Bitcoin Price on Fintechzoom explores the intricacies of Bitcoin trading, covering price variations, influential factors, historical insights, and strategic trading tips. Understanding the Fintechzoom platform‘s features is essential for maximizing investment potential and managing risks effectively.

Bitcoin’s integration shapes trading choices on Fintechzoom Pro, influenced by market demand, regulations, and macroeconomic trends. Price volatility and global events impact Bitcoin value, reflecting investor sentiment. Monitoring the Volatility Index aids in adjusting trading strategies. In-depth analysis and case studies offer valuable insights for successful trading. Enhance your understanding of Bitcoin’s dynamics and optimize trading strategies on Fintechzoom.

Table of Contents

Bitcoin Price Fintechzoom: Understanding Fintechzoom Platform

Amidst the volatile landscape of Bitcoin price fluctuations, gaining a thorough understanding of the Fintechzoom platform is vital for investors seeking to navigate the intricacies of the cryptocurrency market.

Fintechzoom, a leading cryptocurrency news platform, offers a platform where users can buy, sell, and trade various digital assets, including Bitcoin. Understanding how to effectively use the Fintechzoom platform is essential for maximizing investment opportunities and minimizing risks in the ever-changing world of cryptocurrencies. Additionally, seeking an authorised money lenders can provide reliable and legal financing options for those looking to finance their cryptocurrency investments

The Fintechzoom platform provides users with real-time data on Bitcoin prices, trading volumes, market trends, and historical data. By analyzing this information, investors can make informed decisions about when to buy or sell Bitcoin, and how to buy Bitcoin, helping them capitalize on market opportunities.

Additionally, Fintechzoom offers advanced trading tools such as stop-loss orders, limit orders, and margin trading, empowering users to execute their trading strategies with precision and efficiency.

Bitcoin Price Fintechzoom: The Role of Bitcoin in Fintechzoom

The integration of Bitcoin within the Fintechzoom platform plays a pivotal role in shaping the dynamics of digital asset trading and investment strategies. As one of the leading cryptocurrencies, Bitcoin’s presence on Fintechzoom provides users with access to a diverse range of trading options and investment opportunities. Bitcoin’s high liquidity and market capitalization make it a preferred choice for many investors looking to diversify their portfolios within the Fintechzoom ecosystem.

In addition, Bitcoin’s volatility and price movements contribute greatly to the overall market sentiment on the Fintechzoom platform. Traders often analyze Bitcoin’s price trends to make informed decisions about other digital assets, creating a ripple effect across the platform. Furthermore, the transparency and security features inherent in Bitcoin transactions align with Fintechzoom’s commitment to providing a safe and reliable trading environment for its users.

Key Factors Influencing Bitcoin Price

Analyzing the intricate web of factors that influence Bitcoin’s price requires a deep understanding of the cryptocurrency market’s complexities and dynamics. One key factor influencing Bitcoin’s price is market demand. As more individuals and institutions adopt Bitcoin for various purposes such as investment, remittances, or as a store of value, the demand for Bitcoin increases, driving its price up.

Additionally, regulatory developments play an important role in shaping Bitcoin’s price. Positive regulatory news, such as favorable government stances or regulatory clarity, can boost investor confidence and lead to price appreciation. On the contrary, negative regulatory events or uncertainty can trigger sell-offs and price declines.

Moreover, technological advancements and upgrades within the Bitcoin network can impact its price. Improvements in scalability, security, or privacy features can enhance Bitcoin’s utility and attractiveness, potentially driving its price higher.

Lastly, macroeconomic factors like inflation, economic instability, or geopolitical tensions can also influence Bitcoin’s price as investors seek alternative assets to hedge against traditional market risks. Understanding these key factors is essential for anyone looking to navigate the volatile world of Bitcoin trading successfully.

Bitcoin Price Fintechzoom: Price Fluctuations

Understanding the intricate dynamics of Bitcoin price fluctuations on Fintechzoom requires a keen awareness of market trends and technological developments in the cryptocurrency space.

