Analyzing NVDA stock on Fintechzoom reveals strategic growth drivers like innovative products, AI focus, and strategic partnerships. The company’s evolution showcases leadership in AI, diversified revenue streams, and agility in adapting to industry changes. Strong innovation, partnerships, and operational excellence contribute to NVDA’s success amidst challenges like market cyclicality and intense competition.

Compared to competitors, NVDA stands out in high-performance computing and gaming GPUs, while facing threats from market shifts. Investor perspectives highlight NVDA’s market dominance and growth potential. Projections signal increasing demand for high-performance GPUs driven by AI technology. NVDA’s strategic positioning, investor insights, and market trends all shape its performance.

Table of Contents

Understanding Fintechzoom’s NVDA Stock

In delving into the intricacies of Fintechzoom’s NVDA stock, a thorough analysis reveals the underlying factors shaping its performance in the market. NVIDIA Corporation (NVDA) is a renowned semiconductor company that has witnessed significant growth in recent years.

One of the key drivers of NVDA’s stock performance is its innovative product portfolio, particularly in the gaming and data center segments. The company’s focus on artificial intelligence and high-performance computing has positioned it as a leader in these rapidly expanding markets.

Moreover, NVDA’s strategic partnerships and acquisitions have bolstered its market position and contributed to its financial success. By collaborating with industry leaders and investing in cutting-edge technologies, NVIDIA has been able to stay ahead of the curve and capitalize on emerging trends.

Furthermore, the overall market sentiment, industry regulations, and global economic conditions play a pivotal role in influencing NVDA’s stock performance. Investors keen on understanding Fintechzoom’s NVDA stock should closely monitor these factors to make informed decisions and navigate the dynamic landscape of the stock market effectively.

Evolution of Fintechzoom’s NVDA Stock

The trajectory of Fintechzoom’s NVDA stock exemplifies a compelling narrative of strategic evolution within the semiconductor industry. Initially known for its graphics processing units (GPUs) in the gaming market, Fintechzoom recognized the potential to expand into high-performance computing, artificial intelligence, and data centers. This strategic shift allowed NVDA stock to capitalize on emerging technologies and diversify its revenue streams beyond gaming.

As NVDA stock evolved, Fintechzoom strategically positioned itself as a leader in AI and deep learning, providing solutions for autonomous vehicles, healthcare, and cloud computing. This evolution not only broadened Fintechzoom’s market reach but also solidified its reputation for innovation and technological excellence.

Moreover, Fintechzoom’s strategic partnerships and acquisitions have played an essential role in its evolution. Collaborations with industry giants and strategic acquisitions of key technology companies have enabled Fintechzoom to stay at the forefront of technological advancements, driving further growth and market success. This evolution showcases Fintechzoom’s agility and foresight in adapting to the dynamic landscape of the semiconductor industry.

You may like to read our analysis on TESLA.

Factors Driving NVDA Stock Success

Building upon Fintechzoom’s strategic evolution within the semiconductor industry, the success of NVDA stock can be attributed to a combination of key factors driving its growth and market performance.

To begin with, NVDA’s strong focus on innovation and research and development has enabled the company to stay ahead of competitors by consistently introducing cutting-edge technologies in areas such as artificial intelligence, data centers, and autonomous vehicles. This commitment to innovation has not only expanded NVDA’s market reach but has also solidified its position as a leader in the semiconductor space.

Additionally, NVDA’s strategic partnerships and collaborations with industry giants have further boosted its market presence and credibility, leading to increased investor confidence. Moreover, the company’s efficient supply chain management and cost-effective production processes have contributed to its financial success, ensuring sustainable growth and profitability.

Ultimately, NVDA’s success can be attributed to a combination of innovation, strategic partnerships, and operational excellence, all of which have propelled the company to the forefront of the semiconductor industry.

