Fintechzoom offers an in-depth analysis of Amazon stock, providing timely updates on financial trends and data-driven insights. Their analysis covers Amazon’s robust market performance, innovative business model, and potential growth trends. Fintechzoom evaluates factors such as Amazon’s financial health, competitive positioning, and varied revenue streams.

Their expert analyses and strategic advice assist investors in making informed decisions. The platform’s detectable foresights about Amazon’s prospective opportunities are a useful tool for effectively assessing future market trends. Further exploration of Fintechzoom’s insights can yield profitable strategies for understanding Amazon’s stock.

Table of Contents

Understanding Fintechzoom’s Role

To truly grasp the impact of Fintechzoom on Amazon stock, one must first understand the pivotal role this innovative platform plays in the financial technology sector. Fintechzoom, a digital hub for financial news and analysis, has emerged as a significant influencer. It provides thorough, real-time updates on the latest trends and developments in the world of finance and technology.

Fintechzoom’s role extends beyond mere reporting. The platform has become an essential tool for investors, financial advisors, and individuals interested in understanding the financial market’s dynamics. It offers a unique blend of data-driven insights, expert analyses, and strategic advice. These resources equip users to make informed decisions and, ultimately, drive their financial success.

Specifically pertaining to Amazon stock, Fintechzoom’s influence is substantial. Their analyses and reports on Amazon’s financial health and market position provide valuable insights for investors. The platform’s in-depth coverage of Amazon’s earnings reports, business strategies, and market trends offer a well-rounded perspective that helps investors navigate the complex dynamics of Amazon stock. Thus, Fintechzoom has an undeniable impact on how Amazon’s stock is perceived and acted upon in the financial market.

Basics of Amazon Stock

Building on the insights provided by platforms like Fintechzoom, it’s important to understand the fundamental aspects of Amazon stock itself. Amazon, Inc., a technology leader, is listed on the NASDAQ exchange under the ticker symbol ‘AMZN’. It operates in numerous sectors such as e-commerce, digital streaming, artificial intelligence and cloud computing.

The company’s consistent ability to innovate and diversify has led to robust growth, making its stock a popular choice among investors. Amazon’s stock is categorized as a growth stock due to its historical and projected earnings growth. It has been known for its remarkable returns since its initial public offering (IPO) in 1997.

However, like any investment, Amazon stock carries risk. Its performance is subject to market volatility and the company’s financial health. To make an informed decision, investors must evaluate factors such as the company’s earnings reports, competitive landscape, and industry trends. They should also consider the company’s leadership and strategies for future growth.

Responsible investment involves not just understanding the potential returns, but also the risks and the underlying business model of the company. In the case of Amazon, this requires a thorough understanding of its expansive operations and future potential.

Fintechzoom’s Amazon Stock Analysis

When evaluating Amazon’s stock performance, Fintechzoom offers an in-depth analysis that includes a thorough examination of the company’s financials, market trends, and competitive positioning. This detailed analysis enables investors to make informed decisions, based on a holistic view of Amazon’s strengths, weaknesses, opportunities, and threats (SWOT).

Fintechzoom’s methodology is meticulous. It starts with a detailed exploration of Amazon’s balance sheet, income statement, and cash flow statement. This deep dive into Amazon’s financials provides a clear understanding of the company’s profitability, liquidity, and financial stability.

The analysis then proceeds to examine market trends. By evaluating macroeconomic indicators, industry-specific statistics, and consumer behavior, Fintechzoom is able to forecast market trends and estimate their potential impact on Amazon’s future performance.

Finally, Fintechzoom Pro evaluates Amazon’s competitive positioning. It assesses the company’s market share, the strength of its brand, and its ability to innovate and adapt in an ever-changing market scenario.

This thorough, innovative, and reliable analysis provided by Fintechzoom offers a valuable resource for those aspiring to serve others by making informed and responsible investment decisions.

