The domain of Crypto Fintechzoom presents a complex tapestry of opportunities and challenges amidst a dynamic market environment. With soaring valuations and technological innovations driving the landscape, the interplay between market forces and regulatory frameworks holds pivotal importance.

Delving into the nuances of this domain reveals a world where traditional financial paradigms collide with cutting-edge digital transformations, paving the way for new horizons yet to be explored. As stakeholders navigate this intricate terrain, understanding the multifaceted dimensions of Crypto Fintechzoom becomes imperative for informed decision-making and strategic positioning in an ever-evolving ecosystem.

Table of Contents

Key Takeaways

- Crypto Fintechzoom facilitates financial inclusion and transparency in the cryptocurrency market.

- Regulatory challenges hinder crypto growth due to decentralized nature and global classification struggles.

- Institutional adoption and DeFi sector growth present promising investment opportunities in the market.

- Integration of news and sentiment analysis from Crypto Fintechzoom is crucial for understanding market trends and making informed investment decisions.

Crypto Fintechzoom: Market Overview

In the domain of cryptocurrency, the landscape of Crypto Fintechzoom presents a thorough market overview characterized by dynamic growth, evolving trends, and strategic market players. The Crypto Fintechzoom Pro is witnessing exponential growth, with a current market size of USD 1,330.43 billion and an expected surge to USD 1,902.5 billion by 2028.

Within this landscape, the trading segment dominates, driven by the increasing adoption of cryptocurrencies like Bitcoin and Ethereum. Hardware segment innovations, particularly in mining technologies, also play a pivotal role in shaping the market dynamics.

Strategic market players such as Bitcoin, Ethereum, Coinbase, and Binance are at the forefront, influencing market trends and investor sentiments. These key players not only contribute to the market’s liquidity but also set the tone for technological advancements and regulatory discussions within the Crypto Fintechzoom space.

As the market continues to evolve, staying informed about these market constituents and their strategic moves is essential for investors and industry stakeholders looking to navigate the complex yet promising world of cryptocurrency.

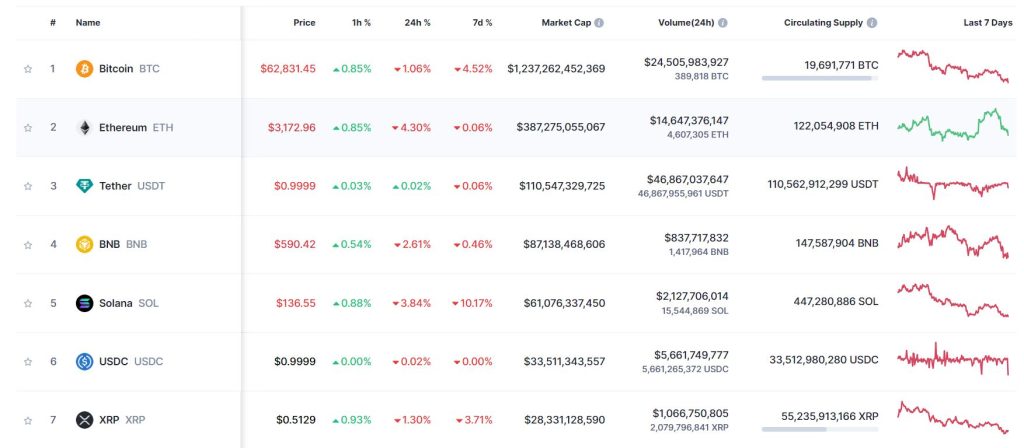

Popular Cryptocurrency Market Constituents

The popular constituents of the cryptocurrency market significantly impact market dynamics and investor sentiment, especially on the best crypto exchanges. Among the top players, Bitcoin (BTC) stands out with a staggering market cap of $1,323,264,503,883, followed by Ethereum (ETH) with $405,122,293,851, Tether USDt (USDT) with $106,149,148,229, BNB (BNB) with $88,369,302,203, and Solana (SOL) with $84,137,717,209.

