Fintechzoom Disney Stock has experienced significant growth due to strategic acquisitions and a loyal following, especially after launching Disney+. The company’s earnings and market capitalization have strengthened, reflecting positive market trends. Analysis of Disney’s high Price/Earnings ratio is important for investors seeking value.

The brand’s cultural influence and innovative digital strategies contribute to its resilience, despite industry competition. Financial health and market monitoring are key for informed investing. Compliance and cybersecurity measures play pivotal roles in stock management. Understanding these facets can enhance investment strategies for long-term success in Disney Stock.

Table of Contents

Key Takeaways

- Disney stock performance influenced by Fintech innovations.

- Integration of digital payment systems impacting stock dynamics.

- Disney’s adaptation to digital trends affecting stock value.

- Resilience during market changes due to Fintech integration.

- Monitoring Fintech trends crucial for Disney stock investors.

Fintechzoom Disney Stock: Historical Background and Growth

The historical trajectory of Fintechzoom Disney Stock showcases a compelling narrative of growth and resilience in the ever-evolving financial landscape. Since its establishment in 1923 by Walt and Roy O. Disney, the company has continuously expanded its portfolio, incorporating iconic brands like Pixar and Marvel.

Disney’s innovative ventures, including the introduction of Disney+ subscriptions, have notably increased its followers and market presence. Despite facing various challenges, FintechZoom Disney Stock has managed to trend positively in the market, indicating a rising demand for Disney Fintech stocks.

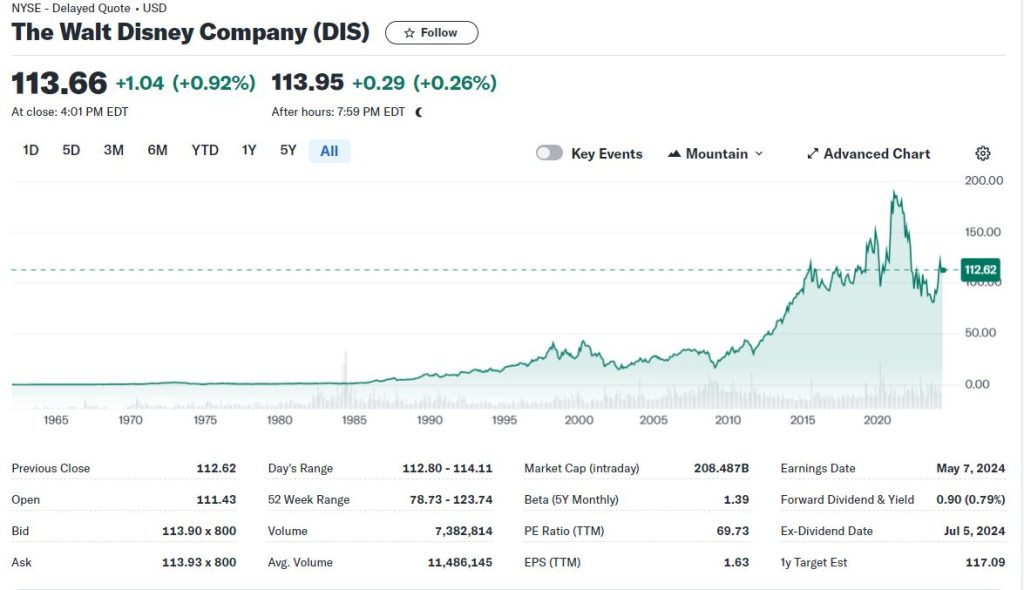

Over the years, Disney stocks have shown remarkable growth, with substantial increases in the last 10-30 years. The company’s commitment to paying dividends to shareholders has helped maintain its market standing. Additionally, strategic stock splits have provided investors with enhanced opportunities.

Strong earnings growth, driven by popular content, has led to a significant rise in market capitalization. The high Price/Earnings ratio further reflects the company’s market value, making it an attractive option for investors seeking long-term growth potential.