Amazon’s Market Performance

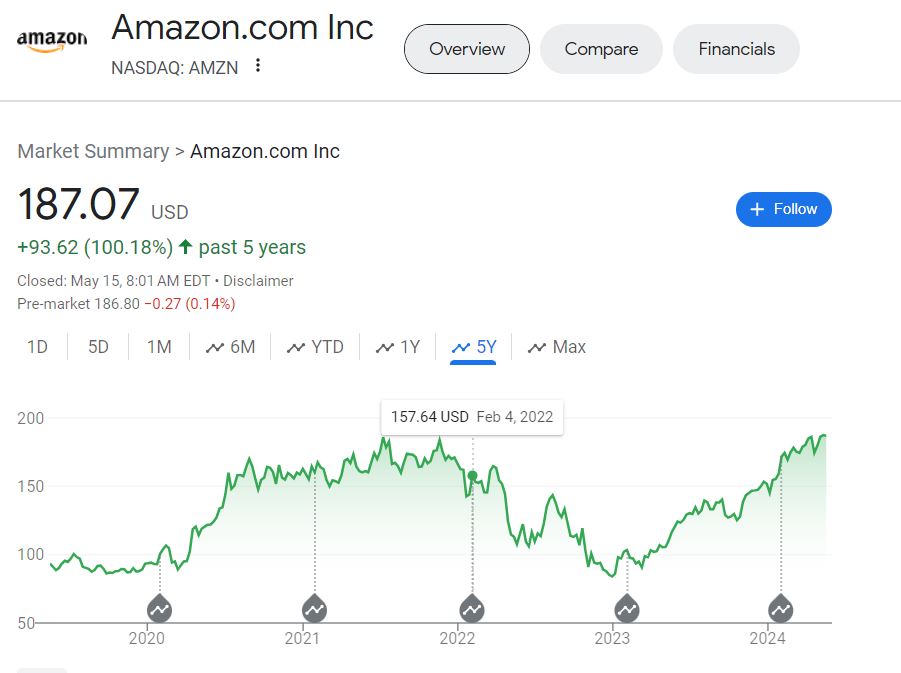

Despite the volatile nature of the stock market, Amazon’s market performance has consistently demonstrated robust growth and stability, showcasing the company’s resilience and adaptability in the face of market fluctuations. Amazon’s stock has been able to withstand the highs and lows of the market, consistently delivering returns to its shareholders and maintaining steady performance.

This stability is largely due to Amazon’s innovative business model, which combines retail, technology, and logistics, making it a unique entity in the marketplace. Additionally, Amazon has continually evolved its operations to address changing consumer needs, thereby ensuring its continuing relevance in a dynamic market environment.

Amazon’s market performance is also a reflection of its strong leadership and strategic decision-making. By focusing on long-term growth rather than short-term profits, Amazon has been able to invest in new markets and technologies that have subsequently driven its market performance. This strategic approach has allowed Amazon to create a diverse and resilient business that is well-positioned for future growth.

Also read Fintechzoom Insights on Dow Jones and Fintechzoom SP500.

Fintechzoom’s Stock Predictions

Given Amazon’s robust market performance and strategic growth focus, Fintechzoom’s stock predictions offer insightful perspectives on the company’s potential trajectory. The financial technology firm‘s analysis is drawn from a thorough evaluation of Amazon’s current market position, competitive advantage, and future growth plans. It is grounded in a deep understanding of the financial market trends and Amazon’s response to them.

Fintechzoom’s predictions suggest a promising future for Amazon stocks, speaking to the company’s capacity to continually innovate and disrupt traditional retail landscapes. Their forecasts consider Amazon’s consistent ability to capitalize on emerging opportunities, thereby increasing investor confidence and stock value. These predictions also take into account potential challenges that might impact Amazon’s growth, providing a balanced view of the company’s financial future.

In serving the interests of others, Fintechzoom’s predictions can be a valuable tool for potential investors. They provide a far-sighted view into Amazon’s stock performance, helping stakeholders make informed decisions. These insights are not only based on numbers but also on the proven resilience, adaptability and the pioneering spirit of Amazon, offering a holistic picture of the company’s potential market trajectory.

