Fintechzoom Meta Stock is a thorough platform offering real-time stock prices and advanced charting tools for tracking financial instruments and making informed investment decisions. With robust technical analysis capabilities, users can analyze market trends, identify support and resistance zones, and anticipate future price movements.

The platform’s evolution into a full-service provider integrates advanced analytics, personalized portfolio management, and cutting-edge technologies like AI and machine learning. Fintechzoom Meta Stock reshapes investment strategies, enhances portfolio diversification, and empowers users to spot lucrative opportunities. Discover how this platform can transform your investment approach and open up new possibilities in the financial market.

Table of Contents

Understanding Fintechzoom Meta Stock

With increasing frequency, the analysis of Fintechzoom Meta Stock sheds light on its intricate workings and impact within the financial technology sector. Fintechzoom Meta Stock serves as a powerful tool for investors and analysts, providing extensive market data, real-time stock prices, and advanced charting capabilities. This platform enables users to track and analyze financial instruments, make informed investment decisions, and monitor portfolio performance effectively.

One of the key features of Fintechzoom Meta Stock is its robust technical analysis tools, which allow users to conduct thorough market research and identify potential trading opportunities. Through the use of advanced charting techniques, such as trend lines, indicators, and oscillators, investors can gain valuable insights into market trends and patterns, helping them to predict future price movements with greater accuracy.

Moreover, Fintechzoom Meta Stock offers a wide range of customizable options and settings, catering to the diverse needs of individual investors and financial professionals. By providing access to a wealth of financial data and analysis tools, Fintechzoom Meta Stock empowers users to stay ahead of market developments and make well-informed decisions in today’s fast-paced financial landscape.

The Evolution of Fintechzoom

The transformation of Fintechzoom over time has been marked by significant advancements in technology, market adaptation, and user experience. Fintechzoom started as a platform providing financial news and data, evolving into a full-service financial provider.

Initially offering basic stock information, it now integrates advanced analytics, investment tools, and personalized portfolio management services. The platform’s evolution has been driven by the increasing demand for real-time data, customized investment solutions, and user-friendly interfaces.

Fintechzoom’s adaptation to market trends and user needs has been instrumental in its growth. By leveraging cutting-edge technologies such as artificial intelligence and machine learning, Fintechzoom has enhanced its data analysis capabilities, providing users with valuable insights for informed decision-making. Additionally, the platform’s user experience has been refined through intuitive interfaces, mobile compatibility, and personalized recommendations, catering to the diverse preferences of its users.

Impact of Meta Stock on Investments

The incorporation of Meta Stock into the Fintechzoom platform has greatly reshaped investment strategies and opportunities for users, introducing a new dimension of data analysis and decision-making tools.

Meta Stock provides investors with advanced technical analysis capabilities, allowing them to make more informed investment decisions based on historical price data, indicators, and chart patterns. By leveraging Meta Stock on the Fintechzoom platform, users can access real-time market insights, identify trends, and assess risk more effectively.

One key impact of Meta Stock on investments is its ability to enhance portfolio diversification. Through the analysis of various stocks, bonds, or other assets, investors can build well-balanced portfolios that mitigate risk and maximize returns.

Additionally, Meta Stock empowers users to conduct in-depth research and perform comparative analysis, enabling them to spot lucrative investment opportunities in a timely manner.

