IBM’s position in the fintech landscape combines cutting-edge technology and strategic growth. With a diversified portfolio and a focus on innovation, IBM stands out. Its notable projects in AI and blockchain drive changes in the financial industry. Historical performance and future forecasts hint at a promising trajectory.

Investors in the technology sector face challenges but also opportunities with IBM’s strong foothold. To understand IBM’s stock fully, consider its financial performance, including revenue growth and profitability. Explore further into IBM’s strategic partnerships and innovations to grasp its position in fintech. Additional insights await on IBM’s impact and potential in the financial world.

Table of Contents

Understanding Fintechzoom IBM Stock

In examining Fintechzoom IBM Stock, a thorough understanding of the company’s financial performance, market positioning, and strategic initiatives is paramount. IBM, a global technology leader, has a long-standing reputation for innovation and excellence.

Its market positioning is characterized by a diverse portfolio of products and services, catering to a wide range of industries and sectors. From cloud computing to artificial intelligence, IBM’s strategic initiatives focus on driving growth and staying at the forefront of technological advancements.

IBM’s commitment to financial performance is evident in its consistent revenue streams and profitability. The company’s ability to adapt to changing market conditions and customer needs has ensured its resilience in the face of economic challenges. By leveraging its strong brand recognition and customer loyalty, IBM continues to explore new opportunities for expansion and development.

Analysis of IBM’s Financial Performance

With a focus on IBM’s financial performance, an in-depth analysis reveals key metrics and trends shaping the company’s current economic standing. IBM, a stalwart in the technology industry, has shown resilience amidst market fluctuations. One important aspect to take into account is IBM’s revenue growth over the past few years. Examining the revenue streams from various segments such as cloud services, software, and consulting services provides insights into the company’s diversified income sources.

Profitability is another essential factor in evaluating IBM’s financial health. Analyzing factors like gross margin, operating margin, and net income can offer a thorough view of the company’s efficiency in managing costs and generating profits.

Furthermore, evaluating IBM’s debt-to-equity ratio and cash flow position is necessary to gauge its financial stability and liquidity. A strong balance sheet with manageable debt levels and healthy cash reserves indicates a favorable financial position for the company.

Also Read: Fintechzoom NVDA Stock

IBM’s Role in the Fintech Industry

IBM’s integration into the fintech industry signifies a strategic move towards leveraging technological advancements in the financial sector. As a renowned technology company with a rich history of innovation, IBM brings a wealth of expertise and resources to the table. In the domain of fintech, IBM plays a pivotal role in developing cutting-edge solutions that enhance security, efficiency, and customer experience.

One of IBM’s key contributions to the fintech industry is its focus on blockchain technology. By harnessing the power of blockchain, IBM helps financial institutions streamline their operations, reduce costs, and mitigate risks. Additionally, IBM’s cloud computing services provide fintech companies with scalable and secure infrastructure to support their digital transformation efforts.

Moreover, IBM’s commitment to data analytics and artificial intelligence enables fintech firms to gain valuable insights, make data-driven decisions, and personalize their services to meet the evolving needs of customers. Overall, IBM’s presence in the fintech industry signifies a commitment to driving innovation and shaping the future of finance through technology. The future of AI opens new horizons for automating processes, improving forecast accuracy and creating smarter financial solutions.

Impact of IBM’s Technological Innovations

Leading the way in technological advancements, IBM’s innovations have redefined the landscape of the financial industry, setting new standards for security, efficiency, and customer satisfaction.

By leveraging cutting-edge technologies such as artificial intelligence, blockchain, and cloud computing, IBM has revolutionized how financial institutions operate, manage data, and interact with customers. IBM’s technological solutions have enabled banks and financial firms to enhance cybersecurity measures, streamline operations, and personalize customer experiences.

IBM’s focus on innovation has not only improved the efficiency and effectiveness of financial services but has also paved the way for greater financial inclusion and accessibility. Through their technological advancements, IBM has empowered financial institutions to reach underserved populations, offer more tailored products and services, and drive financial literacy initiatives.

The impact of IBM’s technological innovations extends beyond just the financial sector, influencing the broader economy by fostering digital transformation and driving progress towards a more interconnected and technologically advanced future.

Case Study: IBM’s Notable Fintech Projects

IBM’s exploration into fintech projects has underscored its commitment to pioneering innovative solutions that reshape the financial landscape. One notable project by IBM is the development of blockchain technology for financial services.

Through platforms like IBM Blockchain World Wire, IBM has facilitated cross-border payments, enabling faster and more secure transactions for businesses globally. This initiative has streamlined payment processes, reducing transaction times and costs for businesses while enhancing transparency and security.

