The Fintechzoom AMC stock has seen an unprecedented surge, drawing attention from investors, analysts, and the public. This surge has sparked debates on market manipulation and the impact of online communities.

Fintechzoom’s coverage of AMC stock highlights the convergence of technology and finance, shaping market narratives and providing real-time updates and analysis. Understanding the key players behind AMC’s surge, including retail and institutional investors, is essential to maneuvering this dynamic market.

Social media platforms have played a significant role in shaping investor sentiment and democratizing access to market information. The future performance of AMC stock is influenced by technological advancements, consumer preferences, and changing market conditions. Understanding these factors is vital for investors looking to navigate the volatile stock market landscape.

Table of Contents

Understanding the Fintechzoom AMC Stock Phenomenon

The unprecedented surge in the Fintechzoom AMC stock price has captivated the financial world with its unique dynamics and implications. AMC stock Fintechzoom has become a focal point of discussion and speculation, drawing attention from investors, analysts, and the general public alike. This sudden rise in the AMC stock price, facilitated by platforms like Fintechzoom, has sparked debates on market manipulation, the power of online communities, and the future of traditional investing.

What makes the AMC stock Fintechzoom phenomenon particularly intriguing is the democratization of information and trading it represents. Online platforms like Fintechzoom have empowered retail investors to participate in ways previously reserved for institutional players. This shift in the investing landscape has challenged conventional wisdom and raised questions about market efficiency and fairness.

As the Fintechzoom AMC stock saga continues to unfold, it serves as a reminder of the evolving nature of financial markets and the increasing influence of technology on investment decisions. Understanding the complexities and implications of this trend is important for anyone seeking to navigate the ever-changing world of finance.

Role of Fintechzoom in Covering AMC Stock

Revealing the impact of Fintechzoom on AMC stock coverage exposes a convergence of technology and finance shaping market narratives. Fintechzoom plays a pivotal role in democratizing financial information by providing real-time updates, analysis, and insights on AMC stock, empowering both seasoned investors and newcomers with valuable data.

Through its platform, Fintechzoom bridges the gap between traditional financial journalism and modern technology, offering a detailed view of AMC’s stock performance.

Fintechzoom AMC Stock: Price Rollercoaster

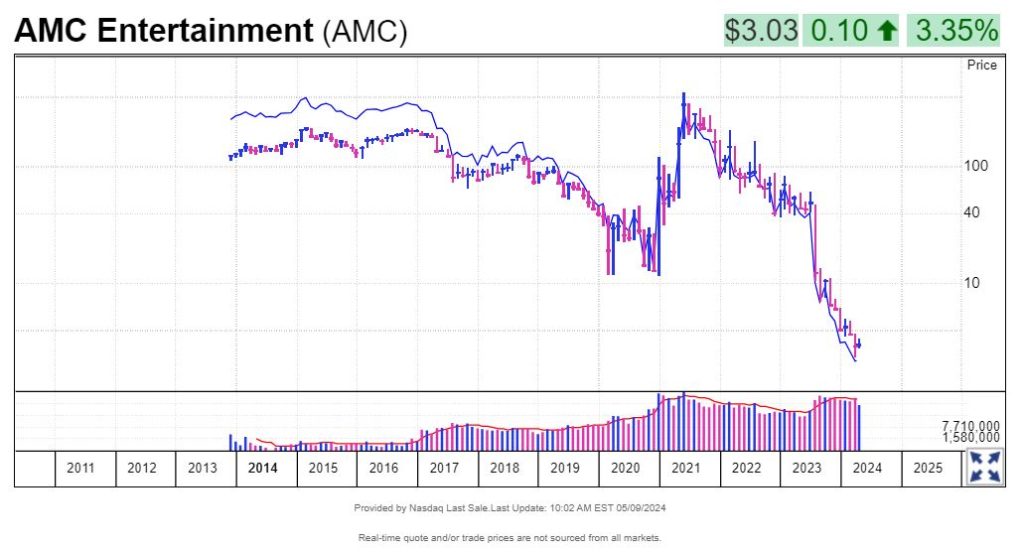

Sailing through the tumultuous waves of market fluctuations, Fintechzoom sheds light on the intricate dynamics of AMC stock’s price rollercoaster. AMC Entertainment Holdings, Inc., the cinema chain operator, has seen its stock price experience extreme volatility in recent times. Fintechzoom’s coverage explores the factors driving these fluctuations, including retail investor interest, short squeezes, and overall market sentiment.

The Fintechzoom AMC stock price rollercoaster has been a spectacle to watch, with dramatic surges and dips occurring frequently. Fintechzoom Pro‘s analysis provides valuable insights into the reasons behind these erratic movements, helping investors understand the underlying forces at play.

As AMC continues to capture the attention of both Wall Street and Main Street, Fintechzoom remains at the forefront of delivering timely updates and in-depth analysis on the stock’s price action. By dissecting the complexities of AMC’s price rollercoaster, Fintechzoom equips its audience with the knowledge needed to navigate the turbulent waters of the stock market with confidence and clarity.

