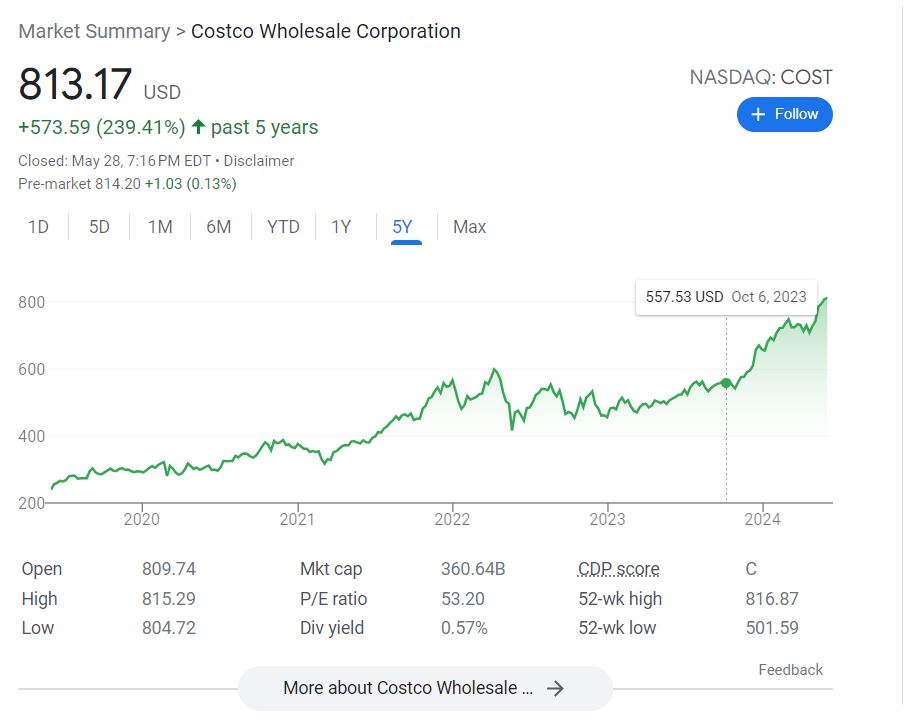

Fintechzoom’s analysis on Costco stock highlights its robust performance with steady growth, strategic market positioning, and solid financial fundamentals. Costco, ticker symbol COST, is a key player in the retail industry known for strong revenue growth and customer satisfaction. Recent performance insights showcase steady stock growth and online sales expansion.

Quarterly earnings reveal valuable data for investors evaluating profitability and market conditions. Market trends like the shift to online shopping impact Costco’s strategy. Expert opinions praise Costco’s focus on value and expansion plans. Further details on investment strategies, risks, long-term projections, and final insights await.

Table of Contents

Fintechzoom Costco Stock: Overview

The analysis of Fintechzoom Costco stock offers a thorough overview of its performance in the current market landscape. Costco Wholesale Corporation, ticker symbol COST, is a prominent player in the retail industry, known for its warehouse club model and diverse product offerings. As of [insert date], Costco’s stock price stood at [insert price], reflecting a [insert percentage] change from the previous quarter.

Costco’s financial health is robust, with a market capitalization of [insert value] and a steady revenue growth trend. The company’s strong fundamentals, including healthy cash flows and a solid balance sheet, position it favorably in the competitive retail sector. Moreover, Costco’s commitment to customer satisfaction and operational efficiency has contributed to its long-term success and investor confidence.

Analyzing Costco’s stock performance involves evaluating key metrics such as price-to-earnings ratio, earnings per share, and dividend yield. These indicators provide valuable insights into the stock’s valuation and growth potential, guiding investors in making informed decisions. Overall, FintechzoomPro‘s analysis underscores Costco’s resilience and strategic positioning in the market.

Fintechzoom Costco Stock: Recent Performance Insights

Analyzed through a data-driven lens, recent insights into Fintechzoom Costco stock‘s performance reveal key trends shaping its current market trajectory. Over the past few months, Costco’s stock has shown steady growth, outperforming many competitors in the retail sector.

One notable trend is the consistent increase in revenue, driven by strong consumer demand for essential goods and the company’s effective cost management strategies.

Additionally, Costco’s online sales have experienced significant growth, showcasing the company’s ability to adapt to changing consumer preferences and capitalize on the e-commerce trend. This shift towards digital sales has not only boosted revenue but also enhanced customer engagement and loyalty.