Challenges Faced by NVDA Stock

Despite NVDA stock’s significant success in the semiconductor industry, it faces a myriad of challenges that warrant careful consideration and strategic maneuvering. One of the key challenges for NVDA stock is the cyclical nature of the semiconductor industry.

Fluctuations in demand, changes in technology, and global economic conditions can have a substantial impact on NVDA’s financial performance. Additionally, competition in the semiconductor market is fierce, with rivals constantly innovating to gain a competitive advantage. NVDA must continue to invest in research and development to stay ahead of the curve.

Moreover, geopolitical tensions and trade policies can also pose challenges for NVDA stock. Tariffs and trade restrictions can disrupt supply chains and impact NVDA’s operations. Additionally, regulatory scrutiny on data privacy and security could potentially affect NVDA’s business practices and profitability. As NVDA expands into new markets and technologies, navigating regulatory environments will be critical for its long-term success.

Comparing NVDA Stock With Competitors

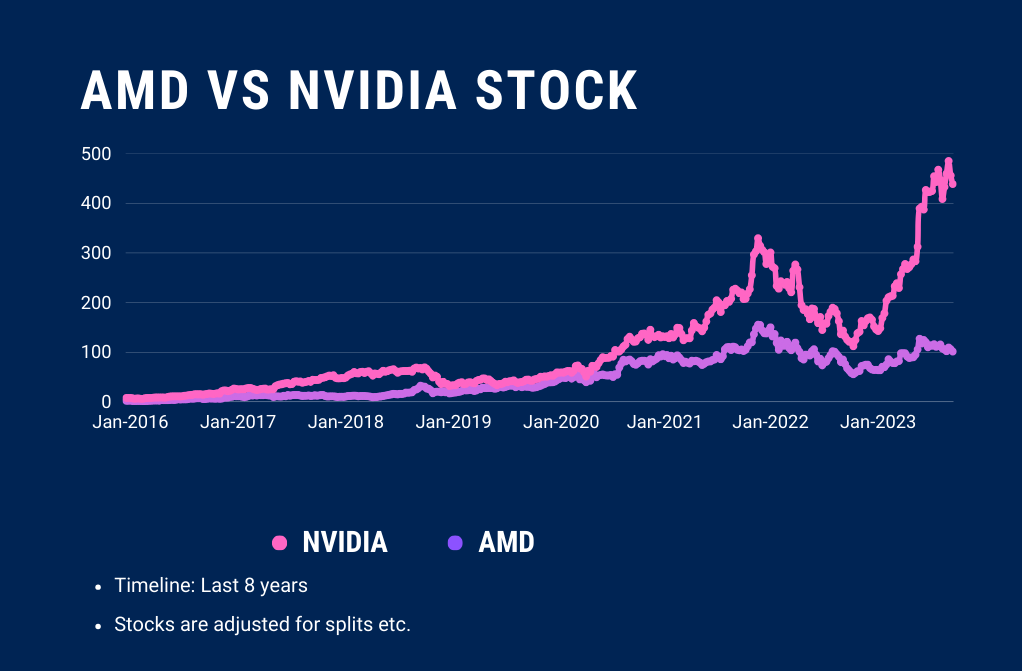

Given the challenges posed by the semiconductor industry‘s cyclical nature and competitive landscape, it is imperative to evaluate NVDA stock in comparison to its industry rivals to gauge its performance and positioning. NVIDIA Corporation (NVDA) faces competition from companies like Advanced Micro Devices (AMD) and Intel Corporation (INTC) in the semiconductor market. When comparing NVDA stock with its competitors, several factors come into play.

NVDA has carved a niche for itself in the high-performance computing and artificial intelligence sectors, which sets it apart from AMD and INTC. Its strong presence in gaming GPUs also gives it a competitive edge. However, AMD has been gaining market share in CPUs and GPUs, posing a threat to NVDA’s dominance. On the other hand, INTC, despite facing challenges, remains a formidable competitor with its established market presence and technological capabilities.

