In the domain of gold price analysis, the incorporation of FintechZoom brings a new dimension to understanding the market dynamics. The utilization of cutting-edge technology to track, analyze, and predict gold prices offers investors a unique advantage in maneuvering the complexities of this precious metal’s value fluctuations.

By exploring how FintechZoom’s platform interprets real-time data and market trends, we can gain valuable insights into potential strategies that may enhance investment decisions in the ever-evolving landscape of gold trading.

Table of Contents

Key Takeaways

- Gold price influenced by supply, demand, and acts as an investment asset.

- FintechZoom offers innovative tools for comparing gold prices and market indicators.

- Gold serves as a safe-haven asset during economic uncertainties and inflation concerns.

- Diversify investments with gold to balance safety and potential returns effectively.

Gold Price Fintechzoom: Influencing Factors

The dynamics of gold prices are intricately tied to a multitude of influencing factors, ranging from global supply and demand dynamics to the impact of currency movements, making it a complex and multifaceted investment asset.

Understanding these factors is important for investors looking to navigate the gold market effectively. Fintechzoom, a platform that offers valuable insights into gold prices and market indicators, plays a pivotal role in guiding investment decisions.

Analyzing historical gold price charts can provide valuable information on price trends and potential future movements. Factors such as geopolitical events, economic data releases, and market sentiment can all impact gold prices significantly.

Additionally, the correlation between gold and the U.S. dollar is a key consideration for investors as currency movements can influence the attractiveness of gold as an investment.

Central Banks and Gold Reserves

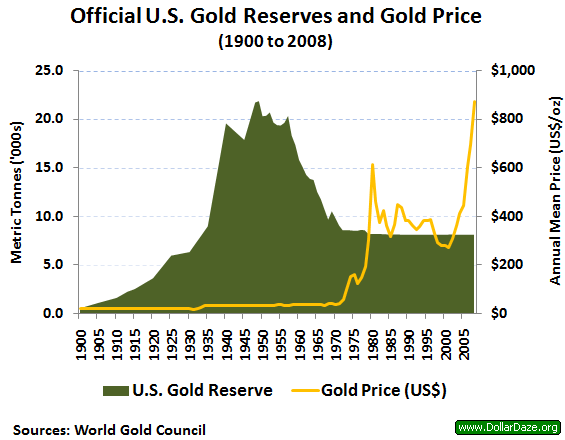

Prominent for their strategic financial planning, central banks worldwide meticulously allocate significant portions of their reserves to gold, a timeless asset revered for its stability and value retention.

Central banks’ decisions regarding gold reserves play a critical role in diversifying their overall reserve portfolio, mitigating risks associated with currency fluctuations and economic uncertainties. Gold’s intrinsic value and limited supply make it a sought-after asset for central banks aiming to bolster their reserve holdings.

The fluctuation in gold prices, influenced by various factors such as supply, demand, and currency movements, underscores the importance of gold in central banks’ asset allocation strategies. Fintechzoom provides valuable insights into gold price dynamics, enabling central banks to make informed decisions regarding their gold reserves management.

By leveraging platforms like Fintechzoom, central banks can closely monitor gold prices, assess market indicators, and optimize their gold investment strategies for long-term financial stability and value preservation.

Interested in Dow Jones index? Check out Dow Jones Fintechzoom charts.

Gold Standard and Currencies

Central banks strategically allocate significant portions of their reserves to gold, a decision influenced by the asset’s importance, value retention, and the historical relationship between the gold standard and currencies.

Historically, the gold standard directly linked currencies to specific amounts of gold, providing stability and confidence in the monetary system. While the gold standard is no longer widely used, gold remains an important asset in the global economy.

The value of currencies and gold often have an inverse relationship, where fluctuations in one can impact the other. Gold prices are particularly sensitive to movements in major currencies, especially the U.S. dollar.

Investors often turn to gold as a safe haven during times of economic uncertainty or currency devaluation, further highlighting the enduring connection between gold and currencies. Understanding this historical link can provide insights into how gold continues to play a significant role in the modern financial landscape.

Gold Trading Methods and Options

In the domain of gold trading, a multitude of methods and options exist for investors seeking to engage with this precious metal. Investors can opt for physical gold purchases, buying gold stocks, trading gold futures, or investing in gold exchange-traded funds (ETFs).

