The FTSE 100 Fintechzoom‘s integration of fintech companies underscores a significant evolution towards technology-oriented financial services. This shift not only emphasizes operational efficiency and broadened accessibility to financial resources but also prioritizes customer convenience and enhanced security.

Technological innovations, particularly in AI and blockchain, are pivotal in propelling financial inclusion and providing the agility to adapt to rapid changes. With fintech’s growing influence, investment strategies within the FTSE 100 now increasingly focus on diversification through ETFs, index funds, and a commitment to long-term sustainability and strict regulatory compliance. Understanding the dynamic interplay of these elements could reveal further insights into the sector’s trajectory.

Table of Contents

FTSE 100 Fintechzoom: Overview

Analyzing the FTSE 100‘s integration of fintech companies reveals a transformative impact on the traditional financial landscape, driven by innovation and competitive adaptation. This evolution highlights a significant shift from conventional banking methods to more agile, technology-driven financial services that not only enhance operational efficiencies but also expand access to financial resources for underserved communities.

The inclusion of fintech firms like Revolut and Monzo within the FTSE 100 underscores a broader trend towards digitalization that prioritizes customer convenience and security.

The strategic positioning of these fintech entities within the FTSE 100 facilitates a more inclusive financial environment, where technology acts as a bridge to financial literacy and empowerment for various socio-economic groups.

This integration supports the notion that the financial sector can indeed contribute positively to societal well-being by democratizing financial services and making them accessible to a larger population. Additionally, the presence of fintech companies in this prestigious index is indicative of their robust financial health and their capability to sustain profitability, which is essential for investor confidence and continuous capital inflow.

Fintech Influence

Building on the strategic positioning of fintech firms within the FTSE 100, their influential role extends beyond mere participation, reshaping the entire financial ecosystem through technological innovation and accessibility.

These companies are not just participants; they are pivotal architects in the reconstruction of market dynamics and consumer interaction with financial services. Utilizing cutting-edge technologies like artificial intelligence, blockchain, and big data analytics, fintech firms within the FTSE 100 are redefining the paradigms of customer service, risk management, and transaction efficiency.

The ripple effects of their innovations extend to enhanced financial inclusion, offering previously underserved demographics access to banking services, insurance, and investment products. This democratization of financial services fosters a more inclusive economic environment, contributing to societal advancement and empowerment.

Additionally, the agility of these fintech companies in adapting to regulatory and technological changes has set new standards for operational excellence in the financial sector.

FTSE 100 Fintechzoom: Investment Strategies

Investing in the FTSE 100 Fintechzoom involves understanding the diverse array of fintech companies and their contribution to the financial sector’s growth and innovation. Each fintech entity, from dynamic startups like Revolut to established players like PayPal, plays a pivotal role in reshaping financial services.

For investors committed to serving and uplifting communities through strategic financial engagement, it’s vital to recognize the societal impacts alongside the financial returns these innovations foster.

A key investment strategy in this segment involves diversifying across different fintech services, such as digital payments, personal finance apps, and online banking platforms. This approach not only mitigates risk but also capitalizes on various growth trajectories within the fintech sector.

Exchange-Traded Funds (ETFs) and index funds focusing on fintech provide an efficient vehicle for achieving such diversification. They enable investors to gain exposure to a broad spectrum of fintech companies within the FTSE 100, benefiting from the collective performance of these innovators.

Moreover, evaluating the long-term sustainability and regulatory compliance of these fintech firms is essential. Investors should prioritize companies that not only promise high returns but also demonstrate robust business models and adherence to evolving financial regulations, ensuring resilience and continuity in a rapidly changing economic landscape.

FTSE 100 Fintechzoom: Historical Growth Analysis

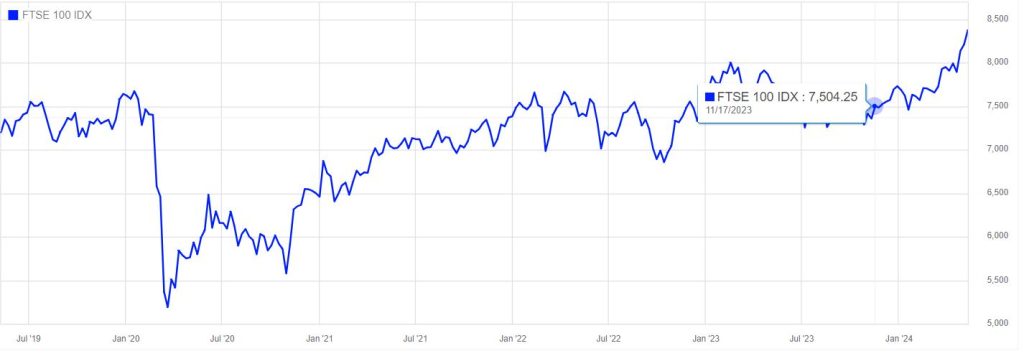

Examining the historical growth of the FTSE 100 FintechZoom reveals a pattern of robust expansion and innovation within the fintech sector. This analysis is instrumental in understanding how digital transformation has propelled the financial services industry forward.