Furthermore, Costco’s strong financial performance and solid balance sheet position the company well for future growth opportunities. By maintaining a focus on operational efficiency and customer satisfaction, Costco continues to solidify its position as a market leader in the retail industry. Investors are closely monitoring these trends, recognizing Costco as a stable and growth-oriented investment option.

Quarterly Earnings Analysis

Building on the insights gained from Fintechzoom Costco stock‘s recent performance, a detailed examination of the company’s quarterly earnings provides a deeper understanding of its financial health and growth prospects.

Costco’s quarterly earnings report offers valuable data for investors and analysts to assess the company’s revenue, profitability, and overall operational efficiency. By analyzing metrics such as revenue growth, net income, gross margins, and operating expenses, stakeholders can gauge Costco’s ability to generate profits and manage costs effectively.

Key aspects to take into account in the quarterly earnings analysis include any notable shifts in sales trends, the impact of cost fluctuations on margins, and the effectiveness of Costco’s strategies in driving profitability.

Additionally, understanding how external factors, such as market conditions and industry competition, influence Costco’s financial performance is essential for making informed investment decisions. By delving into the specifics of Costco’s quarterly earnings, investors can gain valuable insights into the company’s financial trajectory and make strategic choices aligned with their investment goals.

Fintechzoom Costco Stock: Market Trends Impacting Costco

Market trends are exerting significant influence on Fintechzoom Costco stock, impacting the company’s performance and strategic positioning. One key trend affecting Costco is the shift towards online shopping, driven by changing consumer preferences and the convenience of e-commerce.

As more customers opt for online purchases, Costco has been adapting its strategies to enhance its digital presence and improve its online services, such as expanding its e-commerce offerings and investing in digital marketing.

Additionally, another market trend impacting Costco is the focus on sustainability and environmentally friendly practices. Consumers are increasingly conscious of the environmental impact of their purchases, leading companies like AMC, Meta, Amazon and Costco to invest in sustainable sourcing, reducing packaging waste, and promoting eco-friendly products. By aligning with these trends, Costco can attract environmentally conscious consumers and enhance its brand reputation.

Moreover, the current trend of health and wellness awareness is influencing Costco’s product offerings, with an emphasis on organic, natural, and healthy options. Costco’s ability to adapt to these market trends will be essential in maintaining its competitive edge and meeting the evolving needs of consumers in the retail industry.

Expert Opinions on Costco

Experts in the retail industry have provided valuable insights into Costco’s strategic decisions and competitive positioning. One recurring theme among experts is Costco’s relentless focus on providing value to its members through a combination of quality products and low prices. The company’s membership model, which fosters customer loyalty and recurring revenue, is often praised for creating a stable revenue stream and a dedicated customer base.

Additionally, experts have noted Costco’s successful expansion strategies, both domestically and internationally, as a key driver of its continued growth. By carefully selecting new locations and adapting its product offerings to local preferences, Costco has been able to capture market share in diverse regions while maintaining its core value proposition.

Moreover, experts have highlighted Costco’s strong financial performance and efficient operations as key strengths that set it apart from competitors. The company’s ability to deliver consistent growth and shareholder value while prioritizing employee satisfaction and customer experience has earned Costco a favorable reputation in the retail industry.

Competitive Landscape

Analyzing the competitive landscape in the retail industry reveals a complex network of rivalries and strategic positioning among key players. In the case of Costco, the company faces competition from retail giants such as Walmart, Target, and Amazon.

Walmart, with its extensive network of stores and aggressive pricing strategies, poses a significant threat to Costco’s market share. Target, known for its trendy merchandise and focus on customer experience, competes with Costco particularly in the domain of home goods and apparel. Additionally, Amazon’s dominance in the e-commerce space presents a challenge to traditional brick-and-mortar retailers like Costco.

To maintain its competitive edge, Costco leverages its membership model, offering bulk discounts and exclusive benefits to its loyal customers. The company also focuses on providing a unique in-store experience, emphasizing quality products and excellent customer service. By continually innovating and adapting to changing consumer preferences, Costco positions itself strategically in the competitive retail landscape, aiming to differentiate itself from its rivals and sustain long-term success.

Fintechzoom Costco Stock: Investment Strategies

In considering investment strategies related to Fintechzoom Costco stock, it is essential to evaluate the company’s financial performance and market positioning amidst its competitive landscape. Costco Wholesale Corporation (COST) has shown consistent revenue growth over the years, indicating a strong financial foundation.

Its membership-based model provides a steady income stream and customer loyalty, contributing to its competitive advantage. Analyzing key financial metrics such as revenue growth, earnings per share, and return on equity can offer insights into the company’s operational efficiency and profitability.