Physical gold provides tangible ownership, while stocks offer exposure to gold mining companies. Trading futures allows for speculation on future gold prices, and ETFs provide a convenient way to invest in gold without owning the physical asset.

Options trading is another avenue for investors looking to profit from gold price movements without owning the metal itself. Through options, investors can take advantage of both rising and falling gold prices through calls and puts, respectively.

This flexibility allows for strategic positioning in the market based on anticipated price movements. Overall, these diverse methods and options offer investors a range of choices to participate in the gold market according to their risk tolerance, investment objectives, and market outlook.

Gold Price Fintechzoom: Performance Trends and Statistics

Based on recent market data and historical trends, the performance of gold in the current economic landscape showcases a remarkable resilience and strategic importance for investors seeking stability and diversification in their portfolios.

| Year | Average Price | Year-End Price | High Price |

| 2024 | $2,017.05 | $2,073.05 | $2,084 |

| 2025 | $2,156 | $2,264 | $2,317 |

| 2026 | $2,395 | $2,481 | $2,705 |

| 2027 | $2,553 | $2,681 | $2,707 |

| 2028 | $2,553 | $2,681 | $2,707 |

In 2024, gold experienced a decrease of 1.50%, with prices hovering around $2,030 per ounce. However, over the past year, gold has demonstrated a significant change of over 10%, reaching an all-time high of $2150 in December 2023. The volatility observed in 2022, attributed to Fed rate hikes, was followed by a recovery in 2023, highlighting gold’s ability to recover from market fluctuations.

Significantly, gold has historically maintained its value during economic downturns, making it a popular choice for investors looking to hedge against uncertainties. The data underscores gold’s role as a safe-haven asset and a potential store of value, positioning it as a key component in a well-diversified investment strategy.

Gold Investment Strategies Overview

Gold investment strategies play a pivotal role in balancing safety and returns for investors seeking to diversify their portfolios effectively. Gold is often considered a safe-haven asset, providing stability during economic uncertainties.

Attainable objectives and insights from platforms like Fintechzoom are essential for successful gold investments under our gold price Fintechzoom section. Diversification is key to reducing exposure to market fluctuations, and strategies like dollar-cost averaging can help mitigate volatility impacts. Understanding one’s risk tolerance is vital for making informed investment decisions in the gold market.

Investors can choose to buy physical gold, trade through futures, options, stocks, or ETFs to gain exposure to this precious metal. Gold prices are influenced by various factors such as supply and demand dynamics, currency movements (especially the U.S. dollar), and geopolitical events. By incorporating gold into their investment portfolios, investors can benefit from its historical performance as a hedge against inflation and a store of value over the long term.

LBMA Gold Price Benchmark

With the increasing importance of understanding the factors influencing gold prices, the LBMA Gold Price Benchmark serves as a significant reference point for market participants. The London Bullion Market Association (LBMA) Gold Price Benchmark is vital for establishing the daily price for gold in major currencies, including the U.S. dollar, euro, and pound sterling.

This benchmark is set through electronic auctions independently administered by ICE Benchmark Administration (IBA), ensuring transparency and accuracy in price discovery.

Market participants rely on the LBMA Gold Price Benchmark for pricing physical gold transactions, derivatives, and other gold-related financial products. The benchmark reflects real-time market conditions and is influenced by various factors such as supply and demand dynamics, geopolitical events, economic indicators, and investor sentiment.

Understanding and analyzing the LBMA Gold Price Benchmark is essential for making informed decisions in the gold market, guiding investment strategies, and managing risk effectively.

Gold Futures Market Impact

The impact of gold futures market activity on price movements and market expectations is a key aspect influencing the dynamics of the gold market. Gold futures contracts allow investors to speculate on the future price of gold, providing insights into market sentiment and potential price trends.

Changes in gold futures prices can signal shifts in investor confidence, inflation expectations, and overall market volatility. The high liquidity of the gold futures market also plays a role in price discovery, reflecting current supply and demand dynamics.

Furthermore, the gold futures market serves as a platform for hedging against price risks for producers, consumers, and investors with exposure to gold and silver. By locking in future prices through futures contracts, market participants can mitigate potential losses from adverse price movements.

The interaction between the physical gold market and gold futures market is critical for understanding the overarching trends in the gold industry, providing valuable information for decision-making and risk management strategies.