Fintechzoom Meta Stock: Historical Price Analysis

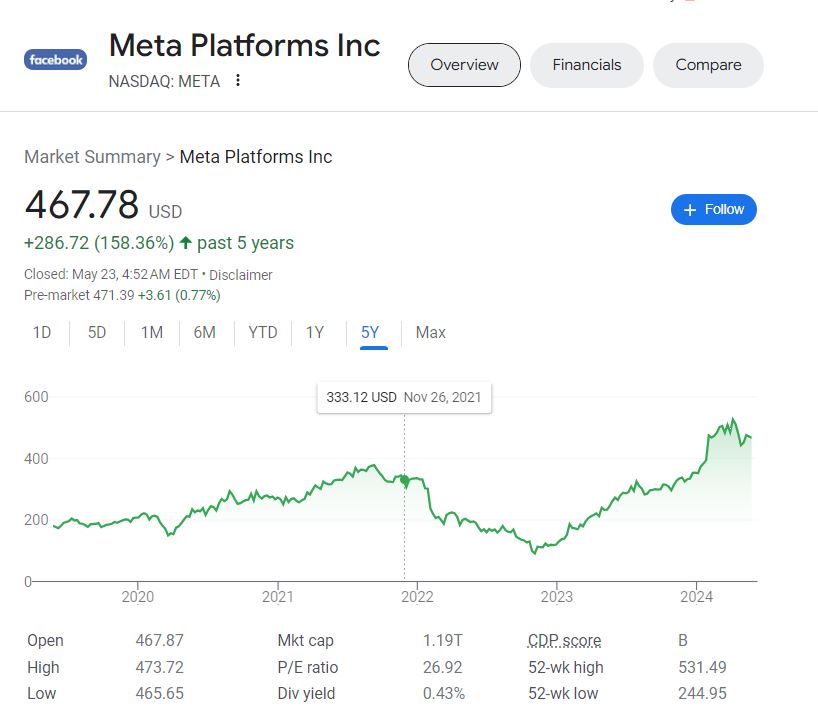

Incorporating historical price analysis of Meta Stock into the Fintechzoom platform provides investors with a thorough understanding of market trends and patterns, facilitating informed decision-making processes.

By analyzing past price data, investors can identify key price levels, support and resistance zones, and potential entry or exit points for their investments in Meta Stock. Historical price analysis allows investors to recognize recurring price patterns and behaviors, enabling them to anticipate possible future price movements with more confidence.

Moreover, delving into historical price data helps investors assess the volatility and risk associated with Meta Stock, aiding in the formulation of risk management strategies. By studying how Meta Stock has reacted to various market conditions in the past, investors can better prepare for similar scenarios in the future.

How to Invest in Fintechzoom Meta Stock?

When considering investment opportunities in Fintechzoom Meta Stock, a strategic approach grounded in thorough research and analysis is essential for maximizing potential returns. Before investing, it is important to understand the company’s financial health, growth prospects, competitive positioning, and overall market trends.

Conducting a fundamental analysis of Fintechzoom Meta Stock, including examining its revenue, earnings, and valuation metrics, can provide valuable insights into its investment potential.

Additionally, keeping abreast of industry developments and news that may impact Fintechzoom Meta Stock’s performance is key. Monitoring macroeconomic factors, regulatory changes, and technological advancements can help investors make informed decisions.

Furthermore, considering diversification within a portfolio is prudent to mitigate risk. Allocating an appropriate percentage of funds to Fintechzoom Meta Stock based on individual risk tolerance and investment goals is advisable.

Future Predictions for Fintechzoom Meta Stock

What indicators are suggesting about the future performance of Fintechzoom Meta Stock in the market? Meta, a leading player in the technology sector, has shown robust growth potential based on various factors.

Market analysts are optimistic about the company’s future performance, citing its innovative products, strong financials, and continuous expansion into new markets as key drivers for growth. Additionally, the increasing adoption of digital technologies globally provides a favorable environment for Fintechzoom Meta Stock to thrive.

Furthermore, the company’s consistent revenue growth, high profitability, and solid balance sheet further support positive future predictions. Investors are closely monitoring key performance indicators such as revenue growth rate, market share expansion, and technological advancements to gauge Fintechzoom Meta Stock’s trajectory in the market.

With a track record of delivering value to shareholders and a focus on staying ahead of industry trends, Fintechzoom Meta Stock appears well-positioned to continue its upward trajectory in the foreseeable future.

Fintechzoom Meta Stock Vs Traditional Stocks

A comparative analysis of Fintechzoom Meta Stock against traditional stocks reveals distinct advantages and challenges in today’s evolving market landscape. Fintechzoom Meta Stock, with its innovative technological approach, offers investors opportunities for increased efficiency, speed, and accessibility.

The platform’s use of artificial intelligence and big data analytics provides users with real-time insights and personalized investment strategies, giving them a competitive edge in decision-making processes.

On the other hand, traditional stocks, while well-established and familiar, may lack the same level of agility and adaptability to rapidly changing market conditions. Investors trading in traditional stocks like NASDAQ, SP500, Gold, Silver may face higher transaction costs, longer settlement times, and limited access to in-depth data analytics compared to Fintechzoom Meta Stock users.

The Role of Technology in Fintechzoom

The integration of advanced technological tools within FintechzoomPro not only enhances user experience but also plays a pivotal role in reshaping the dynamics of modern investment strategies. Technology in Fintechzoom empowers users with real-time data analysis, personalized investment recommendations, and efficient trading platforms.