Moreover, understanding Costco’s market positioning relative to competitors like Walmart and Amazon is vital for devising effective investment strategies. Costco’s focus on offering quality products at discounted prices through its warehouse model sets it apart in the retail industry.

Evaluating market trends, consumer preferences, and the company’s expansion plans can help investors anticipate future growth potential and make informed decisions regarding their investment in Fintechzoom Costco stock. By combining financial analysis with market research, investors can develop well-informed strategies to maximize returns while managing risks effectively.

Risks and Opportunities

Costco’s stock presents a dynamic landscape of risks and opportunities that investors need to navigate strategically. One key risk is the potential impact of economic downturns on consumer spending habits, as Costco relies heavily on discretionary income. External factors like trade tariffs and global economic instability can also pose risks to the company’s profitability.

On the flip side, Costco has opportunities for growth through expanding its e-commerce presence to compete with online retail giants. Additionally, its membership-based model provides a vital revenue stream and customer loyalty.

Investors should consider the competitive landscape within the retail industry, keeping an eye on how Costco differentiates itself from rivals like Walmart and Amazon. Analyzing Costco’s financial health, including factors like debt levels and cash flow, is essential for evaluating risks. Opportunities lie in Costco’s ability to innovate and adapt to changing consumer preferences, such as increasing focus on organic and sustainable products. By carefully weighing these risks and opportunities, investors can make informed decisions regarding Costco’s stock.

Long-term Projections

Long-term projections for Costco’s stock performance hinge on strategic market positioning and sustained financial growth amidst evolving consumer trends. As Costco continues to expand its physical and online presence, it is poised to capture a larger share of the retail market. The company’s focus on offering quality products at discounted prices resonates well with consumers, contributing to its strong financial performance.

Analyzing Costco’s historical financial data reveals a consistent upward trajectory in revenue and net income, indicating a stable and reliable growth pattern. Moreover, Costco’s ability to adapt to changing consumer preferences, such as increased demand for organic and sustainable products, positions it favorably for long-term success.

Considering these factors, it is reasonable to project that Costco’s stock will likely continue to experience growth over the long term. Investors seeking stability and potential for steady returns may find Costco to be an attractive long-term investment option in the retail sector.

Fintechzoom’s Final Thoughts

Upon thorough analysis of Costco’s market positioning and financial performance, Fintechzoom presents its final thoughts on the company’s long-term stock potential. Costco’s robust membership model, loyal customer base, and consistent revenue growth over the years indicate a strong foundation for sustained success. The company’s focus on providing value to its members through competitive pricing and high-quality products has resulted in a resilient business model that withstands economic fluctuations.

Furthermore, Costco’s strategic expansion plans both domestically and internationally position it well for future growth opportunities. The company’s efficient cost management and operational excellence contribute to its ability to generate healthy profits consistently.

Frequently Asked Questions

Are There Any Upcoming Costco Stock Splits?

While there are no official announcements regarding upcoming Costco stock splits, investors should monitor the company’s financial performance and communications for any potential changes in the future. Stay informed to make strategic investment decisions.

How Does Costco’s Stock Performance Compare to Other Retailers?

When comparing Costco’s stock performance to other retailers, it is crucial to take into account factors like revenue growth, profit margins, and market share. By examining financial statements and market trends, a thorough assessment can offer valuable insights for investors.

What Impact Do Economic Indicators Have on Costco Stock?

Economic indicators, such as GDP growth, consumer spending, and employment rates, can have a substantial impact on stock prices. For Costco, positive economic trends may enhance consumer confidence and purchasing power, potentially driving demand for the company’s products and services.

Does Costco Offer a Dividend to Its Shareholders?

Costco offers a dividend to its shareholders. Dividend payments are a way for companies to share profits with investors, providing a return on their investment. This can be an attractive feature for those seeking income from their holdings.

How Does Costco’s Online Presence Affect Its Stock Value?

Costco’s online presence plays a vital role in enhancing its stock value by expanding the reach of its products, improving customer engagement, and driving sales growth. A strong digital strategy can positively impact investor sentiment and financial performance.

Conclusion

To sum up, Fintechzoom’s analysis of Costco stock reveals a promising outlook for investors. With strong quarterly earnings, market trends in their favor, and expert opinions supporting their growth potential, Costco presents a solid investment opportunity. While risks exist, the long-term projections suggest sustained success for Costco stock. Overall, Costco’s stock performance is nothing short of impressive and investors would be wise to contemplate adding it to their portfolio.