Fintechzoom’s detailed analysis of Lucid Motors stock equips investors with essential insights into market trends and growth potential. The thorough reporting provides key indicators impacting valuation, essential for informed decision-making in the dynamic electric vehicle market.

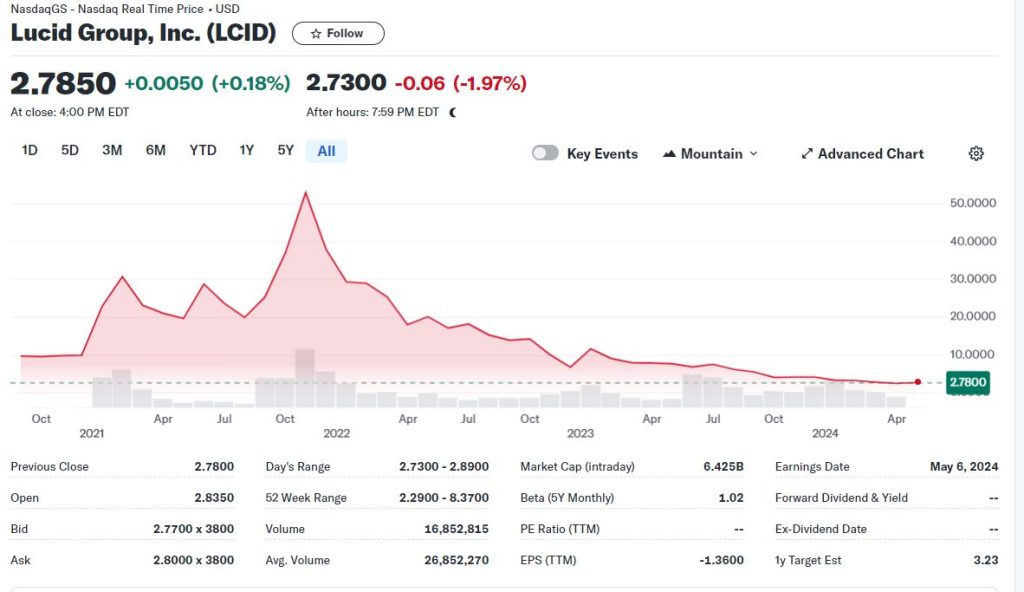

Lucid Motors’ financial strength, with $3.85 billion in cash and $2.42 billion in debt, supports innovation and expansion. The stock price of $2.3600, within a 52-week range of $2.2900–$8.3700, reflects the influence of the Lucid Air and Lucid Gravity SUV launch. Lucid’s strategic positioning in the luxury EV market emphasizes technology and sustainability, showcasing potential growth opportunities.

Table of Contents

Key Takeaways

- Lucid Motors stock analysis provided by Fintechzoom.

- Detailed insights into market trends and growth potential.

- Financial strength with $3.85 billion cash and $2.42 billion debt.

- Average 12-month price target for Lucid Group stock is $4.50.

- Supported by innovative EV models and strategic financial backing.

Fintechzoom Lucid Stock: Lucid Motors Overview

In the domain of financial analysis and market insights, exploring the Fintechzoom coverage of Lucid Motors offers a thorough overview of the company’s stock performance and strategic positioning. Fintechzoom provides in-depth analysis of Lucid Motors stock, catering to investors seeking detailed information on LCID stock. Through Fintechzoom’s lens, investors can gain valuable insights into Lucid’s market position, growth potential, and overall performance.

Fintechzoom’s coverage of Lucid Motors examines the intricacies of the company’s stock, shedding light on key performance indicators, market trends, and forecasts. By closely analyzing Lucid’s stock trajectory, investors can make informed decisions regarding their investments in the company. Furthermore, Fintechzoom’s analytical approach helps investors navigate the dynamic landscape of the stock market, offering a detailed view of Lucid Motors’ stock performance.

Fintechzoom Lucid Stock: Financial Performance

With a focus on financial metrics and operational efficiency, Lucid Motors‘ performance in the market reflects a strategic approach towards sustainable growth and profitability. Recent financial updates show that Lucid Motors had $3.85 billion in cash and $2.42 billion in debt, indicating a healthy cash position.

In 2023, the company reported total revenue of $595.3 million, showcasing a strong revenue stream. This financial strength positions Lucid Motors uniquely in the luxury EV market, allowing for continued innovation and expansion.