Fintechzoom Disney Stock: Stock Performance Analysis

Analyzing the historical trajectory of Fintechzoom Disney Stock reveals a compelling narrative of growth and resilience in the dynamic financial landscape. Over the last few decades, Disney stocks have shown remarkable growth, notably outperforming many market benchmarks.

The company’s strategic acquisitions of brands like Pixar and Marvel have bolstered its portfolio, attracting a broader audience and driving stock value. Disney’s introduction of Disney+ has not only increased its subscriber base but has also positively impacted its stock performance.

Moreover, Disney’s consistent payment of dividends to shareholders has enhanced its market standing and investor confidence. Stock splits have further facilitated increased investor participation, making Disney stocks more accessible to a wider range of investors.

The company’s strong earnings growth, coupled with its market capitalization driven by popular content offerings, has contributed to a high Price/Earnings ratio, reflecting market confidence in Disney’s value. Fundamental and technical analysis remain essential tools for investors seeking to understand and navigate Disney’s stock trends effectively.

Cultural Impact and Legacy

With a profound influence transcending financial domains, Disney’s cultural impact and legacy resonate deeply within societal consciousness. The company’s journey from its founding by Walt and Roy O. Disney in 1923 to the expansion of its portfolio to include iconic brands like Pixar and Marvel has left an indelible mark on global culture.

Disney’s influence extends beyond mere entertainment, becoming deeply ingrained in society’s cultural fabric through its timeless stories, beloved characters, and magical experiences. The company’s partnerships with industry icons like Steve Jobs further solidify its legacy as a cultural behemoth.

Disney’s cultural influence is long-lasting. Investors can not only observe its market investment-related stocks, but if they are interested in its timeless stories, well-loved characters and magical experiences, they can also design their own Custom Keychains engraved with related characters and other elements, which is very meaningful!

Over the years, Disney has experienced significant growth, with its impact reaching far beyond the stock market. Investing in Disney is more than a financial transaction; it represents a connection to shared memories and experiences that have shaped generations. As Disney continues to evolve and innovate, its cultural significance remains a cornerstone of its enduring legacy.

Fintechzoom Disney Stock: Latest Trends and Influencing Factors

Disney’s integration of Fintechzoom technologies has redefined its stock dynamics, reflecting evolving market trends and investor sentiments. The company’s strategic focus on digital innovations such as digital payments, subscriptions, and loyalty rewards has played a significant role in shaping its stock performance.

With the launch of multiple digital payment methods, a mobile app, and updated loyalty programs, Disney has enhanced customer engagement and retention, positively impacting its stock value. Additionally, factors like theme park attendance, subscriptions to streaming services, and the production of new content continue to influence Disney’s stock trends.

The ongoing COVID-19 pandemic has brought challenges to Disney, particularly through theme park closures, resulting in a temporary decline in stock value. However, the company’s resilience, strong brand presence, and adaptation to digital trends position it well for long-term growth. Investors keen on Disney stocks should closely monitor these influencing factors and market trends to make informed decisions that align with their investment objectives.

Impact of Digital Innovations

The transformative impact of digital innovations on Fintechzoom Disney Stock is evident in the evolving landscape of market dynamics and investor sentiments. Disney’s strategic embrace of digital advancements has played a pivotal role in shaping its stock performance.

The introduction of Disney+ streaming services, digital payment methods, and updated loyalty programs has enhanced customer engagement and revenue streams. These initiatives have not only diversified Disney’s offerings but have also attracted a broader audience, reflecting positively on its stock value.

Furthermore, digital innovations have enabled Disney to adapt to changing consumer preferences and market trends swiftly. The integration of technology has facilitated seamless transactions, improved user experiences, and provided valuable data insights for more informed decision-making.