Amazon’s Business Model

Understanding Amazon’s business model is essential, as it forms the foundation of the company’s unparalleled success in the e-commerce sector. This model is multifaceted, combining retail operations, third-party marketplaces, subscription services, web services, and device innovation.

The retail operations segment, Amazon’s most visible aspect, provides a vast array of goods, from books to household items. The third-party marketplace allows independent sellers to offer products, expanding Amazon’s product range substantially. The subscription services, including Amazon Prime, offer customers benefits such as free shipping and access to a vast library of digital content.

Amazon Web Services (AWS), the company’s cloud computing division, generates substantial revenue and is a leader in the global cloud infrastructure services market. It provides businesses with an array of services, including data storage, database and machine learning applications, and analytics.

The company’s focus on innovation is evident through its device segment, which includes Kindle, Fire TV, and Echo. These products leverage the company’s digital content, further enhancing customer engagement.

Amazon’s business model, which combines retail, digital, and service elements, has proven to be a successful strategy, driving the company’s continuous growth and dominance in the e-commerce industry.

Stock Market Trends: Fintechzoom’s View

Building on the discussion of Amazon’s robust business model, we now turn our attention to the assessment of Fintechzoom on the prevailing trends in Amazon’s stock market performance. Fintechzoom, a leading financial technology media, highlights the resilience and adaptability of Amazon’s stock amidst market volatility.

Fintechzoom’s analysis emphasizes the company’s continuous growth trajectory, underpinned by its diverse revenue streams and constant innovation. The e-commerce giant’s stock consistently outperforms market expectations, fueled by its dominant market share and successful expansion into new industries like cloud computing, advertising, and entertainment.

Furthermore, Fintechzoom commends Amazon’s forward-thinking strategy, which has enabled it to weather economic downturns and capitalize on emerging opportunities. This has resulted in a steady upward trend in its stock value, making it a preferred choice among investors seeking long-term growth.

Fintechzoom also notes the significant role of Amazon’s strategic acquisitions and partnerships in boosting its market position, thereby positively affecting its stock performance. These developments reflect Amazon’s commitment to serving a broad consumer base and its dedication to delivering shareholder value.

Also Read: Apple Stock Fintechzoom

Investing in Amazon: Fintechzoom’s Guide

Exploring the intricacies of investing in Amazon, Fintechzoom offers an in-depth guide that sheds light on potential growth opportunities and risks associated with the e-commerce titan’s stock. Amazon’s stock, known for its consistent growth, has been a lucrative investment for many in the past. However, investing in Amazon requires understanding its business model, evaluating its financial health, and monitoring market trends.

Fintechzoom provides a thorough analysis of Amazon’s business operations, including its e-commerce, cloud computing, digital streaming, and artificial intelligence sectors. This all-encompassing view helps potential investors grasp the magnitude of Amazon’s diverse income streams.

Despite the potential for significant returns, investing in Amazon also carries risks. Fintechzoom advises prospective investors to contemplate Amazon’s high stock price, its intense competition, and potential regulatory challenges, which could impact the company’s profitability.

Furthermore, Fintechzoom emphasizes the importance of portfolio diversification, recommending Amazon as part of a balanced investment strategy rather than a standalone investment. By responsibly investing in Amazon, individuals can contribute to their financial growth while supporting a company that continues to innovate and provide valuable services to consumers worldwide.

Amazon’s Future Prospects

While Amazon’s current performance is impressive, the company’s future prospects are equally promising, driven by its relentless innovation and expansion into new markets. Amazon’s ambitious foray into healthcare with Amazon Care, its expansion into the grocery sector with Amazon Fresh, and its venture in the physical retail space with Amazon Go, are all clear signs of a company that is not content with resting on its laurels.

