Exploring the landscape of Fintechzoom SP500 index reveals a terrain rich with analytical opportunities and strategic insights. As investors navigate the intricate web of market dynamics, understanding the nuances of this influential index becomes paramount.

Delving into Fintechzoom’s thorough analysis of the SP500 not only sheds light on its composition and criteria but also provides a platform to explore strategic investment options and market trends. By uncovering the layers of data-driven information within Fintechzoom’s coverage, investors can arm themselves with the knowledge needed to make informed decisions in the ever-evolving financial ecosystem.

Table of Contents

Key Takeaways

- Understanding the sp500’s role in the market is crucial for investors at all levels.

- Investing in the sp500 provides exposure to large companies and growth potential.

- Leveraging real-time data platforms and analysis tools is essential for successful navigation.

- Comparing investment options like SPY and SPX helps in making informed decisions for tracking sp500 performance.

Fintechzoom SP500: Understanding SP 500 Basics

In delving into the foundational elements of the sp500, a thorough grasp of its structure and significance is imperative for formulating sound investment strategies. The sp500, represented by tickers like SPY, plays a pivotal role in the financial markets. Understanding the SPY stock Fintechzoom can provide insights into the index’s performance and trends. Monitoring the Fintechzoom SP price and Fintechzoom SP price prediction allows investors to make informed decisions based on real-time data.

Analyzing historical data on the SPY stock Fintechzoom reveals patterns that can guide investment strategies. By tracking market trends and utilizing Fintechzoom’s tools, investors can identify growth opportunities within the s&p 500. Leveraging Fintechzoom’s resources offers a comprehensive view of the index, aiding in decision-making processes.

Moreover, comparing SPY stock Fintechzoom with other investment options like the Fidelity 500 Index Fund (FXAIX) provides clarity on cost-effectiveness and liquidity. Understanding these basics is fundamental for maneuvering the complexities of the sp500 and optimizing investment portfolios.

Importance of SP 500 Diversification

Exploring the benefits of diversification within the sp500 index requires a nuanced understanding of market dynamics and risk management strategies. Diversification in the sp500 involves spreading investments across various sectors and companies, reducing the impact of any single stock’s performance on the overall portfolio.

This strategy helps mitigate risk by balancing potential losses and gains, ultimately enhancing the stability of the investment. By diversifying within the s&p 500, investors can tap into the index’s broad representation of the U.S. economy, which includes sectors like Technology, Healthcare, Financials, and Consumer Discretionary. This exposure provides a level of insulation against sector-specific risks and market volatility, making the sp500 a robust choice for long-term investment growth.

Additionally, diversification within the index can offer opportunities for capitalizing on different market trends and economic cycles, further optimizing investment returns for prudent investors seeking a balanced and resilient portfolio.

Investing in sp500: Benefits

Investors can leverage the sp500 to capitalize on diversified exposure to leading publicly traded U.S. companies, fostering long-term growth potential and risk mitigation. Investing in the sp500 offers benefits such as broad sector representation, reducing the impact of individual company volatility on the portfolio.

This diversification helps spread risk across various industries, enhancing stability. The index’s historical performance reflects resilience, with an average annualized return of 9.90% since 1928, showcasing its potential for consistent growth over time. Additionally, investing in the sp500 provides access to large companies with established track records and growth prospects, aligning with long-term investment goals.

For investors seeking simplicity and accessibility, financial products like ETFs offer a convenient way to gain exposure to the S&P 500. By understanding the benefits of investing in the S&P 500, individuals can strategically position themselves for long-term wealth accumulation and portfolio growth. Additionally, for those in need of financial flexibility, a trusted money lender in Singapore can provide the necessary support to capitalize on investment opportunities.

Fintechzoom SP500 Composition Overview

Providing a detailed overview of market dynamics, the sp500 Composition Overview explores the structural framework and key components shaping this influential market index. The sp500 comprises 500 of the largest publicly traded companies in the United States, representing various sectors such as Technology, Healthcare, Financials, and Consumer Discretionary.