These cryptocurrencies play a pivotal role in shaping trends and driving trading activities within the market. Investors often track their performance closely to make informed decisions.

When it comes to staying updated on the latest developments and trends in the cryptocurrency market, platforms like Fintechzoom serve as the go-to source for crypto news and insights.

Leveraging Fintechzoom as the best crypto trading platform can provide traders and investors with real-time information, market analysis, and expert opinions to navigate the volatile crypto landscape effectively. Keeping abreast of Fintechzoom crypto news can offer a strategic advantage in understanding market movements and making sound investment choices.

The Powerful Impacts of Crypto Fintechzoom

Popular Cryptocurrency Market Constituents like Bitcoin and Ethereum not only dominate the market but also contribute greatly to the powerful impacts seen in the world of Crypto Fintechzoom.

These impacts are multifaceted, influencing various aspects of the financial landscape. To begin with, Crypto Fintechzoom promotes financial inclusion by providing access to financial services for individuals who are unbanked or underbanked. Additionally, it enhances efficiency and transparency in transactions through blockchain technology, reducing time and costs associated with traditional financial systems.

Furthermore, the trust and security offered by cryptocurrencies attract users seeking alternatives to traditional banking systems. In addition, asset tokenization through Crypto Fintechzoom enables fractional ownership of assets, opening up investment opportunities for a broader audience.

To conclude, the innovative applications of blockchain technology in areas such as smart contracts and decentralized finance (DeFi) showcase the potential for Crypto Fintechzoom to revolutionize traditional financial practices. These impacts collectively demonstrate the transformative potential of cryptocurrencies in reshaping the financial industry.

Regulatory & Compliance Challenges for Crypto

Addressing the complex regulatory landscape poses a significant challenge for the cryptocurrency industry, requiring a nuanced approach to compliance and governance. Cryptocurrencies face hurdles due to their decentralized nature, leading to classification struggles globally among governments and regulatory bodies.

The lack of transparency within the industry also impedes the effective enforcement of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Additionally, the cross-border nature of cryptocurrencies further complicates the consistent enforcement of regulations, making it challenging for authorities to monitor and control illicit activities effectively.

One of the critical issues is the lack of international cooperation, which results in confusion for users and investors, as regulatory standards vary widely from one jurisdiction to another. As the cryptocurrency market continues to evolve and expand, establishing a cohesive regulatory framework that addresses these challenges while fostering innovation and protecting investors will be vital for the industry’s sustainable growth and mainstream adoption.

Future Crypto Fintechzoom Trajectory

Exploring the evolving landscape of cryptocurrency markets requires a strategic understanding of the future trajectory of Crypto Fintechzoom. Bitcoin’s price movements are key indicators influencing investment decisions within the cryptocurrency space.

The increasing institutional adoption by hedge funds and corporations is expected to bring about market stabilization, enhancing credibility and reducing volatility. Additionally, the growth of the decentralized finance (DeFi) sector presents promising investment opportunities, revolutionizing traditional financial services.

The Non-Fungible Token (NFT) market is also reshaping digital ownership and value creation, offering unique ways for creators and investors to engage with digital assets. To navigate this dynamic landscape effectively, integrating news and sentiment analysis from Crypto Fintechzoom will be vital for gaining insights and making informed decisions.

As the cryptocurrency market continues to evolve, staying informed and adaptable will be key to success in this rapidly changing industry.

Market Size and Growth Projections

Analyzing the cryptocurrency market’s current size and projecting its growth presents critical insights for strategic decision-making in the evolving financial landscape. The market currently stands at a substantial USD 1,330.43 billion and is expected to reach USD 1,902.5 billion by 2028.

Within the market, the trading segment holds the majority share, while the hardware segment leads due to widespread bitcoin adoption. Key players such as Bitcoin, Ethereum, Coinbase, and Binance are instrumental in shaping the market dynamics.