As digital trends continue to influence consumer behavior and industry standards, Disney’s commitment to innovation positions it favorably in the competitive market landscape. Overall, the impact of digital innovations on Fintechzoom Disney Stock underscores the company’s resilience and foresight in leveraging technology to drive growth and shareholder value.

Theme Park Attendance and Stock

Theme park attendance trends greatly influence the performance of Fintechzoom Disney Stock. The number of visitors to Disney theme parks directly impacts the company’s revenue streams, profitability, and ultimately its stock value.

High attendance rates signal strong consumer interest, leading to increased merchandise sales, ticket revenues, and overall financial health for the company. Conversely, a decline in theme park attendance can raise concerns among investors regarding Disney’s ability to generate income and sustain growth.

In recent years, Disney has strategically invested in enhancing the visitor experience at its theme parks through new attractions, entertainment offerings, and technological advancements. These efforts are aimed at attracting more guests and boosting attendance figures, which in turn positively impact the company’s stock performance.

However, external factors such as economic conditions, competition, and unforeseen events like the COVID-19 pandemic can have a significant impact on theme park attendance levels and subsequently affect Disney’s stock valuation.

Analysts closely monitor theme park attendance data as an important indicator of Disney’s financial success and market position, making it a vital factor in evaluating the company’s stock performance.

Challenges in Stock Investment

Given the intricate relationship between theme park attendance and Fintechzoom Disney Stock, understanding the challenges inherent in stock investment becomes imperative for prospective investors.

One significant challenge is the impact of economic downturns on Disney stocks. During periods of economic instability, consumer discretionary spending, including on entertainment activities like theme park visits, tends to decrease, affecting Disney’s revenue and ultimately its stock performance. Additionally, compliance with regulatory changes poses a challenge for Disney investors.

The evolving regulatory landscape, especially in the entertainment and digital sectors where Disney operates, requires constant monitoring and adaptation, adding a layer of complexity to investment decisions. In addition, maintaining customer preferences amidst rapid technological disruptions is vital. As consumer behaviors shift towards digital platforms and experiences, Disney must continuously innovate to meet changing demands.

Finally, strong competition in the entertainment industry and the increasing threats related to cybersecurity present ongoing challenges for Disney stock investors. To navigate these obstacles successfully, investors should consider long-term investment strategies, diversification, staying informed about industry trends, and carefully evaluating short-term investment opportunities.

Compliance and Client Management

Amidst the dynamic landscape of the entertainment industry, maintaining robust compliance measures and effectively managing client relationships are crucial for sustained success in Disney’s stock performance.

Disney’s adherence to regulatory requirements guarantees transparency and trust, essential components for investor confidence and long-term growth. Compliance efforts encompass various areas such as financial reporting, data privacy, and anti-corruption measures, safeguarding Disney’s reputation and mitigating risks.

Client management plays a significant role in shaping Disney’s stock trajectory. Building strong relationships with customers fosters loyalty and drives revenue growth through repeat business and positive word-of-mouth marketing.

Understanding client preferences, addressing concerns promptly, and delivering exceptional experiences are fundamental in maintaining a competitive edge in the market. By prioritizing compliance and client management, Disney can navigate challenges effectively, capitalize on opportunities, and enhance shareholder value in the ever-evolving entertainment landscape.

Cybersecurity Threats and Competition

The increasing prevalence of cybersecurity threats and intensifying competition are pivotal factors impacting Disney‘s stock performance in the contemporary market landscape. As Disney expands its digital footprint through platforms like Disney+ and digital payments, the company becomes increasingly susceptible to cyber threats, including data breaches and ransomware attacks.

The protection of customer data and intellectual property is paramount for maintaining investor confidence and avoiding potential regulatory repercussions.

Moreover, the entertainment industry is witnessing a surge in competition from streaming giants like Netflix, Amazon Prime, and Hulu, challenging Disney’s market share and subscriber growth. The need to continuously innovate and produce compelling content while safeguarding against piracy and unauthorized distribution adds another layer of complexity to Disney’s strategic planning.