Gold Price and Economic Indicators

Examining the correlation between gold prices and key economic indicators discloses valuable insights into market trends and potential future developments. Gold prices often react to shifts in economic indicators like GDP growth, inflation rates, and interest rates.

During periods of economic uncertainty or inflation, investors tend to flock to gold as a safe-haven asset, driving up its price. Additionally, central bank policies and geopolitical tensions can also influence gold prices markedly. For instance, when central banks increase their gold reserves, it can signal a lack of confidence in fiat currencies, leading to higher gold prices.

Furthermore, fluctuations in currency values, particularly the U.S. dollar, play an important role in determining the price of gold internationally. Understanding these economic indicators and their impact on gold prices is essential for investors looking to make informed decisions in the gold market. By monitoring these indicators closely, investors can better anticipate future price movements and adjust their investment strategies accordingly.

FintechZoom Gold Trading Platform

A leading fintech platform, Fintechzoom Pro, has transformed the landscape of gold trading with its innovative approach and user-friendly interface. Fintechzoom’s gold trading platform offers a seamless experience for investors, providing tools to compare gold prices with market indicators and facilitating easy buy and sell orders through a user-friendly layout.

The platform boasts a wide range of gold investment options, allowing users to diversify their portfolios conveniently. Additionally, Fintechzoom guarantees a safe and transparent environment for monitoring holdings and tracking market performance effectively.

By leveraging Fintechzoom’s platform, investors can access real-time data, make informed decisions, and optimize their gold trading strategies efficiently. Overall, Fintechzoom’s gold trading platform stands out for its accessibility, reliability, and extensive features that cater to both novice and experienced investors in the gold market.

Frequently Asked Questions

How Does Geopolitical Instability Impact Gold Prices and Investor Behavior?

Geopolitical instability drives gold prices and influences investor behavior. Uncertainty prompts flight to safe-haven assets like gold, increasing demand and prices. Investors seek stability and value retention during turbulent times, impacting gold market dynamics profoundly.

What Role Does Inflation Play in Driving Demand for Gold as an Investment Asset?

Inflation drives demand for gold as investors seek a hedge against currency devaluation. Gold’s historical role in preserving wealth during inflationary periods makes it a coveted investment asset. Its scarcity and intrinsic value further bolster its appeal.

How Do Environmental and Sustainability Factors Affect the Gold Mining Industry and Subsequently, Gold Prices?

Environmental and sustainability factors impact gold mining operations, influencing production costs, regulations, and community relations. Concerns like water usage, deforestation, and carbon emissions drive industry shifts towards eco-friendly practices, potentially altering gold supply and prices.

What Are the Key Differences Between Physical Gold Ownership and Gold ETFs in Terms of Investment Strategy and Risk Exposure?

Physical gold ownership offers tangible asset security but lacks liquidity and convenience compared to gold ETFs. ETFs provide easy trading, diversification, and lower fees but carry counterparty risk. Balancing both can optimize investment strategy and risk exposure.

How Do Global Trade Tensions and Tariffs Influence the Price of Gold in the Market?

Global trade tensions and tariffs impact gold prices by increasing demand for safe-haven assets like gold. Uncertainty in trade relations leads investors to seek stability, driving up gold prices. Market reactions to geopolitical events and trade disputes can greatly influence gold price movements.

Conclusion

To summarize, the intricate dance of supply, demand, central bank reserves, and currency movements all contribute to the ever-changing landscape of gold prices. FintechZoom’s innovative approach to gold trading offers investors a modern platform to navigate this complex market.

As investors seek to diversify their portfolios and preserve value, understanding the historical performance and trends of gold compared to traditional assets like the S&P 500 becomes essential in making informed investment decisions.

[…] in managing the volatile silver market. Silver, known for its higher profit potential and risk compared to gold, requires strategic […]

[…] frequently regarded as a safe haven. Short-term volatility is possible with this metal, though. The price of gold underperforms when compared to the long-term price appreciation of conventional stocks because of […]

[…] gold price fintechzoom has emerged as a game changer in the financial landscape, particularly within the gold market. This platform harnesses cutting-edge technology to provide real-time data and analytics on gold prices, making it accessible for novice and seasoned investors. […]

[…] examine the recent patterns in the XAU/USD exchange rate and examine the major variables affecting gold […]