Notable companies like Apple, Microsoft, JPMorgan Chase, and Johnson & Johnson hold significant weight within the index. To be included in the sp500, companies must meet specific criteria including a market capitalization of at least $8.2 billion, positive earnings, and publicly available shares. The index’s value is determined based on the market capitalizations of its constituent companies, with periodic rebalancing to reflect market changes.

| Sector | Weight (%) |

| Information Technology | 29.80% |

| Health Care | 12.50% |

| Financials | 13.00% |

| Consumer Discretionary | 10.60% |

| Communication Services | 8.90% |

| Industrials | 8.70% |

| Consumer Staples | 6.60% |

| Energy | 3.80% |

| Utilities | 3.30% |

| Real Estate | 1.90% |

| Materials | 1.00% |

Understanding the composition of the sp500 is essential for investors seeking diversified exposure to the U.S. stock market and aiming to track the performance of leading companies across various industries efficiently.

Criteria for Fintechzoom sp500 Inclusion

The inclusion of companies in the sp500 is contingent upon meeting specific financial criteria, ensuring a thorough representation of the market’s leading publicly traded entities. To be considered for inclusion, companies must have a market capitalization of at least $8.2 billion, exhibit positive earnings, and have publicly available shares.

These criteria help maintain the index’s integrity by including established and financially sound companies. The sp500’s value is calculated based on the market capitalizations of its 500 constituent companies, with regular rebalancing to reflect market dynamics accurately. By adhering to stringent criteria, the index aims to provide investors with a detailed and reliable snapshot of the U.S. economy through a diverse range of sectors.

As a result, companies aspiring for inclusion in the sp500 must demonstrate financial stability, market significance, and meet the stipulated criteria to be part of this prominent index.

Tools for Fintechzoom SP500 Data Analysis

Utilizing advanced data analysis tools is essential for extracting valuable insights and trends from sp500 market data. Analyzing sp500 data requires sophisticated tools that can handle vast amounts of information efficiently. Tools like Python programming language with libraries such as Pandas and NumPy enable data manipulation, statistical analysis, and visualization of market trends. Additionally, platforms like Tableau and Power BI offer interactive dashboards for in-depth exploration of sp500 data, allowing users to identify patterns and correlations effectively.

Machine learning algorithms can also be employed to forecast market movements based on historical sp500 data. These algorithms can help investors make informed decisions by predicting potential outcomes and risks. Utilizing sentiment analysis tools on news and social media can provide insights into market sentiment, influencing stock prices within the sp500. Overall, employing a combination of these advanced data analysis tools is critical for gaining a competitive edge in understanding the dynamics of the sp500 market.

Market Trends and Insights

Analyzing market trends and gaining insights from sp500 data requires leveraging advanced data analysis tools for informed decision-making.

Market trends within the sp500 offer valuable insights into price fluctuations and sector performance, aiding in forecasting market developments and uncovering growth opportunities.

Real-time updates and visualization tools play a pivotal role in providing a thorough view of the sp500’s performance metrics. Monitoring these updates allows investors to adapt their strategies to market changes effectively. Understanding the composition and criteria of the sp500, including its sector diversity and the specific requirements for companies to be included in the index, is fundamental for successful investment strategies.

To learn about market trends, follow a few different stocks and see how their price moves. For example, following the umax asx stock can give you insights into market trends.

Fintechzoom’s SP 500 Coverage

How does Fintechzoom’s thorough coverage of the sp500 enhance investors’ decision-making processes? Fintechzoom’s extensive analysis of the sp500 provides investors with real-time updates, historical data insights, and visualization tools essential for moving through the complexities of this key index.

Fintechzoom’s coverage allows investors to compare the sp500 with other indices like the Dow Jones and Nasdaq, understanding differences in companies, weighting methods, and market representation. This comparative analysis aids in making strategic investment choices aligned with individual goals and risk tolerance.

Furthermore, Fintechzoom’s tools facilitate forecasting market developments, identifying growth opportunities, and adapting strategies to changing market conditions.