Importantly, the integration of technology in finance has not only enhanced operational efficiencies but also expanded access to financial services, consequently contributing greatly to societal advancement.

The historical data indicates that fintech companies in the FTSE 100 have consistently pursued growth through technological advancements, strategic partnerships, and global market penetration.

This has resulted in a commendable increase in their market capitalization and influence on the index. For instance, over the past two decades, the average return of the FTSE 100 index, with its substantial fintech representation, stands at an impressive 174.2%. This growth trajectory underscores the sector’s resilience and its pivotal role in shaping financial markets.

Furthermore, the UK fintech sector’s ability to attract substantial equity funding, amounting to £26.8 billion, highlights investor confidence and the inherent potential of these enterprises. This financial backing has facilitated continuous innovation, thereby sustaining growth and ensuring the sector’s attractiveness to both domestic and international investors.

Risk Management Insights

Effective risk management is essential for fintech companies in the FTSE 100 to navigate the complex landscape of regulatory requirements and cybersecurity threats. These firms operate in a highly dynamic sector where financial regulations continuously evolve, and the risk of data breaches remains significant. To manage these risks effectively, companies must develop robust frameworks that guarantee compliance and secure customer data.

A critical component of this framework is the adoption of advanced cybersecurity measures. These include employing state-of-the-art encryption technologies, conducting regular security audits, and fostering a culture of cybersecurity awareness among employees. By prioritizing these areas, fintech companies can mitigate the risk of cyber threats, which not only protects the firm but also builds trust with customers.

Additionally, regulatory compliance is another pillar of effective risk management. Staying abreast of changes in financial legislation and adapting business practices accordingly is crucial. This involves regular training for staff on regulatory updates and implementing technology solutions that can streamline compliance processes.

Innovation in Fintech

Building on the framework of risk management, innovation in fintech continues to propel the industry forward by introducing advanced technologies and novel business models. This surge is largely driven by the imperative to enhance financial inclusivity and streamline complex financial processes, ultimately serving broader societal needs.

Fintech innovations such as blockchain technology, artificial intelligence (AI), and big data analytics are revolutionizing the way financial transactions are conducted, data is analyzed, and security is managed. These technologies not only increase the efficiency and accuracy of financial services but also greatly reduce costs for companies and consumers alike.

Moreover, the integration of AI into customer service solutions in fintech companies exemplifies a commitment to enhancing user experience and accessibility. Through AI-driven chatbots and automated advisory services, fintech is making financial advice and management tools more accessible to the general public, including underserved communities. This democratization of financial services underscores the industry’s role in fostering economic empowerment and reducing inequality.

Market Dynamics

Market dynamics within the fintech sector are heavily influenced by technological advancements and regulatory changes, shaping the competitive landscape and investment opportunities. These elements are pivotal in driving innovation, affecting everything from the development of new financial products to the way services are delivered to both businesses and consumers.

As regulations evolve, particularly in areas like digital payments and data protection, fintech companies must quickly adapt to comply while still pushing the boundaries of technological innovation.

The rapid adoption of technologies such as blockchain, artificial intelligence, and big data analytics has also transformed traditional financial services, creating a more competitive environment. Fintech firms leverage these technologies to enhance operational efficiencies and personalize customer experiences, which are critical in retaining customer loyalty and securing new business.

This technological push is accompanied by significant capital investment, reflecting confidence in the sector’s growth potential despite the complexities introduced by regulatory requirements.

Moreover, the integration of sustainability practices within operational frameworks is becoming increasingly important. Investors and customers alike are showing heightened awareness and preference for companies that prioritize ethical practices and contribute positively to societal goals. This shift not only influences market positioning but also encourages fintech companies to innovate responsibly, ensuring long-term profitability and alignment with global sustainability goals.

Key Industry Players

As we examine the competitive landscape shaped by technological advancements and regulatory changes, it is imperative to highlight the contributions of key industry players in the FTSE 100 fintech sector.

Notable among these are global payment giants like Mastercard and Visa, both of which have greatly influenced financial transactions worldwide. Their efforts in enhancing transactional security and processing efficiency have set industry standards that smaller companies aspire to match.