Price fluctuations in the Bitcoin market are influenced by a myriad of factors, including market demand, regulatory developments, macroeconomic trends, and investor sentiment. On Fintechzoom, these fluctuations are closely monitored and analyzed to provide investors with valuable insights into potential trading opportunities.

The volatility of Bitcoin prices on Fintechzoom can be both a challenge and an opportunity for traders. Sudden price swings can lead to significant gains or losses, making it essential for investors to stay informed and adapt their strategies accordingly.

Technical analysis tools and chart patterns are often utilized on Fintechzoom to predict potential price movements and identify effective entry and exit points.

Moreover, staying updated with the latest news and developments in the cryptocurrency space is important for understanding the underlying factors driving Bitcoin price fluctuations on Fintechzoom. By staying informed and leveraging available resources, investors can navigate the volatile Bitcoin market more effectively and make informed trading decisions.

Bitcoin Historical Price Analysis on Fintechzoom

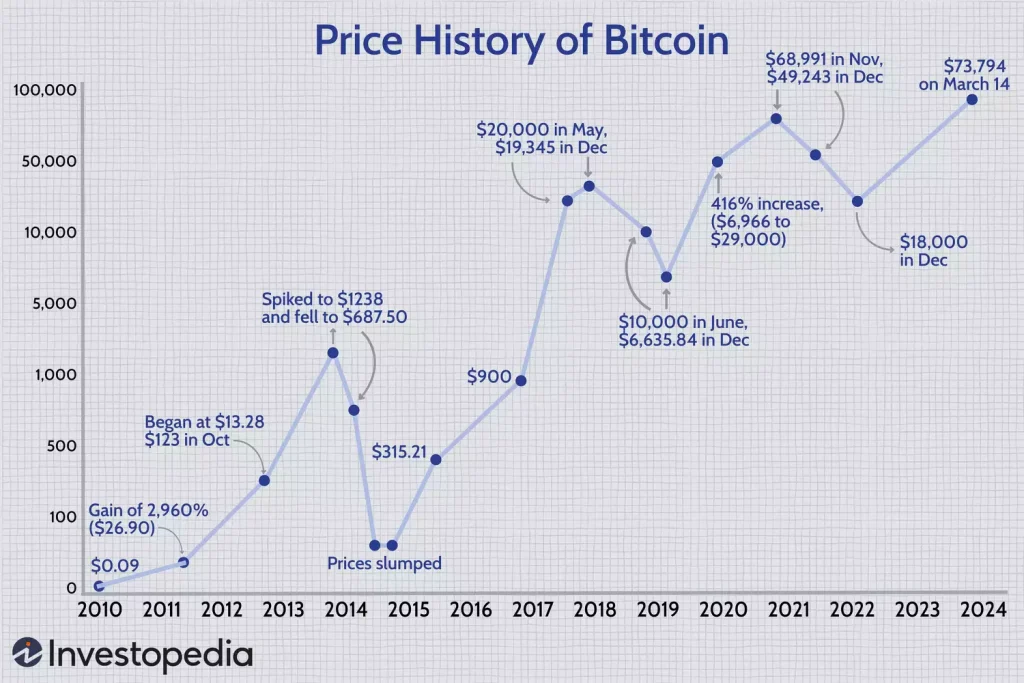

Exploring the historical price data of Bitcoin on Fintechzoom reveals intriguing patterns and trends that offer valuable insights into the cryptocurrency’s market behavior. By delving into past price movements, analysts can identify recurring patterns, key support and resistance levels, as well as potential market sentiment shifts. Historical price analysis allows traders and investors to make more informed decisions based on how the asset has behaved in the past under similar circumstances.

Through Fintechzoom’s historical price data, one can observe the evolution of Bitcoin’s value over time, pinpointing significant milestones such as major price rallies, sharp corrections, or prolonged periods of consolidation. This information is essential for understanding the market dynamics surrounding Bitcoin and can aid in developing trading strategies that capitalize on past trends.

Moreover, historical price analysis on Fintechzoom enables users to backtest various trading strategies, assess risk-reward ratios, and fine-tune entry and exit points based on historical price action. Overall, studying Bitcoin’s historical price data on Fintechzoom serves as a valuable tool for market participants seeking to navigate the cryptocurrency market with a more informed approach.