Key Players Behind Amc’s Surge

Deciphering the intricate web of AMC stock’s price fluctuations, understanding the key players behind AMC’s surge is imperative for investors seeking to grasp the driving forces shaping the market dynamics. In the case of AMC Entertainment Holdings, retail investors have emerged as a formidable force.

These individual investors, often communicating and coordinating through online platforms like Reddit’s WallStreetBets, have shown a collective ability to influence stock prices greatly. Their coordinated buying and holding of AMC shares have played an essential role in driving up the stock price.

Additionally, institutional investors, such as hedge funds and large financial firms, also play a crucial role in AMC’s surge. Their actions, whether through short-selling or buying into the stock, can have a substantial impact on the market. The interactions and conflicts between retail investors and institutional players create a dynamic environment that contributes to the volatility and unpredictability of AMC’s stock price.

Understanding the motivations and strategies of these key players is essential for investors looking to navigate the complexities of AMC’s market movements effectively.

Impact of Social Media on AMC Stock

Social media platforms have become a significant driving force behind the fluctuations in AMC stock prices, reshaping the landscape of investor sentiment and market dynamics. The rise of retail investors congregating on platforms like Reddit, Twitter, and TikTok has led to a new era of collective action, where individual investors can band together to influence stock prices.

This phenomenon was particularly evident in the case of AMC Entertainment Holdings, where enthusiastic online communities rallied behind the stock, driving up its price through coordinated buying efforts.

Social media has democratized access to market information and empowered individual investors to challenge traditional financial institutions. While this newfound power can lead to rapid and sometimes volatile price movements, it also highlights the potential for retail investors to have a meaningful impact on the market.

As social media continues to shape investor behavior and market trends, it is essential for market participants to stay informed, critically evaluate information, and make well-informed decisions to navigate the evolving landscape of stock trading influenced by online platforms.

Wall Street’s Response to AMC

Amid the surge of retail investor activity fueled by social media platforms, Wall Street’s response to AMC Entertainment Holdings’ stock performance has been closely scrutinized for its strategic adaptations to this evolving market landscape. As retail investors rallied behind AMC, driving significant volatility in its stock price, traditional Wall Street institutions had to navigate this new paradigm.

Some hedge funds and institutional investors initially took short positions on AMC, betting against its success. However, as the stock price soared due to retail investor enthusiasm, some Wall Street players recalibrated their positions, either by closing out shorts or even joining the buying frenzy.

Wall Street’s response to AMC reflects a complex interplay of market dynamics, institutional strategies, and risk management practices. It highlights the need for adaptability and agility in the face of rapidly changing market conditions. The evolving relationship between retail investors and traditional financial institutions in the context of AMC’s stock performance underscores the shifting power dynamics in today’s market environment.

Lessons From Amc’s Stock Performance

An in-depth analysis of AMC’s stock performance reveals valuable insights for investors traversing the complexities of today’s market landscape. AMC Entertainment Holdings, Inc. has experienced significant volatility in its stock price, driven by retail investor interest, short squeezes, and meme stock phenomena.

One key lesson from AMC’s stock performance is the power of retail investors banding together on social media platforms to influence stock movements, challenging traditional Wall Street dynamics.

Another lesson learned is the importance of understanding market sentiment and momentum. AMC’s stock price movements have often defied fundamental analysis, showcasing the impact of investor emotions and collective behavior on stock valuations.

Additionally, the importance of risk management and diversification is highlighted by the extreme fluctuations in AMC’s stock price, emphasizing the need for a balanced portfolio strategy.

Fintechzoom AMC Stock: Predictions for AMC’s Future

In the domain of stock market analysis, the future trajectory of AMC Entertainment Holdings, Inc. is a subject of keen interest and speculation among investors and financial experts alike. As the entertainment industry continues to evolve, AMC’s future performance is influenced by various factors such as technological advancements, consumer preferences, and overall economic conditions. Predicting AMC’s future involves a blend of fundamental analysis, industry trends, and market sentiment.

Some predictions for AMC’s future suggest that the company may experience volatility due to changing viewer habits, competition from streaming services, and the ongoing impact of the pandemic on movie theater attendance. However, others remain optimistic about AMC’s potential for recovery and growth, especially as restrictions ease and blockbuster films drive audiences back to theaters.

Ultimately, the future of AMC stock remains uncertain, and investors should carefully assess the risks and opportunities before making any decisions. It is essential to stay informed, diversify portfolios, and consider a long-term investment strategy to navigate the potential ups and downs in AMC’s future performance.

Fintechzoom AMC Stock: Investing Safely in Volatile Stocks

Managing the fluctuations in volatile stocks like Apple, NASDAQ, S&P 500 and Fintechzoom AMC requires a strategic approach that emphasizes risk management and informed decision-making. When investing in such stocks, it is essential to conduct thorough research, understand the company’s fundamentals, and stay updated on market trends. Diversification is vital to mitigating risks; spreading investments across different assets can help cushion against potential losses from any single stock.