Moreover, IBM has ventured into the domain of artificial intelligence (AI) with projects like IBM Watson. By leveraging AI capabilities, IBM has enabled financial institutions to enhance customer service through chatbots, personalized recommendations, and fraud detection systems. These AI-driven solutions have revolutionized the way financial services interact with customers, providing a more seamless and efficient experience.

IBM’s Strategic Partnerships in Fintech

In the domain of fintech, IBM has strategically forged key partnerships to drive innovation and foster growth in the financial technology sector. Partnering with leading financial institutions and fintech startups, IBM has been able to leverage its expertise in technology and data analytics to create cutting-edge solutions tailored to meet the evolving needs of the industry.

By collaborating with key players in the fintech landscape, IBM has been able to enhance its offerings, ranging from cloud-based services to blockchain solutions, ultimately helping clients streamline operations, reduce costs, and improve customer experience.

One of IBM’s notable partnerships is with Ripple, a global provider of enterprise blockchain solutions for cross-border payments. Through this collaboration, IBM has integrated Ripple’s technology into its payment solutions, enabling faster and more cost-effective cross-border transactions for clients.

Additionally, IBM has partnered with various regulatory bodies to guarantee compliance and security in its fintech solutions, further solidifying its position as a trusted leader in the industry. These strategic partnerships underscore IBM’s commitment to driving innovation and shaping the future of fintech.

Fintechzoom IBM Stock: A Historical Perspective

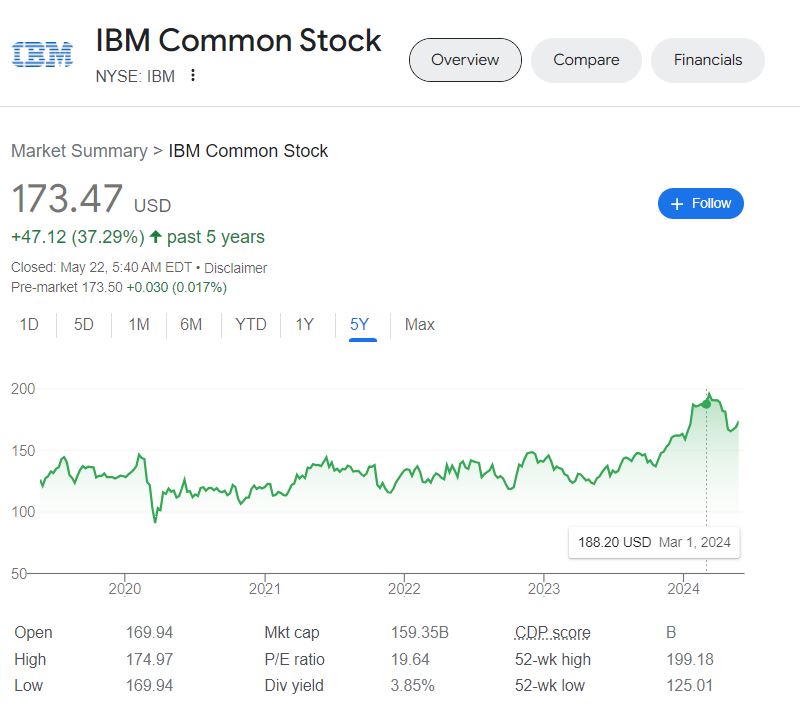

Examining the trajectory of Fintechzoom’s IBM stock reveals a rich historical narrative of market performance and strategic evolution. IBM, a stalwart in the tech industry, has witnessed fluctuations in its stock value over the years, influenced by various internal and external factors.

Historically, IBM has navigated through periods of innovation and transformation, adapting to the ever-changing landscape of technology. The company’s stock performance has reflected these shifts, including peaks during times of groundbreaking advancements and dips during periods of restructuring or market challenges.

Throughout its history, IBM has demonstrated resilience by strategically realigning its focus to meet the demands of the industry. Investors tracking IBM stock have observed the company’s ability to innovate, acquire, and divest in line with its long-term vision.

Understanding the historical performance of IBM stock provides valuable insights into the company’s past strategies and their impact on market perception. By analyzing these trends, investors and stakeholders can gain a deeper understanding of IBM’s historical resilience and strategic evolution in the tech sector.

Forecasting IBM’s Fintech Future

With the rapid evolution of financial technology and the ever-changing landscape of the tech industry, a profound analysis of IBM’s future in the fintech sector becomes imperative. IBM, a long-standing leader in the technology space, has been making strategic moves to position itself strongly in the fintech arena.

The company’s focus on innovation and its vast resources put it in a favorable position to capitalize on the growing demand for fintech solutions.