Comparing Stock Market Indices

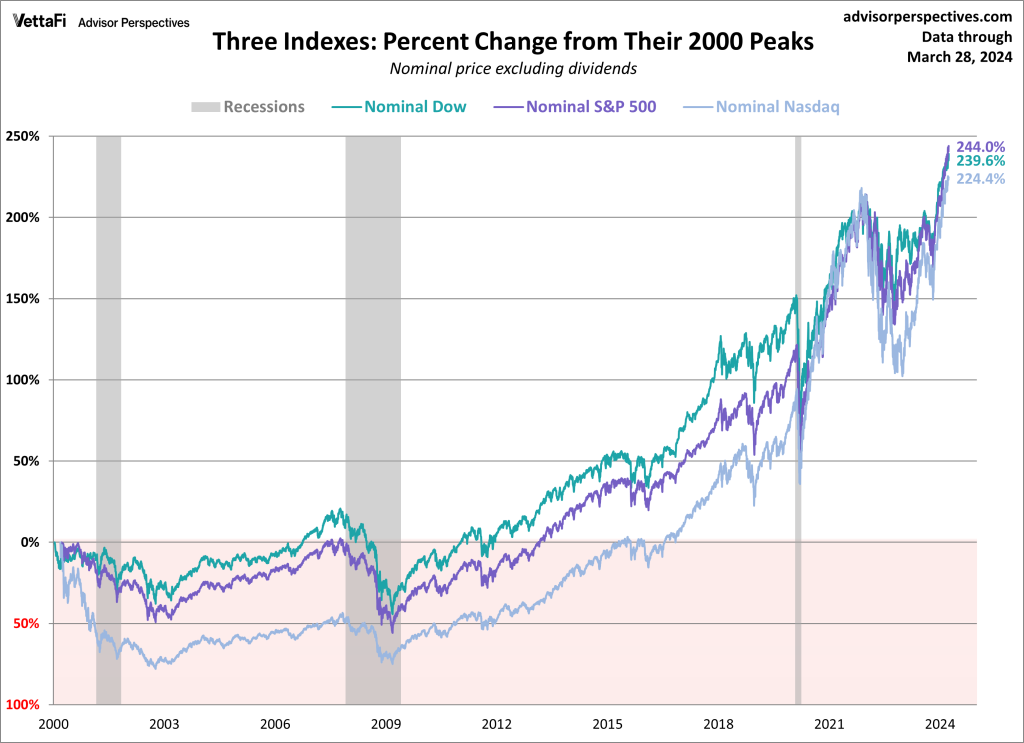

Fintechzoom Pro‘s thorough analysis of the sp500 equips investors with valuable insights for comparing stock market indices and making strategic investment decisions based on market performance metrics and trends. By comparing various indices like the sp500, Dow Jones Industrial Average, and Nasdaq, investors can gauge market representation, company inclusion criteria, and weighting methods, aiding in informed decision-making.

Each index serves a distinct purpose in reflecting different segments of the market, with the sp500 encompassing 500 large-cap U.S. companies, the Dow focusing on 30 blue-chip stocks, and the Nasdaq centering around technology and growth-oriented firms. Understanding these differences is important for constructing a well-diversified portfolio and benchmarking performance accurately.

Additionally, comparing options like SPY and SPX provides insights into cost-effectiveness, liquidity, and diversification benefits, enabling investors to choose instruments aligning with their investment goals and risk tolerance. Strategic evaluation of stock market indices is essential for optimizing portfolio returns and mitigating risks in a dynamic market environment.

Strategic Investment Options

Strategizing investment options involves meticulous evaluation of market trends, risk assessments, and portfolio diversification strategies to optimize returns and navigate dynamic financial landscapes effectively. Investors looking for strategic investment options can consider a range of possibilities.

These may include investing in index funds like the sp500, which historically has shown resilience and offered an average annualized return of 9.90% since 1928. Additionally, exploring low-cost sp500 index funds such as the Fidelity 500 Index Fund (FXAIX) with its minimal expense ratio of 0.015% can be a viable option for long-term investment goals. Comparing investment vehicles like SPY and SPX options can provide insights into cost-effectiveness and liquidity benefits for tracking the sp500 performance.

By leveraging data analysis tools, staying informed about market trends, and considering renowned investors’ strategies like Warren Buffett’s inclusion of the sp500 in Berkshire Hathaway’s portfolio, investors can make informed and strategic investment decisions to achieve their financial objectives.

Conclusion

Exploring the intricacies of the sp500 index is akin to traversing a vast ocean of financial data, where each wave represents a unique opportunity for strategic investment. Utilizing Fintechzoom’s thorough coverage alongside a QR code generator free use can provide investors with additional tools to navigate the complexities of the sp500 index.

By analyzing market trends, understanding index composition, and leveraging data tools, investors can chart a course towards informed decision-making and potential growth. Fintechzoom’s thorough coverage serves as a valuable compass in this ever-evolving financial landscape.

[…] to rapidly changing market conditions. Investors trading in traditional stocks like NASDAQ, SP500, Gold, Silver may face higher transaction costs, longer settlement times, and limited access to […]