This growth is driven by various factors, including increasing institutional adoption, the rise of decentralized finance (DeFi) opportunities, and the revolutionary impact of non-fungible tokens (NFTs) on digital ownership. Understanding these trends is pivotal for market participants seeking to navigate this dynamic landscape successfully.

As the market continues to evolve, monitoring price movements, institutional involvement, and emerging trends like DeFi and NFTs will be essential for investors and businesses alike. Strategic decision-making informed by these insights will be paramount for capitalizing on the cryptocurrency market’s projected growth.

Dominant Players in the Crypto Market

The cryptocurrency market is dominated by key players such as Bitcoin, Ethereum, Coinbase, and Binance, shaping the industry landscape with their significant influence and market presence. Bitcoin, with a market cap exceeding $1.3 trillion, remains the flagship cryptocurrency, known for paving the way for digital assets.

Ethereum, valued at over $400 billion, stands out for its smart contract capabilities and decentralized applications. Coinbase, a leading cryptocurrency exchange, plays a crucial role in facilitating crypto transactions for millions of users worldwide. Binance, another prominent exchange, offers a wide range of trading pairs and innovative products, contributing to its popularity among traders and investors.

These dominant players not only drive market trends but also set the tone for the broader crypto ecosystem. Their actions, developments, and policies often influence investor sentiment, regulatory discussions, and technological advancements within the industry.

As the crypto market continues to evolve, monitoring the strategies and movements of these key players is essential for understanding the dynamics and opportunities within this rapidly changing landscape.

Benefits of Crypto Fintechzoom

Shifting from the discussion on Dominant Players in the Crypto Market, an examination of the Benefits of Crypto Fintechzoom reveals the transformative advantages that cryptocurrency and fintech innovations offer in today’s financial landscape.

Cryptocurrency and fintech solutions provide avenues for financial inclusion, allowing individuals without access to traditional banking services to participate in the global economy. These technologies enhance efficiency and transparency by streamlining transactions and reducing the need for intermediaries. Trust and security are bolstered through cryptographic protocols and decentralized networks, offering users greater control over their assets.

Moreover, asset tokenization enables fractional ownership of real-world assets, unleashing liquidity and investment opportunities. The integration of blockchain technology in various industries facilitates innovative applications such as smart contracts and decentralized finance (DeFi). Overall, the benefits of Crypto Fintechzoom extend beyond monetary transactions, paving the way for a more inclusive, efficient, and secure financial ecosystem.

Obstacles in Crypto Regulation

Regulatory challenges in the cryptocurrency sector pose significant hurdles for effective governance and oversight due to the decentralized nature of cryptocurrencies. The decentralized and borderless characteristics of cryptocurrencies make it difficult for traditional regulatory frameworks to keep pace with the rapidly evolving landscape.

Governments and regulatory bodies worldwide struggle with the classification of cryptocurrencies, leading to inconsistent approaches to oversight and compliance. A lack of transparency within the industry further complicates enforcement of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, raising concerns about illicit activities.

The cross-border nature of crypto transactions adds another layer of complexity, making it challenging to ensure consistent regulation across jurisdictions. Additionally, the absence of robust international cooperation exacerbates these challenges, causing confusion for users and investors.

Overcoming these obstacles will require collaborative efforts between regulators, industry players, and policymakers to establish a coherent regulatory framework that balances innovation with investor protection and market integrity.

Trends Shaping Crypto Industry

Exploring the evolving landscape of the cryptocurrency sector involves understanding the dynamic trends that are shaping the industry’s trajectory. One prominent trend is the increasing institutional adoption of cryptocurrencies, particularly Bitcoin, by hedge funds and corporations.

This adoption not only stabilizes the market but also enhances mainstream acceptance. The growth of the Decentralized Finance (DeFi) sector is another significant trend, offering promising investment opportunities and challenging traditional financial systems.