To mitigate these risks, Disney must invest in robust cybersecurity measures, stay ahead of technological advancements, and differentiate its content offerings to remain competitive in an ever-evolving landscape.

Strategic partnerships, acquisitions, and a focus on enhancing user experience can also help Disney navigate the intensifying competition and cybersecurity challenges in the market.

Investment Strategies and Recommendations

How can investors strategize effectively to capitalize on the current trends in Disney stock performance and navigate potential challenges in the market landscape? Disney’s stock performance has shown resilience and growth over the years, making it an attractive option for investors.

| Year | Stock Price (Opening) | Stock Price (Closing) | % Growth |

|---|---|---|---|

| 2018 | $100.35 | $109.65 | 9.27% |

| 2019 | $109.91 | $144.63 | 31.60% |

| 2020 | $145.29 | $181.18 | 24.72% |

| 2021 | $182.42 | $159.20 | -12.73% |

| 2022 | $160.32 | TBD | TBD |

To make informed investment decisions, it is essential to conduct thorough fundamental and technical analysis of Disney’s financial health and market trends. Considering the impact of factors such as theme park attendance, streaming service subscriptions, and new content production on stock value is significant.

Investment strategies for Disney stocks should include a mix of long-term investment for stability and short-term investment for capitalizing on market fluctuations. Diversification of investment portfolios can help mitigate risks associated with economic downturns and industry-specific challenges.

Staying informed about regulatory changes, customer preferences, and technological disruptions is crucial for adapting investment strategies accordingly. Despite the challenges posed by competition and cybersecurity threats, Disney stocks remain recommended for investors who carefully consider these factors before investing.

Frequently Asked Questions

How Has Disney’s Stock Performance Been Impacted by Theme Park Attendance?

Theme park attendance markedly influences Disney’s stock performance due to its correlation with revenue generation and brand perception. Declines in attendance can lead to stock decreases, while high attendance rates often result in positive stock movements.

What Are the Cultural Implications of Investing in Disney Stocks?

Investing in Disney stocks carries profound cultural implications, reflecting a connection to a legacy intertwined with society’s fabric. Beyond financial transactions, it symbolizes a shared heritage, innovation, and partnerships with industry icons, enriching investor engagement.

How Does Compliance With Regulations Affect Disney Stock Value?

Compliance with regulations is crucial for Disney stock value. Adherence guarantees legal and ethical operations, fostering investor trust. Regulatory violations can lead to fines, reputation damage, and stock devaluation. Therefore, robust regulatory compliance strategies are imperative for sustained stock performance.

What Cybersecurity Threats Pose Risks to Investing in Disney Stocks?

Cybersecurity threats pose risks to investing in Disney stocks. Potential risks include data breaches, ransomware attacks, and intellectual property theft. Mitigating these threats is essential for safeguarding investor confidence and sustaining the company’s market value.

How Can Investors Navigate Economic Downturns When Investing in Disney Stocks?

Managing economic downturns when investing in Disney stocks requires strategic planning. Diversify holdings, monitor market trends, and align with long-term investment goals. Analyze fundamental indicators, stay informed on industry developments, and adapt to changing economic landscapes for best portfolio management.

Conclusion

To sum up, FintechZoom Disney Stock stands as a beacon of resilience and innovation in the entertainment industry. Like a well-oiled machine, Disney’s stock performance reflects a legacy of growth and strategic decision-making.

As investors navigate the ever-evolving market landscape, staying attuned to digital trends and competition is paramount. By employing sound investment strategies and leveraging Disney’s cultural impact, investors can ride the wave of success in this dynamic market.

[…] and AI are super helpful because they can spot trends and patterns. This gives businesses a deeper insight into how things work, which can give them an advantage in the market. Therefore, building […]

[…] You can go through the real-time trends and make your plan clear. Along with the Fintech Disney stock comes in. Disney is the source of entertainment, media networks, and streaming services. So […]