Barclays and HSBC, traditional banks with substantial fintech investments, have seamlessly integrated technological innovations into their services, offering customers a blend of reliability and modern financial solutions. They exemplify how longstanding financial institutions can evolve, adopting fintech capabilities to improve customer engagement and operational agility.

Moreover, companies like PayPal have revolutionized digital payments, emphasizing user experience and accessibility. Their business models, focusing on consumer-centric solutions, have not only fostered financial inclusivity but also spurred competition, pushing the envelope on what is technologically feasible in the fintech space.

These key players not only drive economic growth but also embody the sector’s commitment to serving society by making financial services more accessible and efficient. Their ongoing innovations continue to shape the fintech landscape, underscoring the dynamic interplay between technology and financial services.

Emerging Market Trends

Emerging market trends in the fintech sector are reshaping consumer expectations and driving the adoption of advanced technologies. As financial institutions navigate this evolving landscape, they are increasingly integrating Artificial Intelligence (AI) and machine learning to enhance customer service and operational efficiency. These technologies not only streamline processes but also personalize customer interactions, fostering a service-oriented approach that prioritizes client satisfaction and trust.

Moreover, the surge in mobile and digital payment solutions reflects a shift towards more accessible financial services. This trend is particularly pronounced in emerging markets, where mobile penetration is leapfrogging traditional banking infrastructure.

By enabling transactions via smartphones, fintech is democratizing access to financial services, thereby serving a broader spectrum of the population and underscoring a commitment to financial inclusion.

Blockchain technology also continues to gain traction, offering transparent and secure transactions. Its implications for cross-border payments and identity verification are profound, providing a foundation for trust and security in digital interactions. This not only enhances consumer confidence but also fosters a regulatory environment conducive to innovation.

These trends collectively signify a robust drive towards a more inclusive, efficient, and secure financial ecosystem, reflecting a deep commitment to serving the community’s evolving needs.

Investment Opportunities

Building on the dynamic advancements in fintech with Fintechzoom Pro, investors now have a plethora of opportunities to engage with the FTSE 100 FintechZoom, leveraging diversified portfolios to capitalize on the sector’s growth. The fintech landscape within the FTSE 100 presents both burgeoning startups and established firms, such as Barclays and PayPal, which have shown resilience and strategic growth in response to digital financial demands. The recent surge in equity funding, amounting to £26.8 billion, underscores the sector’s robust potential for growth and innovation.

Investment strategies should prioritize diversification, not only across financial technologies but also by considering geographical and sectoral spread, to mitigate risks associated with market volatilities.

Additionally, the integration of Environmental, Social, and Governance (ESG) criteria into investment decisions reflects a commitment to societal betterment, aligning with the core values of modern investors who prioritize sustainable and ethical investing.

Moreover, with fintech firms at the forefront of addressing regulatory and cybersecurity challenges, investments in these companies are poised to benefit from enhanced compliance frameworks and innovative cybersecurity solutions. This strategic approach not only safeguards assets but also enhances the long-term viability and profitability of investments in the fintech sector.

Frequently Asked Questions

How Does Brexit Impact FTSE 100 Fintech Companies?

Brexit impacts FTSE 100 fintech companies by altering regulatory frameworks, potentially limiting access to European markets, and affecting talent mobility. These changes necessitate strategic adjustments to maintain competitiveness and market position.

What Are the Ethical Considerations in Fintech Investments?

Ethical considerations in fintech investments include data privacy, cybersecurity, fair lending practices, and transparency. Investors must assess the societal impact, regulatory compliance, and ethical use of AI and algorithms by fintech companies.

How Does Fintech Adoption Vary Across Different Age Groups?

Fintech adoption varies notably across different age groups, with younger demographics typically embracing technology-driven financial services more rapidly than older ones, reflecting broader trends in technology usage and adaptability.

What Role Does Artificial Intelligence Play in Fintech Customer Service?

Artificial intelligence in fintech customer service streamlines interactions, provides personalized advice, and enhances efficiency. AI tools analyze vast data sets, offering tailored financial solutions and improving overall customer experience and satisfaction.

How Do Fintech Companies Affect Traditional Banking Employment Trends?

Fintech companies are reshaping traditional banking employment trends by introducing automation and innovative technologies, leading to job shifts and the creation of new roles focused on digital expertise and customer experience management.

Conclusion

To sum up, as the allegorical Titan Prometheus brought fire to humanity, illuminating progress and innovation, so too have fintech entities within the FTSE 100 ignited transformative shifts across the financial landscape. These companies catalyze growth, redefine risk management, and sculpt investment landscapes, heralding a new era in economic dynamics. Stakeholders must navigate this evolving terrain with strategic acumen, embracing emerging trends and potentialities that promise to reshape the contours of global financial services.