Moreover, Lucid Motors’ positive stock results are supported by its sound financial backing, especially from Saudi Arabia. The stock price as of April 2024 stood at $2.3600, with a 52-week range of $2.2900–$8.3700.

Despite fluctuations, the average 12-month price target for Lucid Group stock is $4.50, suggesting confidence in the company’s future performance. Investors are advised to monitor Lucid Motors’ progress closely, considering its financial stability and growth potential.

Fintechzoom Lucid Stock: Lucid Stock Price Analysis

How does the current stock price of Lucid Motors reflect its market position and growth trajectory? Lucid Motors’ stock price of $2.3600 as of April 2024 showcases a significant change from its 52-week range of $2.2900–$8.3700.

Despite this fluctuation, the average 12-month price target for Lucid Group stock stands at $4.50, indicating a potential upside. The stock’s performance is influenced by factors such as the launch of models like the Lucid Air and Lucid Gravity SUV, as well as strategic financial support, particularly from Saudi Arabia.

Additionally, with Lucid Motors holding $3.85 billion in cash and $2.42 billion in debt, the company seems well-positioned to navigate market challenges. The stock’s current valuation reflects investor sentiment regarding Lucid’s growth prospects, technological innovations, and ability to capture market share in the competitive EV industry. Investors should continue to monitor how these factors shape Lucid Motors’ stock performance in the coming months.

Fintechzoom Lucid Stock: Lucid’s Market Positioning

Lucid Motors’ market positioning is underscored by its strategic financial backing, innovative EV models, and unique standing in the luxury EV market landscape. With investments from entities like Saudi Arabia, Lucid has been able to advance with models such as the Lucid Air and the upcoming Lucid Gravity SUV.

These financial resources have enabled the company to strengthen its position in the EV market and expand into new markets. Additionally, Lucid’s focus on cutting-edge technology and sustainability aligns with the future trends of the EV industry, further solidifying its market position.

Moreover, Lucid Motors stands out in the luxury EV segment due to its high-quality offerings and innovative designs. The company’s notable safety records and the impressive 900-hp test vehicle have garnered attention within the industry.

As a result, Lucid has carved a unique niche for itself in the competitive luxury EV market, positioning itself as a key player to watch in the evolving landscape of electric vehicles.

Fintechzoom Lucid Stock Coverage

Providing in-depth analysis and coverage of Lucid Motors stock, Fintechzoom offers investors valuable insights into market trends and growth potential. Fintechzoom’s thorough reporting on Lucid stock performance and market trends equips investors with the information necessary to make informed decisions.

By keeping a close eye on Lucid Motors’ stock and market position, Fintechzoom aids investors in understanding the company’s trajectory and forecasting its future performance. With a focus on data-driven analysis, Fintechzoom presents a detailed view of Lucid Motors’ stock, highlighting key indicators that impact its valuation.

This type of coverage is essential for investors looking to navigate the dynamic landscape of the electric vehicle market and capitalize on opportunities for growth. As Fintechzoom remains cautiously optimistic about Lucid Motors stock, investors are encouraged to stay informed, monitor progress, and stay attuned to market developments that could influence the company’s performance and stock value.

Lucid Revenue Insights

With a focus on financial performance and key revenue indicators, what insights can be gleaned from Lucid Motors‘ recent revenue figures? Lucid Motors reported total revenue of $595.3 million in 2023, reflecting a strong performance in the luxury EV market.

This revenue figure showcases Lucid’s ability to attract high-end consumers and compete effectively in the electric vehicle industry. The company’s revenue growth trajectory indicates a positive trend, supported by the increasing demand for their cutting-edge EV models like the Lucid Air and Lucid Gravity SUV.

Moreover, Lucid Motors’ financial position is notable, with $3.85 billion in cash and $2.42 billion in debt. This healthy cash position provides the company with a solid financial foundation to support its growth initiatives and innovation efforts.

As a result, investors and market analysts remain cautiously optimistic about Lucid Motors’ revenue potential and market position. Monitoring Lucid’s revenue growth, market developments, and product innovation will be vital for stakeholders looking to capitalize on the company’s performance in the evolving EV landscape.

Industry Position of Lucid

After reviewing Lucid Motors‘ recent revenue figures and financial position, it is evident that the company has solidified a strong industry position in the luxury electric vehicle market. With $3.85 billion in cash and $2.42 billion in debt, Lucid Motors is in a robust financial position.