Analyzing NVDA’s financial performance, market share, technological innovations, and strategic partnerships vis-a-vis its competitors can provide investors with valuable insights into the company’s standing within the industry and its potential for future growth.

Investor Perspectives on NVDA Stock

An in-depth analysis of investor perspectives on NVDA stock reveals key insights into the market sentiment and strategic considerations driving investment decisions in the semiconductor sector. Investors view NVDA as a leader in the semiconductor industry due to its innovative technology, strong financial performance, and market dominance.

The company’s consistent revenue growth and expansion into new markets such as artificial intelligence and autonomous vehicles have attracted a large investor following. Additionally, NVDA’s strategic partnerships and acquisitions have positioned it favorably for future growth opportunities. Investors are optimistic about NVDA’s long-term prospects, considering its solid track record of delivering shareholder value and staying ahead of industry trends.

However, some investors express concerns about the competitive landscape and potential market fluctuations impacting NVDA’s stock performance. Overall, investor sentiment towards NVDA remains positive, with many seeing it as a solid investment choice in the semiconductor sector.

Also Read: Fintechzoom Apple Stock Analysis

Future Projections for NVDA Stock

Building on the positive investor sentiment surrounding NVDA stock, future projections for the company’s performance reflect a blend of optimism and strategic considerations in the ever-evolving semiconductor landscape. NVIDIA (NVDA) is poised to benefit from the increasing demand for its high-performance graphics processing units (GPUs) in various sectors, including gaming, data centers, artificial intelligence, and autonomous vehicles. The company’s focus on innovation and research in areas like AI, machine learning, and autonomous driving technology positions it favorably for sustained growth.

Furthermore, NVDA’s strategic partnerships with key industry players and its expansion into new markets indicate a promising outlook for the company. As the global semiconductor market continues to evolve rapidly, NVDA’s ability to adapt to changing trends and capitalize on emerging opportunities will be critical for its long-term success.

With a solid financial track record and a reputation for cutting-edge technology, NVDA is well-positioned to navigate the dynamic landscape of the semiconductor industry and deliver value to its shareholders in the coming years.

How to Invest in NVDA Stock?

To maximize potential returns through strategic investment, understanding the fundamentals and market dynamics of NVDA stock is vital. NVDA, a leading semiconductor company, has shown strong growth potential driven by its innovative technologies and market dominance. Investing in NVDA stock requires careful consideration of various factors.

To begin with, conducting in-depth research on the company’s financial health, product pipeline, and competitive position is essential. Analyzing industry trends, such as the demand for AI and gaming technology – areas where NVDA excels, can provide valuable insights for investment decisions.

Additionally, monitoring macroeconomic indicators and geopolitical events that could impact the semiconductor industry is important. Diversifying your portfolio to mitigate risks associated with a single stock investment is advisable. Setting clear investment goals and risk tolerance levels will help in formulating a sound investment strategy.

Regularly reviewing and adjusting your investment portfolio in response to changing market conditions is also recommended to optimize returns. By following these strategies, investors can make informed decisions when investing in NVDA stock.

Impact of Market Trends on NVDA Stock

Understanding the impact of current market trends is essential when evaluating the trajectory of NVDA stock performance. Market trends, such as technological advancements, industry regulations, and global economic conditions, play a significant role in influencing the stock price of NVDA.

For instance, if there is a surge in demand for artificial intelligence technology, which is one of NVDA’s core offerings, the stock price is likely to rise. Conversely, if there are trade tensions affecting the semiconductor industry, NVDA’s stock may experience a decline.

Additionally, investor sentiment and market speculation can also sway NVDA’s stock price. Positive news about new product launches or strategic partnerships can lead to increased investor confidence and a rise in stock value. On the other hand, negative publicity or a bearish market outlook can cause the stock price to drop.

Therefore, keeping a close eye on current market trends and understanding their potential impact on NVDA’s business operations is essential for investors looking to make informed decisions about buying or selling NVDA stock.

