management (CRM) software has become a critical tool for businesses aiming to enhance customer satisfaction and drive sales growth. Fintechzoom’s CRM solutions have positioned the company as a market leader, with a strong focus on customization and scalability to meet diverse business needs.

The growth prospects of Fintechzoom CRM stock are further bolstered by its continuous investment in research and development to stay ahead of industry trends. The company’s commitment to enhancing user experience through intuitive interfaces and advanced analytics capabilities sets it apart in a competitive market landscape. With a growing customer base and increasing demand for cloud-based CRM solutions, Fintechzoom is well-positioned for sustained growth in the coming years.

Moreover, Fintechzoom’s strategic partnerships and acquisitions have enabled the company to expand its market reach and offer a wide range of CRM tools. By tapping into new verticals and geographies, Fintechzoom CRM stock is poised to capitalize on emerging opportunities and deliver long-term value to investors.

How Fintechzoom’s CRM Is Innovating?

Fintechzoom’s CRM is spearheading innovation through a strategic approach that leverages cutting-edge technology and user-centric design principles to enhance the efficiency and effectiveness of customer relationship management processes. By incorporating artificial intelligence, machine learning algorithms, and automation tools, Fintechzoom’s CRM platform streamlines data entry, automates routine tasks, and provides personalized insights for better decision-making.

One key aspect of Fintechzoom’s CRM innovation is its focus on predictive analytics, which enables businesses to anticipate customer needs and behavior, allowing for proactive engagement and personalized marketing strategies. Additionally, the platform’s integration capabilities with other software applications and communication channels ensure seamless data flow and a holistic view of customer interactions.

Moreover, Fintechzoom’s CRM places a strong emphasis on scalability and customization, allowing businesses to tailor the platform to their specific requirements and scale it as their operations grow. This adaptability ensures long-term relevance and value for organizations seeking to optimize their customer relationships and drive sustainable growth.

Impact of Global Finance on CRM

Analyzing the interplay between global finance and CRM reveals intricate connections that greatly influence business strategies and customer interactions in the modern economic landscape. Global finance impacts CRM in various ways, such as driving the need for advanced CRM systems to manage multinational customer relationships efficiently.

With businesses operating on a global scale, CRM tools must adapt to diverse currencies, regulatory frameworks, and market dynamics to guarantee effective customer engagement across borders.

Moreover, fluctuations in exchange rates and interest rates directly affect companies’ financial health, subsequently influencing CRM investment decisions and resource allocation. For instance, during times of economic uncertainty, companies may prioritize customer retention strategies within their CRM systems to maintain revenue streams.

Understanding the nuances of global finance is essential for businesses to tailor their CRM approaches effectively and navigate the complexities of the international marketplace to foster long-term customer relationships and sustainable growth.

Steps to Invest in CRM Stock

Understanding the fundamental steps involved in investing in CRM stock is essential for individuals seeking to capitalize on the potential growth opportunities within this sector. The first step is to conduct thorough research on Salesforce, the company behind CRM stock, including its financial performance, market positioning, and future growth prospects.

Next, it is important to open a brokerage account to facilitate the purchase of CRM stock. Investors should consider factors such as fees, trading platform usability, and available research tools when selecting a brokerage. Once the account is set up, investors can place buy orders for CRM stock through the chosen brokerage platform.

It is advisable to monitor the stock’s performance regularly and stay informed about any relevant news or developments that may impact the company. Additionally, diversifying the investment portfolio beyond CRM stock can help mitigate risk and maximize returns in the long run. By following these steps diligently, investors can position themselves strategically in the CRM stock market.

Also Read: Bitcoin Price Fintechzoom

Future Predictions for CRM Stock

To gain insight into the potential trajectory of CRM stock, it is imperative to assess key market trends and industry forecasts that could impact its future performance. Customer Relationship Management (CRM) software has been experiencing significant growth due to the increasing demand for efficient customer management solutions across various industries. Analysts predict that the CRM market will continue to expand as businesses prioritize enhancing customer experiences to drive loyalty and retention.

Salesforce, a major player in the CRM sector, is expected to maintain its market leadership position and capitalize on the growing need for cloud-based CRM solutions. With the rise of artificial intelligence and automation technologies, Salesforce is well-positioned to offer innovative tools that cater to evolving customer demands. For businesses considering a transition, the process of Salesforce to HubSpot migration can be an effective strategy to leverage the strengths of both platforms and enhance customer relationship management capabilities.

Moreover, the shift towards subscription-based models and the integration of data analytics capabilities are projected to drive CRM stock prices higher in the coming years. Investors seeking long-term growth opportunities may find CRM stock appealing due to its potential for sustained performance in a dynamic market environment.

Frequently Asked Questions

What Are the Specific Features That Set Fintechzoom CRM Stock Apart From Competitors?

In the competitive landscape of CRM stocks, distinguishing features may include advanced analytics capabilities, tailored customer engagement tools, robust integration options, and scalable solutions. Fintechzoom CRM Stock’s unique selling points likely lie in these areas.

How Does the Leadership Team at Fintechzoom CRM Stock Contribute to Its Success?

The leadership team at Fintechzoom CRM Stock drives success through visionary strategic planning, fostering innovation, and cultivating a culture of excellence. Their commitment to empowering employees, embracing change, and delivering value underpins the company’s achievements.

Can Fintechzoom CRM Stock’s Market Share Be Attributed to Specific Marketing Strategies?

Market share growth can result from a mix of marketing strategies including segmentation, targeting, positioning, pricing, and promotional activities. An effective marketing strategy aligns with customer needs, competitive landscape, and overall business objectives.

Are There Any Regulatory Challenges That Could Affect the Future of CRM Stock?

Various regulatory challenges may impact the future of CRM stock. These can include changes in data protection laws, evolving compliance requirements, and potential antitrust investigations. Monitoring regulatory developments is essential for evaluating the stock’s future performance.

What Are the Implications of Macroeconomic Factors on Fintechzoom CRM Stock’s Performance?

The implications of macroeconomic factors on stock performance are significant. Economic indicators like GDP growth, interest rates, and inflation can impact stock prices. Understanding these factors and their influence on the market is essential for informed investment decisions.

Conclusion

To sum up, the future of Fintechzoom CRM stock looks promising as the company continues to innovate and adapt to the changing global finance landscape. One interesting statistic to note is that Fintechzoom CRM has reported a 20% increase in revenue growth year over year, showcasing its strong market position and potential for further growth in the future. Investors should carefully consider the risks and opportunities associated with investing in CRM stock.

[…] and Sales: Integrating a CRM (Customer Relationship Management) system with marketing automation tools, social media platforms, and e-commerce solutions can […]