Utilizing Fintechzoom for Bitcoin Trading

Drawing on the wealth of historical price data available on Fintechzoom, traders can leverage valuable insights for optimizing their Bitcoin trading strategies. Fintechzoom provides a full platform that offers a range of tools and features to assist traders in making informed decisions.

By analyzing past price movements, traders can identify trends, patterns, and key levels of support and resistance in the Bitcoin market. This information can be essential for developing effective trading strategies and managing risk effectively. However, for those new to cryptocurrency, simply buy Bitcoin online through reputable exchanges like Coinbase or Kraken can be a good first step towards getting involved in this dynamic market.

One of the key benefits of using Fintechzoom for Bitcoin trading is the ability to access real-time market data and news updates that can impact the price of Bitcoin. Traders can stay informed about market developments and react quickly to changing conditions, giving them a competitive edge in the fast-paced cryptocurrency market.

Furthermore, Fintechzoom offers advanced charting tools that allow traders to conduct in-depth technical analysis, helping them to spot potential entry and exit points for their trades. By combining historical price data with technical analysis, traders can make more informed and strategic trading decisions, enhancing their overall performance in the Bitcoin market.

The Impact of Global Events on Bitcoin Price

Global geopolitical events possess a profound influence on the valuation of Bitcoin in the cryptocurrency market. Bitcoin’s price is not immune to external factors such as political tensions, economic uncertainties, or regulatory changes happening on a global scale.

For instance, during times of heightened geopolitical tensions, investors often turn to Bitcoin as a safe-haven asset, similar to gold, causing an increase in demand and subsequently driving up its price. On the other hand, negative news like regulatory crackdowns or bans in major economies can lead to a decrease in Bitcoin’s value as it shakes investor confidence and triggers sell-offs.

Moreover, global events like the COVID-19 pandemic have also showcased Bitcoin’s potential as a hedge against traditional market volatility. As central banks worldwide implemented massive stimulus packages, concerns about inflation grew, prompting investors to diversify their portfolios with Bitcoin. Understanding the impact of these events on Bitcoin’s price can help traders anticipate market movements and make informed decisions to navigate the cryptocurrency market successfully.

Analyzing Bitcoin’s Volatility Index on Fintechzoom

Amidst the backdrop of global events impacting Bitcoin’s price, a detailed examination of Bitcoin’s Volatility Index on Fintechzoom provides valuable insights into the cryptocurrency’s market behavior and potential trends.

The Volatility Index measures the degree of variation in Bitcoin’s price over a specific period, reflecting the market’s uncertainty and risk levels. By analyzing this index on Fintechzoom, traders and investors can better understand the market sentiment surrounding Bitcoin and make informed decisions.

High volatility in the cryptocurrency market can present both opportunities and risks. Sudden price fluctuations may offer the chance for significant profits, but they also increase the potential for losses. Monitoring Bitcoin’s Volatility Index can help market participants gauge the level of price instability and adjust their trading strategies accordingly.

Furthermore, tracking the Volatility Index on Fintechzoom enables users to spot trends, such as periods of heightened volatility followed by relative stability. This information can be vital for devising risk management plans and capitalizing on potential trading opportunities in the ever-evolving Bitcoin market.

Tips for Successful Bitcoin Trading with Fintechzoom

For traders looking to navigate the dynamic world of Bitcoin trading on Fintechzoom, implementing strategic approaches is important for maximizing potential gains and minimizing risks. One vital tip is to conduct thorough research before making any trading decisions.

Stay informed about market trends, regulatory developments, and any news that could impact Bitcoin’s price. Additionally, it’s crucial to set clear investment goals and risk management strategies. Define your entry and exit points, establish stop-loss orders, and stick to your trading plan to avoid emotional decision-making.

Another tip for successful Bitcoin trading on Fintechzoom is to diversify your portfolio. Avoid putting all your funds into a single trade; instead, spread your investments across different assets to reduce risk. Moreover, stay disciplined and patient.