Additionally, the Non-Fungible Token (NFT) market is revolutionizing digital ownership and value creation, attracting artists, collectors, and investors alike. To navigate this rapidly evolving industry, integrating news and sentiment analysis from platforms like Crypto Fintechzoom is important for making informed decisions.

Overall, these trends reflect a shift towards broader acceptance, innovation, and diversification within the crypto industry, signaling exciting opportunities and challenges ahead.

Frequently Asked Questions

What Are the Key Factors Influencing the Price Volatility of Cryptocurrencies in the Market?

Price volatility in cryptocurrencies is influenced by factors like market demand, regulatory developments, technological advancements, macroeconomic conditions, and investor sentiment. These elements create a dynamic landscape where supply and demand forces interact, shaping price fluctuations.

How Do Decentralized Finance (Defi) Platforms Impact the Traditional Financial System?

Decentralized finance (DeFi) platforms disrupt the traditional financial system by offering borderless, permissionless access to financial services, enabling direct peer-to-peer transactions, automated lending, and borrowing, eliminating intermediaries, enhancing financial inclusion, and challenging traditional banking models with innovative decentralized solutions.

What Are the Potential Risks Associated With Investing in Cryptocurrencies That Investors Should Be Aware Of?

Investors considering cryptocurrencies should be cautious of market volatility, regulatory uncertainties, security breaches, and potential fraud. Understanding risks like lack of consumer protection, technological vulnerabilities, and legal challenges is important for informed investment decisions.

How Do Blockchain Technology and Smart Contracts Contribute to the Security and Efficiency of Cryptocurrency Transactions?

Blockchain technology guarantees security through decentralized ledger, immutability, and cryptographic hashing. Smart contracts automate transaction execution, reducing intermediaries and enhancing efficiency. Together, they revolutionize cryptocurrency transactions by providing transparency, trust, and resistance to fraud.

How Does the Environmental Impact of Cryptocurrency Mining Affect the Sustainability of the Industry?

The environmental impact of cryptocurrency mining poses sustainability challenges, with high energy consumption and carbon emissions. Industry stakeholders must prioritize green mining solutions, such as renewable energy usage and efficiency improvements, to mitigate negative ecological effects and guarantee long-term viability.

Conclusion

To sum up, the Crypto Fintechzoom market is positioned for ongoing expansion and transformation, driven by key players like Bitcoin and Ethereum. Despite regulatory challenges, the sector’s future trajectory will be shaped by factors such as institutional adoption, DeFi growth, NFT market revolution, and integration of news and sentiment analysis. Maneuvering these trends will be vital for investors and stakeholders to capitalize on the evolving landscape of the cryptocurrency market.

[…] embracing blockchain and cryptocurrency, Fintechzoom positions itself at the forefront of technological advancements in the financial […]

[…] and cryptocurrency, for instance, has the potential to streamline processes like cross-border payments and trade […]

[…] a leading cryptocurrency news platform, offers a platform where users can buy, sell, and trade various digital assets, including Bitcoin. […]

[…] is a step forward in reducing the complications for patients and providers by using mobile apps, blockchain tech, and automated systems to ease payment, minimize mistakes, and facilitate financial […]

[…] Many sought the assistance of specialized attorneys to navigate the complex legal landscape of cryptocurrency. This case underscored the necessity of having experienced legal representation, such as an NYC […]

[…] 2024, as institutional adoption of cryptocurrency reaches all-time highs, it’s getting cozy with the big boys. Asset managers, banks, and hedge […]

[…] it’s worth taking the time to understand what Bitcoin’s finite supply really means for the crypto market. As highlighted in the article, there are many implications that everyone engaged in the crypto […]

[…] offers a wide range of supported cryptocurrencies for staking, allowing users to diversify staking portfolios and choose from different digital […]

[…] critical development in fintech-driven crypto trading platforms is the creation of intuitive user interfaces. Navigating traditional crypto […]

[…] technology is another fintech innovation making waves in the debt management sector. By providing transparent and secure […]

[…] Also Read: Detailed Cryptocurrency Market Analysis […]