IBM’s commitment to developing cutting-edge technologies, such as artificial intelligence and blockchain, bodes well for its future in fintech. These technologies have the potential to revolutionize the way financial services are delivered, offering increased efficiency, security, and customer satisfaction.

Additionally, IBM’s partnerships with key players in the financial industry enhance its credibility and market reach. By leveraging these partnerships and staying at the forefront of technological advancements, IBM is poised to play a significant role in shaping the future of fintech. Investors and industry observers should keep a close eye on IBM’s fintech initiatives as they have the potential to drive substantial growth and innovation in the sector.

The Risks and Rewards of IBM Stock

Given the promising trajectory of IBM’s fintech initiatives and its strategic positioning in the industry, an evaluation of the risks and rewards associated with investing in IBM stock is warranted. IBM’s stock presents both opportunities and challenges for investors.

One of the rewards of investing in IBM stock is the company’s strong foothold in the technology sector, particularly in areas such as cloud computing and artificial intelligence. IBM’s continued focus on innovation and its ability to adapt to changing market dynamics can potentially lead to long-term growth and profitability for investors.

However, there are risks to take into account as well. IBM operates in a highly competitive industry where technological advancements can quickly disrupt the market. Additionally, fluctuations in global economic conditions and regulatory changes can impact IBM’s performance and stock value. Investors should also be mindful of IBM’s debt levels and cash flow position when analyzing the risks associated with investing in the company’s stock.

Investing in IBM: A Comprehensive Guide

Understanding the complexities of investing in IBM requires a thorough grasp of the company’s financial performance and strategic direction. IBM, a global technology and consulting company, has a long history of innovation and adaptation to market trends.

To make an informed investment decision, potential investors should analyze IBM’s revenue growth, profitability, and cash flow generation. Examining IBM’s competitive positioning within the tech industry, including its market share and differentiation strategy, is essential for understanding its potential for future growth.

Additionally, evaluating IBM’s management team and their ability to execute strategic initiatives is vital. Investors should pay close attention to IBM’s investments in research and development, as well as its acquisitions and partnerships, to gauge its commitment to staying competitive in the rapidly evolving technology landscape.

Furthermore, understanding macroeconomic factors that could impact IBM, such as regulatory changes and global economic conditions, is paramount. Diversification strategies, risk management practices, and long-term growth prospects should also be considered when evaluating IBM as an investment opportunity. By conducting a thorough analysis of IBM’s financial health and strategic direction, investors can make well-informed decisions aligned with their investment objectives.

Frequently Asked Questions

How Does IBM’s Stock Performance Compare to Its Competitors?

When evaluating IBM’s stock performance against its competitors, it is imperative to take into account factors such as financial health, market positioning, innovation, and industry trends. Conducting a thorough comparative analysis can provide valuable insights for strategic decision-making.

What Are the Key Challenges IBM Faces in the Fintech Sector?

In the fintech sector, IBM faces challenges such as adjusting to rapidly evolving technologies, meeting stringent regulatory requirements, coping with intense competition, and attracting top talent. Overcoming these hurdles will be essential for IBM’s success.

How Does IBM Ensure Data Security in Its Fintech Projects?

IBM guarantees data security in its fintech projects through robust encryption protocols, stringent access controls, continuous monitoring, and regular security audits. By integrating cutting-edge technologies like AI and blockchain, IBM safeguards sensitive financial information, ensuring trust and compliance.

What Impact Do Regulatory Changes Have on Ibm’s Fintech Initiatives?

Regulatory changes impact IBM’s fintech initiatives by shaping the legal framework within which these projects operate. Compliance requirements, market shifts, and consumer protection laws influence strategy, product development, and risk management, necessitating agile adaptation to guarantee continued success.

How Does IBM Adapt to Emerging Fintech Trends in the Market?

IBM adapts to emerging fintech trends by leveraging its vast resources, investing in research and development, fostering partnerships with fintech startups, and implementing agile strategies. This approach enables IBM to stay competitive and innovative in the rapidly evolving market.

Conclusion

To sum up, as we navigate the intricate landscape of fintech and technology, IBM’s stock stands as a beacon of innovation and resilience. By delving into IBM’s financial performance, technological advancements, and industry influence, we gain a deeper understanding of its potential in the market. Investing in IBM requires a strategic approach, considering both risks and rewards. Just as IBM has adapted and evolved over time, investors must also be prepared to adapt to the ever-changing fintech landscape.

[…] association among IBM and FintechZoom is critical on the grounds that it mixes IBM’s longstanding industry presence […]

[…] Also read Fintechzoom’s analysis on IBM stock. […]

[…] Analyst opinions vary, encompassing buy, hold, and sell ratings. Price targets and recommendations should be considered alongside broader investment strategies and market contexts. We provide a summary of current analyst opinions on IBM stock. […]