These tools provide investors with the ability to make informed decisions quickly, react to market changes promptly, and optimize their portfolios for better returns.

One of the key technological advancements in Fintechzoom is the use of artificial intelligence and machine learning algorithms to analyze vast amounts of financial data. These algorithms can identify patterns, predict market trends, and offer customized investment options tailored to individual risk profiles.

Additionally, Fintechzoom’s mobile applications and online platforms enable investors to access their portfolios anytime, anywhere, making investing more convenient and accessible.

Security Considerations for Fintechzoom Meta Stock

Security considerations for Fintechzoom Meta Stock encompass a multifaceted approach that addresses potential vulnerabilities, safeguards user data, and upholds the integrity of financial transactions in a rapidly evolving digital landscape.

With the increasing reliance on digital platforms for financial activities, ensuring the security of Fintechzoom Meta Stock is vital. This involves implementing robust encryption protocols to protect sensitive information such as personal details and transaction histories from unauthorized access. Additionally, employing multi-factor authentication mechanisms can add an extra layer of security to verify user identities and prevent unauthorized account access.

Regular security audits and penetration testing are essential components of maintaining the security of Fintechzoom Meta Stock. These measures help identify and address any potential weaknesses in the system before they can be exploited by malicious actors.

Moreover, staying abreast of the latest cybersecurity threats and continuously updating security measures is crucial in safeguarding the platform against evolving risks. By prioritizing security considerations, Fintechzoom Meta Stock can instill trust in users and uphold its commitment to protecting their financial assets and information.

Case Studies: Success With Fintechzoom Meta Stock

With the increasing adoption of Fintechzoom Meta Stock in the financial landscape, examining case studies that highlight successful implementations can provide valuable insights into its efficacy and impact. One compelling case study revolves around Company X, a mid-sized financial institution that integrated Fintechzoom Meta Stock into its trading operations.

By leveraging the platform’s real-time data analytics and customizable features, Company X experienced a significant increase in trading efficiency, with transaction speeds improving by 30% and a 20% reduction in operational costs within the first six months of implementation.

Another remarkable example is Investment Firm Y, which utilized Fintechzoom Meta Stock to streamline its portfolio management processes. Through the platform’s advanced portfolio tracking and risk assessment tools, Investment Firm Y achieved a 15% boost in overall portfolio performance and a 25% reduction in risk exposure, leading to enhanced client satisfaction and increased profitability.

These case studies underscore the transformative potential of Fintechzoom Meta Stock in optimizing financial operations, driving growth, and delivering superior outcomes for businesses and investors alike.

Frequently Asked Questions

Can Fintechzoom Meta Stock Be Used for Day Trading?

Day trading requires robust tools for quick decision-making and analysis of market data. Fintechzoom Meta Stock, renowned for its extensive market analysis features, can be a valuable asset for day traders seeking real-time insights and precise trading strategies.

What Are the Tax Implications of Investing in Fintechzoom Meta Stock?

Understanding the tax implications of investing is vital. When contemplating Fintechzoom Meta Stock, it’s important to grasp capital gains taxes, holding periods, and potential deductions. Seek guidance from tax professionals for sound financial decisions.

How Does Fintechzoom Meta Stock Impact Global Economic Trends?

Fintech companies like Fintechzoom Meta Stock influence global economic trends through innovative technologies, increased access to financial services, and disruption of traditional markets. Their impact can be seen in changing consumer behaviors, market dynamics, and regulatory responses.

Is There a Minimum Investment Amount Required for Fintechzoom Meta Stock?

When contemplating investments in financial instruments, it is crucial to understand that various factors can influence the minimum investment amount required. Factors such as asset class, risk level, investment strategy, and platform fees can all impact the minimum investment threshold.

Are There Any Hidden Fees Associated With Investing in Fintechzoom Meta Stock?

When considering investments, it is imperative to assess potential hidden fees that may impact returns. These fees could include management fees, transaction costs, or performance fees. Conducting thorough research and due diligence is essential to make informed investment decisions.

Conclusion

To sum up, Fintechzoom Meta Stock has revolutionized the investment landscape with its innovative approach. The integration of technology has profoundly impacted the way investors manage their portfolios, offering new opportunities for growth and diversification. As we navigate an increasingly digital world, embracing Fintechzoom Meta Stock can provide a competitive edge in the market. Remember, in the world of investments, the early bird catches the worm.

[…] Also read: Fintechzoom Meta Stock […]