Investors looking to handle the volatility of Fintechzoom AMC should set clear investment goals and establish a well-defined risk tolerance. Setting stop-loss orders can help limit losses by automatically selling a stock if it reaches a predetermined price. Additionally, staying disciplined and avoiding emotional decision-making is crucial in volatile markets.

Furthermore, staying informed about the latest news and developments related to Fintechzoom AMC can provide valuable insights for making investment decisions. Consulting with financial advisors or experienced investors can also offer guidance on managing volatile stocks safely.

By approaching volatile investments with caution and a well-thought-out strategy, investors can potentially capitalize on opportunities while managing risks effectively.

The Legacy of AMC’s Stock Movement

The evolution of AMC’s stock movement exemplifies a dynamic interplay between market forces and investor sentiment that has left a lasting impact on the financial landscape. AMC Entertainment Holdings, a company deeply affected by the COVID-19 pandemic due to its reliance on in-person movie experiences, saw its stock price fluctuate substantially in response to shifting market dynamics and investor behavior.

The unprecedented surge in retail trading activity, fueled by online communities and social media platforms, propelled AMC’s stock to unprecedented highs, challenging traditional notions of stock valuation and market efficiency.

The legacy of AMC’s stock movement serves as a testament to the power of collective action and the influence of retail investors in shaping market trends. It highlights the potential for individual investors to band together and challenge established financial institutions, underscoring the importance of democratizing access to investment opportunities.

As AMC continues to navigate its recovery journey, the lessons learned from its stock movement are poised to redefine the future of investing and inspire a new generation of market participants.

Frequently Asked Questions

How Does the Fintechzoom Platform Select Which AMC Stock News to Cover?

When deciding which AMC stock news to cover, platforms often prioritize relevance, impact, and timeliness. Factors such as market trends, company performance, and audience interest guide the selection process to guarantee informative and valuable content delivery.

Can Social Media Influencers Manipulate the AMC Stock Price Through Fintechzoom Coverage?

In the dynamic world of finance, the influence of social media personalities on stock prices is a subject of intrigue. Their impact, intertwined with media coverage, can spark fluctuations, underscoring the need for vigilant monitoring.

Are There Any Regulatory Concerns Associated With Fintechzoom’s Reporting on AMC Stock?

Regulatory concerns may arise from media outlets’ reporting that potentially influences stock prices. Transparency, accuracy, and ethical considerations are paramount. Regulatory bodies oversee to guarantee fair markets, investor protection, and integrity in financial reporting.

What Are the Potential Long-Term Implications of Fintechzoom’s Coverage on AMC Stock?

The long-term implications of media coverage can shape perceptions, influence investor behavior, and impact market dynamics. Thoughtful reporting nurtures informed decisions and market stability, while sensationalism may lead to volatility and misinformed choices.

How Does Fintechzoom Ensure Accurate and Unbiased Reporting on AMC Stock?

Ensuring accurate and unbiased reporting involves thorough fact-checking, verification from multiple sources, adherence to journalistic ethics, avoiding conflicts of interest, and transparency in reporting processes. Maintaining objectivity and integrity is paramount in journalistic endeavors.

Conclusion

To sum up, the Fintechzoom coverage of AMC stock has shed light on the unpredictable nature of the stock market. Despite the rollercoaster ride of AMC’s stock price, key players and social media have played significant roles in its surge. Investors can learn valuable lessons from AMC’s performance and make informed decisions for the future. As the saying goes, ‘the proof is in the pudding’ – highlighting the importance of diligence and caution in investing in volatile stocks.

[…] whether to put resources into Fintechzoom AMC stock requires a nuanced comprehension of the securities exchange’s elements, the […]

[…] the risks, there are also potential opportunities for investors. AMC’s efforts to innovate and diversify its revenue streams, such as expanding into digital content and enhancing […]

[…] Entertainment Holdings, Inc., an American entertainment company primarily involved in the theater business, has become a focal point in the stock market. Historically, AMC was a conventional stock, not […]

[…] are increasingly conscious of the environmental impact of their purchases, leading companies like AMC, Meta, Amazon and Costco to invest in sustainable sourcing, reducing packaging waste, and promoting […]

[…] AMC is largely dictated by technology, consumer demand and other factors, the future movement of FinTechzoom AMC Stock will depend on new technologies, demand for products, and any changes in market conditions. This […]

[…] stocks like FintechZoom AMC Stock present serious financial risks, making diversifying your portfolio imperative. To prevent losses, […]

[…] such as media coverage, social media discussions, and analyst reports, plays a crucial role in AMC’s stock price volatility. FinTechZoom’s analysis and insights contribute to shaping this sentiment, […]

[…] the forefront of dissecting AMC’s meteoric rise, FintechZoom employs a rigorous analytical approach. Through detailed market analysis and expert insights, […]

[…] what impacts AMC Stock in 2024 involves looking at both economic and industry-specific factors. The broader economic environment […]