The cryptocurrency market can be highly volatile, so it’s important to remain calm and avoid impulsive actions based on short-term price fluctuations. By following these tips and continuously educating yourself about the market, you can increase your chances of success in Bitcoin trading on Fintechzoom.

Case Studies of Bitcoin Price Movements on Fintechzoom

Examining real-world examples of Bitcoin price movements on Fintechzoom provides valuable insights into the dynamics of cryptocurrency trading. One notable case study involves a sudden 10% surge in Bitcoin’s price within a few hours due to a significant buy order from a renowned institutional investor. This event highlighted the impact of large players on the market and how their actions can swiftly influence prices.

Another case study revealed a sharp decline in Bitcoin’s value following regulatory news from a major country. The market reaction demonstrated how external factors such as government regulations can trigger rapid price fluctuations, underlining the importance of staying informed about global developments when trading cryptocurrencies.

Furthermore, analyzing the price movements during a period of high market volatility showcased the need for risk management strategies. Traders who had set stop-loss orders were better equipped to limit their losses during turbulent times, emphasizing the significance of implementing protective measures in a volatile market environment. By studying such case studies, traders can enhance their understanding of Bitcoin price dynamics and make more informed trading decisions on platforms like Fintechzoom.

Frequently Asked Questions

How Does Fintechzoom Platform Ensure Security for Bitcoin Transactions?

In the domain of digital currency, Fintechzoom employs a fortress of encryption protocols, biometric authentication, and multi-factor authorization. These protective layers shield Bitcoin transactions, ensuring a secure environment where financial exchanges can thrive without fear of compromise.

What Are the Main Advantages of Using Bitcoin in Fintechzoom Services?

Bitcoin provides advantages in fintechzoom services through decentralized transactions, low fees, fast transfers, and increased security. Its blockchain technology guarantees transparency and immutability, fostering trust among users. These features boost efficiency and innovation in financial transactions.

What External Factors Can Influence the Price of Bitcoin on Fintechzoom?

Various external factors, such as market demand, regulatory changes, geopolitical events, and technological advancements, can greatly impact the price of Bitcoin on Fintechzoom. Understanding these dynamics is essential for informed decision-making in cryptocurrency investments.

Can Fintechzoom Users Predict Bitcoin Price Fluctuations Accurately?

Fintechzoom users’ ability to predict Bitcoin price fluctuations accurately depends on various factors, including market analysis, trend identification, and understanding of cryptocurrency dynamics. Utilizing research, data analysis, and market insights can enhance predictive capabilities.

How Do Global Events Impact the Stability of Bitcoin Prices on Fintechzoom?

Global events such as geopolitical tensions, economic crises, or regulatory changes can have a substantial impact on the stability of Bitcoin prices on Fintechzoom. Investors may react to these events by buying or selling, causing price fluctuations.

Conclusion

To sum up, the Bitcoin Price Fintechzoom platform offers valuable insights into the world of cryptocurrency trading. By understanding the key factors influencing Bitcoin price, analyzing historical data, and staying informed about global events, traders can make more informed decisions. The platform provides a wealth of information and tools to help navigate the volatility of the market. With strategic planning and careful analysis, success in Bitcoin trading on Fintechzoom is within reach.

[…] a safe and effective chance to invest in Bitcoin finance. The company has an unClever name: Bitcoin Price Fintechzoom. The platform provides a friendly interface and advanced trading tools. It also has secure storage. […]

[…] Also Read: Bitcoin Price Fintechzoom […]

[…] 2014, Mt. Gox, once the world’s largest Bitcoin exchange, filed for bankruptcy after losing around 850,000 bitcoins, valued at approximately $450 […]

[…] The proof-of-work (PoW) community, which is led by prominent cryptocurrencies like Ethereum and Bitcoin, has come under fire for its energy-hungry practices. The carbon footprint they leave behind is […]

[…] take a closer look at recent Bitcoin price trends through the lens of […]

[…] this aspect. Besides newly mined BTCs, miners are also rewarded with transaction fees, so when Bitcoin reaches its limited supply, fees will remain their unique source of […]

[…] store of wealth and hedge against established financial institutions is influenced by various global economic factors, such as inflation rates, currency depreciation, and economic […]