Furthermore, the firm’s commitment to investing in technology, especially artificial intelligence (AI) and machine learning (ML), is poised to yield substantial returns. These technologies not only enhance Amazon’s core e-commerce business by improving customer service and fulfillment efficiency but also provide potential growth in cloud computing and ad sales.

Additionally, Amazon’s outstanding performance in emerging markets, particularly India and the Middle East, bodes well for its future. As these markets mature and internet penetration increases, Amazon is well-positioned to capitalize.

Case Studies: Amazon’s Stock Performance

Historically, Amazon’s stock performance has consistently reflected its robust business growth and innovative strategies, offering insightful case studies for investors and market analysts alike. The firm’s dynamic approach to market trends and customer-centric philosophy has propelled its financial success, reflected in its ascending stock trajectory.

One such case study involves Amazon’s bold venture into cloud computing with Amazon Web Services (AWS). Despite initial skepticism, Amazon’s stock soared as AWS grew to dominate the cloud market, showcasing the company’s strategic foresight and risk-taking propensity.

Another compelling case study is the impact of the COVID-19 pandemic on Amazon’s stock. The global crisis accelerated the shift to online retail and digital services, propelling Amazon’s revenue and stock price to new heights. This scenario underscores Amazon’s adaptability and resilience in the face of unprecedented challenges.

These case studies highlight Amazon’s ability to identify opportunities, innovate rapidly, and execute successfully. They serve as a confirmation to the company’s enduring financial strength and its potential for future growth. The lessons drawn from Amazon’s stock performance are invaluable for those seeking to navigate the complex terrain of investment decision-making.

Frequently Asked Questions

What Is Amazons Dividend Policy for Its Shareholders?

Amazon does not currently offer dividends to its shareholders. Instead, the company reinvests its earnings back into the business to fuel growth and innovation, serving its customers with improved and new products and services.

Has Amazon Ever Had a Stock Split in Its History?

Yes, Amazon has had three stock splits in its history. The first occurred in 1998, followed by two more in 1999. However, since then, Amazon has not implemented any further stock splits.

How Can I Purchase Amazon Stocks From Outside the United States?

To purchase Amazon stocks from outside the United States, one can utilize international brokerage platforms. These platforms, compliant with the U.S. regulatory framework, enable global investors to participate in U.S. stock market activities.

Are There Any Major Competitors Posing a Threat to Amazons Market Dominance?

Major competitors such as Alibaba, Walmart, and eBay indeed pose potential threats to Amazon’s market dominance due to their significant global presence, innovative strategies, and consistent efforts to enhance customer service standards.

What Are Some Risks Involved in Investing in Amazons Stock?

Investing in Amazon’s stock involves potential risks such as fluctuating market conditions, regulatory changes, competition, and operational disruptions. Prior to deciding to invest, it is crucial to conduct thorough research and consider these factors.

Conclusion

To sum up, Fintechzoom’s analysis offers valuable insights into Amazon’s stock performance and future prospects. It provides a thorough guide for potential investors, highlighting key market trends and predictions. The impressive statistic of Amazon’s continual growth, even during economic downturns, further validates the company’s strong market hold. This analysis reaffirms the potential of investing in Amazon and its promising future in the ever-evolving digital marketplace.

[…] ETF mirroring the Nasdaq-100 Index, offering exposure to tech giants such asApple, Microsoft, and Amazon. Its value is influenced by company performance, market trends, and economic indicators. Advanced […]

[…] You may like to read: Fintechzoom Amazon Stock Analysis […]

[…] You may be interested: Fintechzoom Amazon Stock Analysis […]

[…] Also Read: Fintechzoom Amazon Stock Analysis […]

[…] holdings further influence stock performance against competitive pressures from giants like Amazon and Google. On the financial front, Roku exhibits a favorable current ratio and positive net […]

[…] Also Read: Fintechzoom Amazon Stock Analysis […]

[…] diverse revenue streams, including e-commerce, cloud computing (AWS), and subscription services, contribute to its continuous growth and dominance in the industry. Investors can gain insights into how Amazon’s strategic investments in cutting-edge […]