Case Studies of NVDA Stock Performance

How have past market conditions influenced the performance of NVDA stock in various case studies? When examining case studies of NVDA stock performance, it becomes evident that market conditions play a significant role in shaping the stock’s trajectory.

For instance, during periods of technological advancements or increased demand for graphic processing units (GPUs) in sectors like artificial intelligence, NVDA stock tends to experience substantial growth. Conversely, during economic downturns or times of heightened competition, the stock may face challenges and fluctuations.

One notable case study is NVDA’s performance during the cryptocurrency boom of 2017. As cryptocurrencies surged in popularity, the demand for GPUs for mining purposes skyrocketed, benefiting NVDA’s stock performance. On the other hand, during the trade tensions between the U.S. and China, NVDA stock faced volatility due to its exposure to international markets and potential tariff implications.

Frequently Asked Questions

Can Individuals Directly Purchase Shares of NVDA Stock From Fintechzoom?

Individuals can directly purchase shares of NVDA stock through brokerage platforms like Fintechzoom. Fintechzoom Pro serves as a facilitator, enabling users to invest in a variety of stocks, including NVDA, offering a seamless and user-friendly experience for investors.

What Impact Do Global Economic Policies Have on NVDA Stock Prices?

Global economic policies can have a substantial impact on NVDA stock prices. Policies related to trade, tariffs, interest rates, and fiscal stimulus can influence demand for NVDA products and services, affecting revenues and profitability, ultimately reflecting in stock price fluctuations.

Are There Any Upcoming Product Launches That Could Affect NVDA Stock?

Anticipated product launches can greatly impact NVDA stock. These events generate excitement, drive investor interest, and often lead to short-term price spikes. Analyzing the potential market reception and performance outcomes is vital for informed decision-making.

How Does NVDA Stock Perform During Periods of Economic Recession?

During periods of economic recession, NVDA stock may experience volatility due to reduced consumer spending and business investment. Investors often seek safe-haven assets, impacting tech companies like NVDA. Diversification and monitoring economic indicators are key strategies.

What Are the Potential Risks Associated With Investing in NVDA Stock?

Investing in NVDA stock carries risks like market volatility, competition, and technological changes affecting demand. Economic downturns or regulatory challenges may also impact stock value. Diversification and research can help manage risks for investors.

Conclusion

To wrap up, Fintechzoom’s NVDA stock has shown remarkable growth and success, driven by various factors and strategies. Despite facing challenges and competition in the market, NVDA stock has managed to stand out and maintain a strong position.

Looking ahead, projections for NVDA stock remain positive, and investors can consider this stock for potential growth opportunities. The performance of NVDA stock serves as a confirmation of its resilience and innovation in the ever-changing market landscape.

[…] risks inherent in the sector. To read more about NVDA’s investment potential, visit the Fintechzoom NVDA Stock Analysis: AI Focus, Market Trends & Growth Drivers and FintechZoom NVDA Stock: A Comprehensive […]

[…] – which NVDA’s strategic partnerships and cutting-edge investments have helped it do. NVDA maintains competitive edge by investing in cutting-edge technologies which help it to maximize […]

[…] for investors. Updates about Nvidia’s next moves and tech breakthroughs, reported by FintechZoom’s Nvidia analysis, significantly affect where the money […]

[…] architecture and strategic acquisitions like Xilinx bolster its competitive edge against Intel and NVIDIA. However, market volatility and supply chain risks can affect performance. Keep exploring to […]

[…] Also Read: Fintechzoom NVDA Stock […]

[…] and significant contributions to artificial intelligence (AI) advancements. The company’s stock, represented by the ticker symbol NVDA, is a focal point for investors worldwide, given its […]

[…] Maintaining this position will require continuous investment in R&D and staying ahead of technological advancements. For more detailed insights, visit FintechZoom NVDA Stock. […]

[…] semiconductor company known for its strong financial performance and stock trends. Looking at the nvidia stock price history and nvidia stock financial data shows the company’s growth and market […]