In 2023, the company reported total revenue of $595.3 million, showcasing its growth and potential in the EV sector. Lucid’s unique focus on technology and sustainability has differentiated it in the market, with models like the Lucid Air and Lucid Gravity SUV gaining traction.

Supported by strategic financial backing, notably from Saudi Arabia, Lucid Motors has been able to advance its production capabilities and expand into new markets. The company’s stock price as of April 2024 stood at $2.3600, with a 52-week range of $2.2900–$8.3700.

Analysts have set an average 12-month price target for Lucid Group stock at $4.50, indicating optimism about its future performance. Overall, Lucid Motors holds a promising position in the luxury EV segment, with a strong foundation for continued growth and success.

Fintechzoom’s Stock Forecasts

Analyzing Fintechzoom’s stock forecasts reveals valuable insights into the future trajectory of Lucid Motors’ market performance and growth potential. As reported, Fintechzoom provides detailed coverage and analysis on Lucid Motors stock, aiding investors in understanding the company’s market position.

The platform offers updates on Lucid stock performance, market trends, and forecasts about the company’s future outlook. With Lucid Motors making strides with models like the Lucid Air and Lucid Gravity SUV, supported by strategic financial backing, particularly from Saudi Arabia, the stock has shown positive momentum. As of April 2024, Lucid Motors’ stock price stood at $2.3600, within a 52-week range of $2.2900–$8.3700.

Additionally, the average 12-month price target for Lucid Group stock is reported at $4.50. Fintechzoom’s cautious optimism about Lucid Motors stock suggests potential growth opportunities, indicating the importance for investors to monitor the company’s progress and market developments closely.

Lucid Motors’ Cash Flow

Fintechzoom’s detailed reporting on Lucid Motors‘ financial status reveals significant insights into the company’s cash flow position. As of the latest data available, Lucid Motors reported $3.85 billion in cash and $2.42 billion in debt. This important cash position indicates a strong financial foundation that can support the company’s operations, investments, and growth strategies.

Furthermore, with a total revenue of $595.3 million in 2023, Lucid Motors has been able to effectively manage its cash flows while driving revenue generation. The company’s ability to balance its cash reserves with its debt obligations showcases a prudent financial management approach that is essential for long-term sustainability and success in the competitive electric vehicle market.

Investors and stakeholders closely monitor Lucid Motors’ cash flow dynamics as it provides significant insights into the company’s liquidity, financial health, and ability to fund its ambitious projects like the Lucid Air and Lucid Gravity SUV. As Lucid Motors continues to expand its market presence and innovate in the EV sector, its cash flow management will remain a key factor influencing its future growth trajectory.

Monitoring Lucid’s Progress

As Lucid Motors continues to navigate the dynamic landscape of the electric vehicle market, close observation of its advancements and strategic decisions is essential for stakeholders seeking to gauge the company’s trajectory and potential for sustained growth.

Lucid Motors has been making significant strides with the introduction of models like the Lucid Air and the upcoming Lucid Gravity SUV, showcasing its commitment to innovation in the EV sector. Additionally, the company’s efforts to strengthen its finances through investments and expanding into new markets indicate a proactive approach towards growth.

Monitoring Lucid’s progress involves tracking not only its product developments but also its financial performance and market positioning. With positive stock results in recent trends and performance highlights, Lucid Motors has garnered attention from investors.

Furthermore, focusing on generating positive returns with cutting-edge EVs while emphasizing technology and sustainability positions the company for success in the evolving automotive industry. Stakeholders should remain vigilant in monitoring Lucid’s advancements to stay informed about its evolving market position and growth trajectory.

Conclusion

In analyzing Fintechzoom’s coverage of Lucid Motors, it is evident that the company’s financial performance, stock price trends, and market positioning are closely monitored for insights into its trajectory. With a strong focus on cutting-edge EV technology and sustainability, Lucid Motors is well-positioned for long-term success in the electric vehicle industry. Monitoring Lucid’s progress and industry position provides valuable insights for investors and industry experts alike.

[…] Also read our latest analysis on Lucid Motor Stock. […]

[…] Also Read: Fintechzoom Lucid Stock […]

[…] entrants such as Rivian and Lucid Motors are also making significant strides. Rivian, in particular, has captured attention with its […]